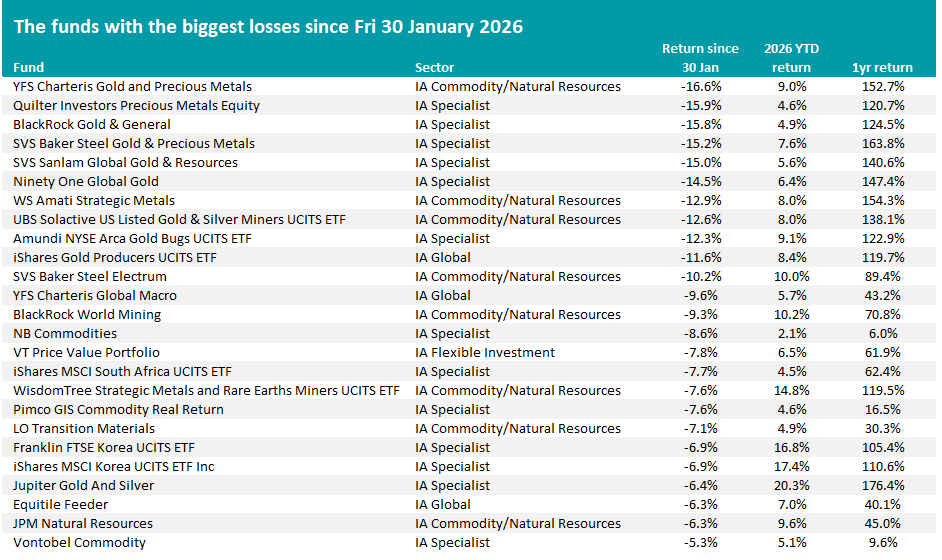

YFS Charteris Gold and Precious Metals, Quilter Investors Precious Metals Equity and BlackRock Gold & General have lost more than 15% in recent days after gold and silver were hit with a dramatic sell-off, FE fundinfo data shows.

On Friday 31 January, gold had its worst single day since 1983 while silver posted its worst day since March 1980. The metals continued falling on Monday.

Gold fell from an intraday peak of $5,595 per ounce on 29 January to below $4,500 by Monday morning, while silver crashed from $121.64 to below $78. However, both have rallied this morning.

Performance of gold and silver

Source: AJ Bell, LSEG Refinitiv data

Friday will likely be remembered as the most volatile day for both metals in modern history, according to Nitesh Shah, head of commodities and macroeconomic research at WisdomTree. “These are price swings that would typically be expected over the course of a year - not within a single trading day,” he said.

Russ Mould, investment director at AJ Bell, outlined five competing theories for the meltdown. The first is simply that both metals had gone too far, too fast and were due a pullback.

The second theory holds that losses in Microsoft after its second-quarter results forced investors to sell other positions to cover losses. “If this is true, then the foundations of the markets may be wobblier than we thought, especially given the degree of margin and leverage which are building up within the system,” he added.

The third explanation centres on the nomination of Kevin Warsh as the next Federal Reserve chair. Some see Warsh as a monetary policy hawk whose previous criticism of quantitative easing suggests he will keep policy tighter than expected, supporting the dollar and reducing demand for alternative haven assets like gold.

However, the fourth theory is that Warsh’s previous calls for lower interest rates suggest he would aggressively loosen policy, Mould said. That could weaken the dollar, especially against the Japanese yen, forcing the closure of short yen positions and cutting off a source of cheap liquidity to global markets.

The fifth explanation points to how the COMEX commodity exchange raised its margin requirements on metal-trading positions and switched from a flat dollar fee to a percentage-based fee. This could have left the more speculative metals players needing to liquidate gold to raise cash.

“Whatever the explanation, gold and silver are now trying to recover and both are no lower than they were in early January. Moreover, gold bugs may well be tempted to argue that both of the 1971-1980 and 2001-10 bull runs in the precious metal featured several retreats which did not ultimately nullify or prevent major gains,” Mould added.

Source: FinXL. Total return in sterling between Friday 30 Jan and Monday 2 Feb.

The top 10 hardest-hit funds since the sell-off started are all precious metals specialists: YFS Charteris Gold and Precious Metals is down 16.6%, Quilter Investors Precious Metals Equity 15.9%, BlackRock Gold & General 15.8%, SVS Baker Steel Gold & Precious Metals 15.2% and SVS Sanlam Global Gold & Resources 15%.

But even after the sell-off, most precious metals funds retain positive year-to-date returns. YFS Charteris Gold and Precious Metals is up 9% for the year to 3 February, while Jupiter Gold and Silver has gained 20.3%.

One-year returns remain very strong, given the extended bull run both precious metals enjoyed. Jupiter Gold and Silver is up 176.4% over 12 months, SVS Baker Steel Gold & Precious Metals has returned 163.8% and YFS Charteris Gold and Precious Metals has gained 152.7%.

Looking deeper into what drove the metal’s bull run and recent falls, WisdomTree’s Shah argued that traditional institutional channels do not point to a speculative frenzy.

Net speculative positioning on the COMEX futures exchange shows neither gold nor silver at extreme levels, with silver looking “relatively bearish” by historical standards. Gold ETP buying picked up in recent weeks but not on the scale observed in 2024, while silver ETPs look to have had large net outflows in North America and Europe.

“Taken together, the traditional institutional channels of futures markets and exchange-traded products do not point to a speculative frenzy,” Shah said. “This suggests that retail investors or over-the-counter markets may have seen elevated buying – and subsequent selling – over the past month.”

John Wyn-Evans, head of market analysis at Rathbones, characterised the event as reflecting “stress among specific market participants rather than systemic weakness across precious metals”.

Shah said the sharp drawdown is likely to discourage speculative buying. “Friday's market moves may have flushed out a significant portion of speculative froth – potentially creating space for long-term strategic buyers to re-allocate,” he said.

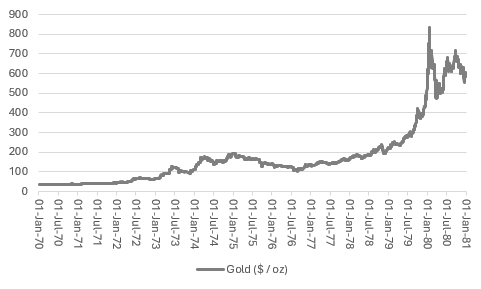

Source: AJ Bell, LSEG Refinitiv data

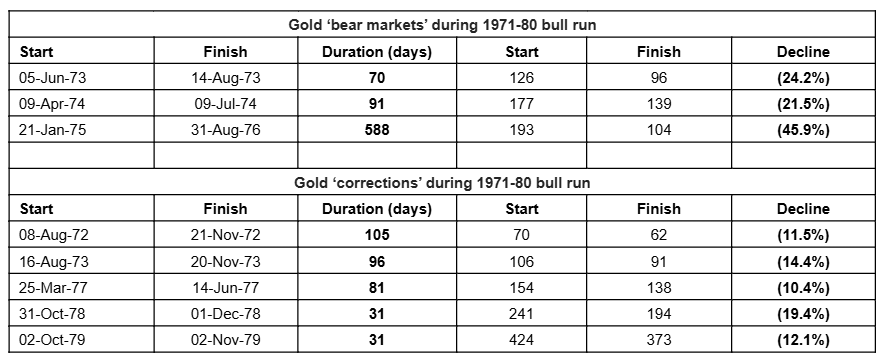

Mould pointed to historical precedent showing that major precious metals bull runs regularly experience severe corrections. The 1971-1980 bull run featured three bear markets where gold fell by more than 20%.

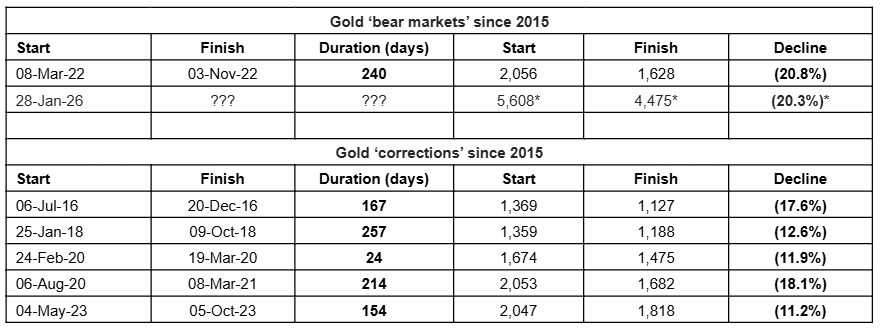

Gold’s second surge from 2001 to 2011 also endured two bear markets and five corrections of more than 10%. The current bull run since 2015 has already seen one bear market in 2022, along with corrections in 2016, 2018, 2020, 2021 and 2023.

Source: AJ Bell, LSEG Refinitiv data. *Intra-day, not closing figures.

The fundamental case for precious metals remains unchanged, according to multiple analysts. “The strategic rationale for holding gold as a diversifier – against market volatility, geopolitical risk and policy uncertainty – remains intact,” Wyn-Evans said.

Mould argued that geopolitical uncertainty, sticky inflation and galloping government debts form the bedrock of the bull case for gold. “None of those issues are any different now from the end of last week,” he added.

Shah argued that both gold and silver appear to be undergoing a structural break, catalysed by heightened geopolitical tensions, concerns around fiscal dominance and growing unease over central bank independence. This has been compounded by a broadening buyer base, including Chinese insurance companies and Indian pension funds.

“Together, these dynamics have pushed precious-metal prices into territory that traditional valuation and volatility models - which have served investors well for decades - increasingly struggle to capture,” he explained.

Wyn-Evans countered that the sharp pullback “looks more like a liquidity and positioning event than a change in the long-term case for the asset”. After a bull run driven by momentum strategies, short squeezes and leveraged buying, that same positioning unwound rapidly.

“These dynamics can be sharp but are often transient,” Wyn-Evans said.

Shah said further bouts of volatility cannot be ruled out. Mould suggested bulls may be tempted to argue that the sudden dip represents a chance to buy more, given that the underlying concerns driving precious metals higher remain unresolved.

“From a portfolio perspective, our stance is unchanged,” Wyn-Evans said. “We continue to see a role for measured exposure to precious metals within a balanced, long‑term investment strategy, while recognising that near‑term moves may be dominated by technical factors and positioning.”