A combination of money printing, rising structural demand and tightening supply for commodities is setting it up for a bull market, according to Ian Williams, chairman and chief executive of Charteris Treasury Portfolio Managers.

Fund manager Williams said measures to support the global economy such as quantitative easing should lead to higher inflation and higher commodity prices.

He said: “The thing underpinning all this is all this money printing. If the global money supply increases by 20 per cent, then all other things being equal, the price of a basket of commodities is going to go up 20 per cent.

“We just think it feeds through to higher inflation. One of the drivers of higher rates of inflation are going to be much higher commodity prices.”

He said once generalist investors and hedge funds start to notice commodity prices going up, “they will just jump on board and it will amplify the trend”.

It seems as though some on Wall Street have also noticed.

In a recent note, analysts at Morgan Stanley were anticipating a rally in commodities and argued that copper “stands to be the largest beneficiary given its tight supply into 2021”.

They said: “A faster V-shaped recovery and rising inflation expectations constitute a positive backdrop for mining equities.

“As inflationary forces continue to align, our economists believe the case for a return of inflation is now stronger than before.”

Williams singled out copper as the main commodity he is particularly bullish on.

He said: “All this transition to green energy and electric power needs more copper.

The potential demand for copper as we decarbonise is enormous.”

He pointed out that an electric car needs four times as much copper as a petrol car, and that the copper required for charging systems and things like wind turbines is also quite substantial.

Williams explained: “If you look forward two or three years, if the whole world goes to green energy, it's very difficult to see where all the copper is going to come from.

“There must inevitably be a shortage of copper, two or three years down the road.”

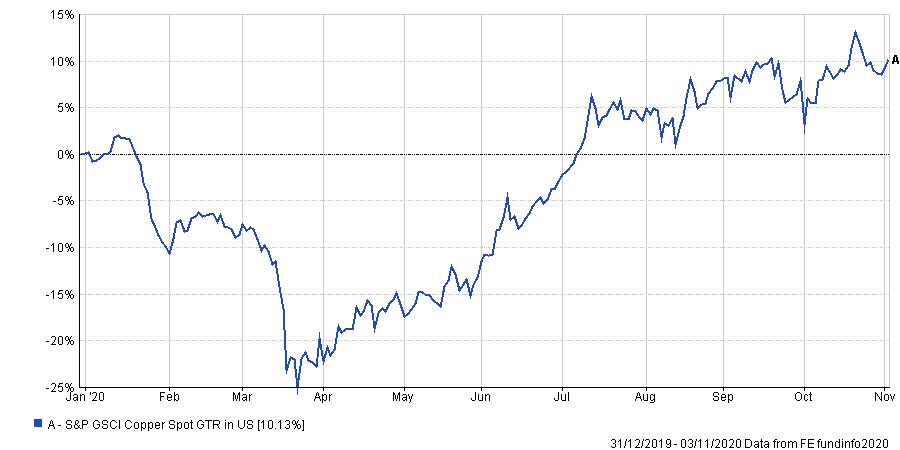

The price of copper broke two-year highs a few weeks ago, almost surging to seven-year highs.

The spot price of copper is up 10.13 per cent year to date in dollar terms, after a strong rally post-March.

Performance of copper year-to-date

Source: FE Analytics

Williams said this is why one of the biggest holdings in his £5.3m DMS Charteris Global Macro fund is mining firm Antofagasta, which he said has the world's biggest, independently quoted copper mine. He also holds Rio Tinto and BHP Billiton, which produce predominantly iron ore but also have some copper exposure.

“What’s interesting is that both Rio Tinto and BHP Billiton would quite like to increase copper as a percentage of their overall metal portfolio,” he said.

“All the chief executives of these companies and anything with decent copper exposure has had a knock on the door from Chinese mining companies over the last 10 years trying to buy out the company.

“This is because they’re thinking strategically, looking out at a plan for 10 years ahead, unlike Donald Trump who plans at 10 minutes ahead.”

“They’re thinking ‘well, if we’re going to make all these electric cars and we’re going to turn China into the powerhouse for assembling a major manufacturing electric cars, we need to tie up all the supplies of the metals that go into those cars, and copper is the big one’.”

He added: “So when other car manufacturers start to compete with the Chinese and make electric cars, they're suddenly going to find that they can’t source the metals they need to build them.”

Even if new mines were discovered and started up, he reckons demand for copper will likely kick in quicker than the supply can keep up.

“Supposing you were in the mining business and you found a huge, great copper deposit today, it'd be five years before you get any supply out of it,” Williams explained.

“You want to get permission from the jurisdiction where it mines, then you have to start raising the funds to start drilling, you have to build the infrastructure, crushing machine for the rocks, leech mills, and all this other stuff.”

“So even if you found a huge deposit today, it would probably be five years before any other supply came onto the market.”

Williams, who also manages the £29m DM Charteris Gold & Precious metals fund, argued that the growing trend towards electrification also benefits silver given its role in the renewable energy industry and solar panels in particular.

However, he is more cautious about the prospects for oil, which he said has a “big question market over future demand”.

“We're actually not bearish on oil, but we're not bullish either,” said Williams.

“We just think that it will be the very last commodity to start going up the ladder to go up after all the others have gone up, but eventually, you could see oil drift up to $60 a barrel.

“Asia or Russia and all the huge population countries out now in the Far East are not racing into green energy at the same rate as Europe and the US,” he said.

He finished: “What tends to happen is, as these economies like Vietnam and China start to grow 6 or 7 per cent again, you get increased demand for oil straight away.

“If China goes up 5 per cent China's demand for oil will be two or three per cent higher than it is this year.”