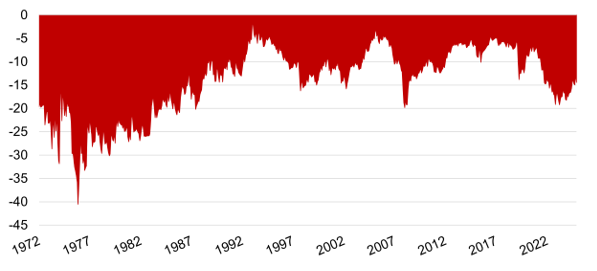

Today's double-digit discounts among investment trusts are not without precedent, according to data from the Association of Investment Companies (AIC), which published a 53-year history of average investment trust discounts. In fact, they are the norm.

The data begins on 29 December 1972 and tracks unweighted average discounts across the investment trust universe, excluding venture capital trusts (VCTs). On this basis, discounts have spent prolonged stretches in double-digit territory. The longest ran from December 1972 to June 1989, lasting 16 years and six months. A second extended period occurred between June 1997 and January 2001, spanning three years and seven months. The current phase, which began in May 2022, has so far lasted three years and seven months to December 2025.

The data also highlights the scale of historical extremes. The widest average discount on record was 41% in October 1976. At the other end of the spectrum, the narrowest average discount was 2%, recorded in December 1993, when the UK economy was emerging from recession and interest rates were falling.

Looking across decades, the figures underline how sensitive discounts have been to the prevailing economic backdrop. During the 1970s, average discounts stood at 26%, reflecting a period marked by high inflation, rising unemployment and weak growth. The 1980s saw some improvement, with discounts averaging 20%, while the more stable conditions of the 1990s brought the average down to 10%, a level that broadly persisted through the 2000s.

The 2010s stand out as the only decade in which average investment trust discounts remained consistently below 10%, at around 8%. According to the AIC, this coincided with low interest rates and strong demand for income-producing assets. So far in the 2020s, the average discount has risen again, to 13%, reflecting a less supportive environment for asset prices.

Average investment trust discount, 1972-2025

Source: Association of Investment Companies

Nick Britton, research director at the Association of Investment Companies, said discount behaviour has shifted materially over time as the structure of the market has evolved.

“In the 1970s and 1980s, investment trusts generally traded at double-digit discounts. Discounts were narrower through most of the next two decades, though they widened during the financial crisis. The 2010s was the one decade when investment trust discounts averaged less than 10% over the 10-year period,” he said.

Britton added that structural changes have altered how discounts are managed and perceived.

“Of course, things have moved on a lot since 1972. The change in legislation in 1999 to allow investment trusts to buy back their own shares has helped many trusts trim their discounts. Increasing competition from other fund structures, such as ETFs, has changed investors’ expectations about what level of discount is acceptable,” he said.

“Investment trust boards are not complacent about discounts. We’ve seen record levels of share buybacks and corporate activity over the past few years. Investors should bear in mind that historically, investing during periods of double-digit discounts has tended to lead to better returns over the following five years,” Britton added.

Discounts are a hot discussion point in the trusts world, with debates on how to manage them and whether buybacks truly are a silver bullet to curb them.