More than two years have passed since the trade war between the US and China began, and with the US presidential elections looming, both candidates seem to be indicating a harder stance on China.

Regardless of who wins the election, however, experts are focusing on domestic growth stories for the country which has exhibited the strongest coronavirus recovery year-to-date.

In sterling terms, the MSCI China index is up 22.8 per cent year-to-date compared to the S&P 500 which is up by 10.83 per cent, the MSCI Japan which is up 2.54 per cent, and the FTSE 100 which is down 18.09 per cent.

Performance of MSCI China vs developed markets

Source: FE Analytics

Bearing this in mind, six experts explain below how they are navigating the US-China trade war in the lead up to the US election and where they are finding investment opportunities.

Jane Andrews, chief investment officer of BambuBlack Asset Management, is focused on domestic-facing companies within healthcare and cloud services, which she said are beneficiaries of the US-China tensions.

She said: “The adoption of telemedicine has been accelerated thanks to the Covid-19 pandemic, utilisation of the latest AI technology and the support of China’s authorities.

“Coupled with a positive regulatory tailwind, this is an area of long-term secular growth that is relatively immune to the economic cycle.”

Andrews said investors should focus on Chinese companies operating in the domestic market, which are beneficiaries of president Xi Jinping’s new ‘domestic circulation’ strategy, which prioritises domestic consumption and markets.

She added: “For instance, Ping An Healthcare and Technology, the world’s leading online healthcare platform, has revolutionised the Chinese healthcare system, giving people access to doctors and medical advice more quickly than ever.”

She pointed out that during the Covid-19 outbreak, one billion people visited ‘Good Doctor’, Ping An’s online medical portal, to receive healthcare advice.

Hugo Robinson, manager of the Arisaig Global Emerging Market Consumer fund, said consumer staples are one area of the Chinese economy relatively well-insulated from US and China trade war tensions.

He said: “It seems unlikely Washington would have much interest in sanctioning soy sauce producers or hot pot restaurant chains.

“Many businesses in this space are naturally growing very fast, as China continues to tilt its economy away from exports and foreign investment and towards domestic demand.

“Their simplicity, strong brands and the low unit cost of items they sell mean the best staples companies tend to have resilient all-weather business models.”

Robinson said that some brands have an added growth driver as they dominate sectors with more cottage-industry style competitors.

He highlighted Foshan Haitian as an example, which – with its 300-year-old brand – is the biggest sauces and condiments company in China with a 7 per cent market share.

“Businesses like this tend to gain market share in most circumstances, but this can accelerate during tougher spells for the economy as its weaker rivals fall by the wayside,” he explained.

He also likes consumer-facing internet businesses such as JD.com and Meituan which have performed well this year despite ongoing geopolitical noise. “It seems likely domestic consumer demand will continue to grow, with more of this demand shifting from offline to online,” he finished.

Juliana Hansveden, manager of the $4bn Nordea Emerging Stars Equity fund, has been finding opportunities in the Chinese cloud-based software as a service space (SaaS), as well as the semiconductor design and e-commerce space.

She said the cloud-based SaaS market is ‘significantly underpenetrated’ due to the fact that Chinese software spending is only a fraction compared to developed market economies.

She added: “Meanwhile, semiconductor design is an attractive area, as China is working hard to develop local solutions to be less reliant on US technology.”

Eric Moffett, portfolio manager of the $228m T. Rowe Price Asian Opportunities Equity fund, also likes domestic fragmented industries.

He said: “We have identified attractive opportunities to invest in market leaders in domestic fragmented industries we believe will play a major role in industry consolidation.

“For example, we have invested in one of the largest property management companies in China, which controls about 1 per cent market share. With its strong execution track record and high-quality management, we believe the company will consolidate the sector.

“Another example is a high-quality pharmacy chain – the Chinese equivalent of Boots – which will emerge as a consolidator in the pharmacy space.”

Another theme Moffett is focused on is import substitution, investing in domestic companies gaining market share from foreign competitors.

“Following the escalation of the US-China trade wars, China has been making a distinct effort to rely less on other countries,” he explained.

There are plenty of reasons to be positive on the Chinese domestic market, said Luc Filip, head of discretionary portfolio management at Syz Private Banking, as authorities still have plenty of tools to stimulate the economy.

He said: “Chinese central bank has unleashed a raft of initiatives to stimulate consumer spending and keep the economy afloat, including substantial fiscal spending and easing credit conditions to facilitate bank lending.”

Filip said this marks a departure from previous crises, where the focus was on saving export sectors and coastal hubs.

Therefore, he is looking for domestic-oriented companies benefitting from the stimulus and tech companies well equipped to navigate the global digitalisation trend.

In April, he invested in a Chinese internet exchange-traded fund (ETF), which he believes should continue to perform well and remain unaffected by escalating trade tensions in the wake of the US presidential election.

Vincent Ropers, co-manager of the TB Wise Multi-Asset Growth fund, has also focused on domestically orientated companies.

In particular he has been searching for companies benefitting from the ongoing emergence and growth of Chinese consumers.

“Such companies are likely to see relatively little impact from a deterioration of relationships between China and the rest of the world,” he explained.

By focusing on the rise of the middle class consumer and domestic innovation, he is leaning towards consumer sectors, as well as technology and healthcare.

He continued: “We are also particularly attracted to smaller companies, given their decade-high valuation discount relative to large firms.

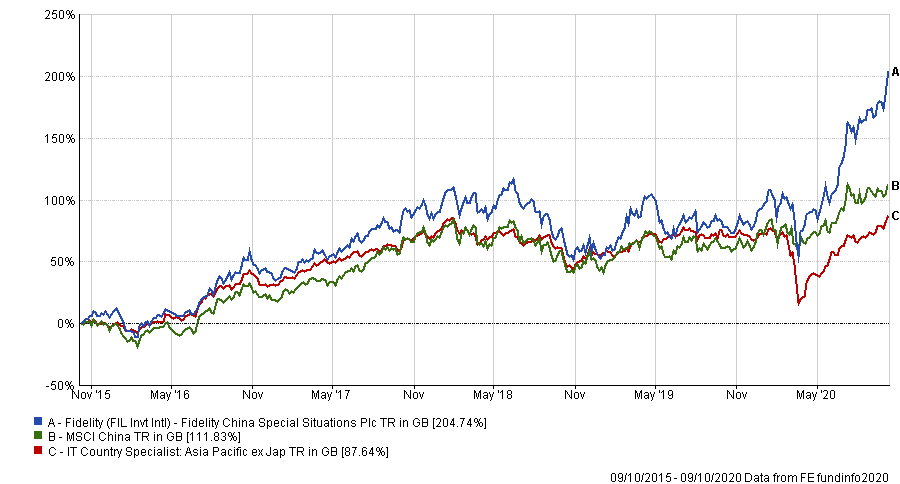

“We primarily get our Chinese equities’ exposure through the Fidelity China Special Situations trust, which offers access to on-the-ground research conducted with the scrutiny we are used to in western markets.”

Performance of Fidelity China Special Situations vs benchmark & sector over 5yrs

Source: FE Analytics

Over five years, the trust has returned 204.74 per cent versus the MSCI China’s 111.83 per cent and the IT Country Specialist: Asia Pacific ex Japan sector’s 87.64 per cent. It is trading at a discount of 7 per cent to net asset value (as at 12 October), is 26 per cent geared and has ongoing charges of 0.99 per cent.