The idea of investors holding out for a ‘silver bullet’ vaccine is misguided, according to Argonaut Capital Partners absolute return manager Barry Norris.

The FE fundinfo Alpha Manager has shorted vaccine companies, as he believes they will have little pricing power and will lose out to the first mover advantage.

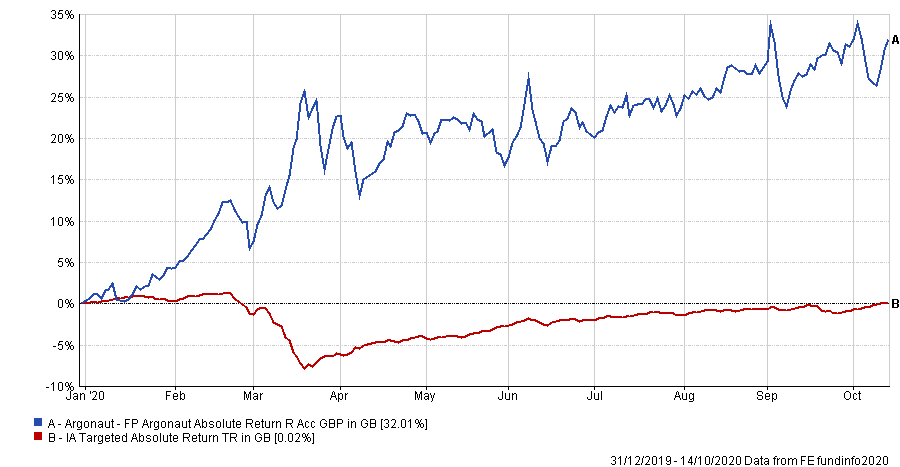

While the IA Absolute Return sector has struggled this year – its average member is up just 0.03 per cent – Norris’ FP Argonaut Absolute Return fund has risen more than 30 per cent. The manager credits this to the fund’s low correlation strategy, as oppose to the low volatility tactics of other funds in the sector.

With the introduction of new restrictions in the UK, governments are giving increasing weight to the importance of a vaccine.

“One of the most dangerous ideas is that we can lock down the economy and behave in an exceptional risk averse way because there is a silver bullet vaccine,” he said.

“There’s a lot of misinformation and misconceptions about Covid and this is now the biggest one of those.”

He explained that investors and analysts who talk about different stocks plays dependent on the emergence of vaccine aren’t taking into the account the nature of the solution.

“The question is, will the vaccine stop you being infected, or will it just lessen the symptoms?” he asked.

“Given that over 90 per cent of infections are asymptomatic already, if the vaccine doesn’t stop you getting the infection but just stops symptoms, how will that stop the spread of the disease?”

Norris explained that because trials are only taking place in healthy adults, the people that are most at risk are left out of trials as they’re less likely to generate an immune response.

“My contention is if its 50/50 in the healthy adult population, with lower efficacy in people at risk from Covid, then why is it being styled as this silver bullet to cure Covid? It doesn’t make sense,” he said.

“The only way it could make sense if it’s some sort of psychological placebo to get governments out of the deep lockdown holes of their own making.”

With this in mind, Norris has taken short positions on several companies in the sector who he feels are trading at overinflated values.

“We’ve avoided the blue chip companies as it doesn’t really move the needle for them,” he explained.

“This idea of a vaccine as being the only solution has obviously helped pump up these stocks. But you look at some of the companies developing vaccines and they’re just not credible.”

“Maderna have never ever come up with a vaccine or drug that has been approved,” he continued.

“CureVac have a market cap of $10bn and this is a company that doesn’t have any sales. Considering too the company had an initial public offering (IPO) in July, and in June had a pre-IPO fundraising which valued it at $1.5bn.”

Norris explained that vaccine companies make up about 7 or 8 per cent of the net asset value (NAV) of his fund and around roughly 15 per cent of its short book.

“We closed our short in BioNTech because if any vaccine is going to be approved before Christmas it will likely be the BioNTech/Pfizer vaccine,” he added.

He explained that while there is considerable amount of first mover advantage, there is little for the majority.

“As a group, if one of them gets lucky, then the other lot will go down so you hedge yourself by being short all of them,” he said.

The pricing power of similar vaccines would be hard to gauge and Norris sees no advantage to that.

“My contention would be, even if we got to a situation where the marginal efficacy vaccines were approved, there’s so many that could do that, there are no differentials between them,” the manager said.

He also believes the overinflated valuations is especially prevalent in the small-cap space: “Their share price has gone up a hundredfold because they’ve had a press release mentioning a Covid vaccine, irrespective of whether they’ve got an ability to do so.”

Amidst the backdrop of shorting those stocks, FP Argonaut Absolute Return has enjoyed strong returns year-to-date. While the market had one of the sharpest contractions in history in March, the fund enjoyed its best ever month, returning 15 per cent.

Performance of fund vs sector YTD

Source: FE Analytics

He explained that the absolute return funds that have struggled so far this year have been those focused on low volatility.

“We’ve always marketed it as a low correlation fund,” he said.

“Low volatility means the returns will be modest and fees will be a high proportion of the targeted returns and what we saw in March when the market was down, all the low volatility funds lost money.”

Norris outlined that a low correlation strategy offers diversification in the sense that success and failures come at different times to the market’s successes and failures.

“Most people will own passive and long only funds,” he said. “This is an industry where 99 per cent of equity returns come at the same time.”

He explained that investors are primarily focused on volatility alone as a diversifier, which is not what the FP Argonaut Absolute Return fund offers.

“If my fund only delivers returns at the same time as the market delivers returns then there’s no unique selling point,” he said. “If my returns come at different times then I’ve got a USP and a valuable diversifier.

“If you genuinely are uncorrelated, you don’t want low volatility, because low volatility would mean lower returns.”

He concluded: “Why have a lower uncorrelated return when you have a higher uncorrelated return?”

Performance of fund vs sector since launch

Source: FE Analytics

Since launch in February 2009, FP Argonaut Absolute Return has made a total return of 146.59 per cent. It has an ongoing charges figure (OCF) of 2.67 per cent