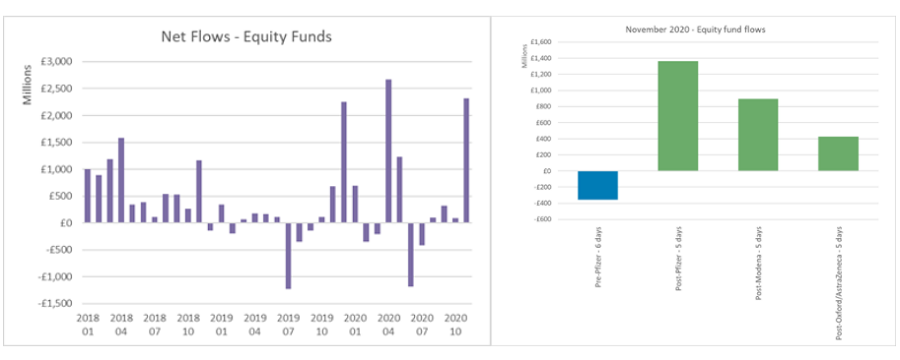

UK investors poured a near-record amount of money into equity funds following the announcement of three effective vaccines for coronavirus in November, data from global funds network Calastone shows.

Calastone’s latest Fund Flow Index (FFI) found that £2.3bn was allocated to equity funds last month, which is the second highest monthly total on record. Higher inflows were only seen in April 2020, when investors flocked to equities on the back of massive economic and financial support packages to tackle the coronavirus pandemic.

The data makes clear that the inflows are linked to the vaccines. In the five days before announcement of Pfizer’s vaccine, some £389m was pulled out of equity funds; Calastone said this is likely to down to investors considering US president-elect Joe Biden being the less market-friendly candidate in the election.

However, equity fund inflows reached £1.4bn over the five days following Pfizer’s announcement. Another £897m flowed in the five days following the Moderna announcement, while the Oxford/Astrazeneca news prompted another £429m of inflows.

Source: Calastone FFI

Edward Glyn, Calastone’s head of global markets, said: “The long-awaited vaccine news could scarcely have been any better. Despite languishing in renewed lockdown confinement, investors went off to the races to celebrate.

“Record fund turnover, record inflows for some of the biggest equity fund categories and near-record inflows for equity funds overall add up to a huge sigh of relief that the end may finally be in sight for the pandemic and its devastation of the global economy.”

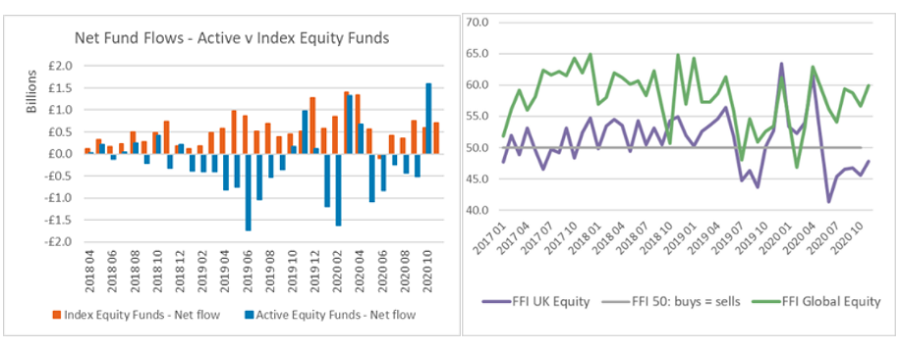

As part of this, active equity funds had their strongest month for inflows in more than five years, after taking in more than £1.6bn of fresh investor cash.

This inflow was enough to reverse half of the net cumulative outflows they have struggled with since May.

In November, most of the inflows went into global equity strategies and these funds benefited from a record £1.5bn inflow over the course of the month.

But large amounts of money also went into active emerging market, sector specialist and North American funds. UK funds appeared remain out of favour, however.

Index tracking equity funds – which have dominated inflows this year – took in £713m over the month. This is exactly in-line with the monthly average of the past year.

Source: Calastone FFI

Glyn said: “Active fund managers will celebrate such a successful month after enduring months of outflows. Anchored in monthly savings plans, index-tracking fund flows tend to be steady and positive, but active funds benefit much more when there is a big positive swing in sentiment.”

Record inflows were also witnessed among ESG funds, which have outperformed their conventional peers in 2020 and attracted high levels of interest from investors across the year.

But the £820m of new money investors put in ESG funds was more than double the monthly average this year so far, according to Calastone.

In order to allocate to equities, investors pulled money out of safe havens. Money market funds saw their biggest outflows on record in November after investors withdrew £695m. Outflows from money market funds were especially strong following the Pfizer news.

Fixed income funds continued to attract inflows during November, the data shows, although outflows continued for property funds, Many of these fund only recently reopened following their suspensions over liquidity and valuation concerns.