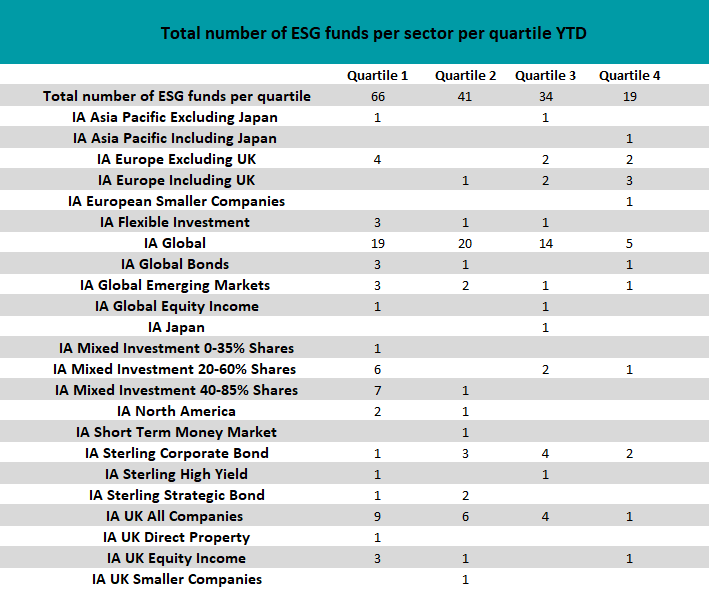

Research by Trustnet has found 41.25 per cent of environmental, social & governance (ESG) and sustainable funds have made top-quartile returns in 2020 so far while another 25.63 per cent of funds have made second-quartile returns, challenging the idea that sustainable investment means sacrificing returns.

Source: FE Analytics

Year-to-date, the average IA Global fund with an ESG approach has made a positive return of 1.77 per cent, whereas the average IA Global fund has made a loss of 3 per cent.

The same outperformance was seen in IA UK All Companies sector where the average ESG fund did make a loss of 15.26 per cent, but still beat the average sector fund’s fall of 19.33 per cent year-to-date.

In 2020, interest in ESG investment has intensified with more attention on companies’ environmental and social responsibilities during the coronavirus crisis.

So why has more socially and environmentally mindful investing in good companies performed so well this year?

AJ Bell head of active investments Ryan Hughes said: “ESG funds have certainly benefited from the fact that the market has been very polarised in its overall performance from a sector perspective.”

ESG funds tend to be more invested in major growth sectors – such as technology and healthcare – whilst being significantly underinvested in oil stocks, Hughes said, and this has made a significant contribution to their performance this year.

Breaking down into the data and Trustnet found that the sectors where the biggest proportion of their ESG members were in the top quartile (aside from those were they is only one fund with an ESG remit) were: IA Mixed Investment 40-85% Shares, IA Mixed Investment 20-60% Shares and the IA North America.

The IA Mixed Investment 40-85% Shares sector which had eight ESG-sustainable funds, seven of which (88 per cent) were top quartile. Some of the better-known funds that are in the top quartile of this sector in 2020 are the £1.5bn Liontrust Sustainable Future Managed fund run by Peter Michaelis and Simon Clements and FE fundinfo Alpha Manager Mike Fox's £1.3bn Royal London Sustainable World Trust managed b.

Fox also runs a sustainable fund in the IA Mixed Investment 20-60% Shares sector which had 67 per cent of its ESG-sustainable funds produce top-quartile performances, including Fox’s £1.5bn Royal London Sustainable Diversified Trust.

Looking at the IA North America sector and 67 per cent of its ESG-sustainable funds – two out of three in total – were top-quartile year-to-date.

One is the £687m Brown Advisory US Sustainable Growth fund – which was the only fund out of the three with more than £100m assets under management (AUM) – is run by David Powell and Karina Funk.

The other was four FE fundinfo Crown-rated Legg Mason ClearBridge US Equity Sustainability Leaders fund, which has been managed by Mary Jane McQuillen and Derek Deutsch since 2015.

The IA Global sector - one of the most popular peer groups in the Investment Association universe - has a 58 ESG-sustainable funds and 19 (32.76 per cent) of these are in its top quartile. While this is a lower proportion than most other sectors, it remains comfortably above the 25 per cent you'd expect to see if ESG funds were no better or worse than their conventional peers.

The best performing sustainable IA Global funds were two Baillie Gifford strategies: Baillie Gifford Positive Change (up 25.18 per cent) and the Baillie Gifford Global Stewardship (up 21.64 per cent), both managed by two different management teams.

The £607.5m Baillie Gifford Positive Change fund invests in a concentrated portfolio of 25-50 global companies within four categories: social inclusion and education, environment and resource needs, healthcare and quality of life and ‘Base of the Pyramid’ addressing the world’s poorest populations.

Whereas the £352.4m Baillie Gifford Global Stewardship fund invests across 70-100 stocks excluding business who make over 10 per cent of their revenue from one of the six ‘sin’ sectors: alcohol, fossil fuel extraction, gambling, tobacco, adult entertainment and armaments.

These examples are testament to the idea that you don’t have to make a choice between investing for good for the sake of returns.

Adrian Lowcock, head of personal investing at Willis Owen, said: “Investors have seen that ESG no longer means sacrificing returns, so effectively you can have your cake and eat it.

“Fund managers have also learnt and are still learning how to incorporate ESG factors into every aspect of their investment process so rather than being an alternative way it is another bit of data which can help them make better decisions.”

AJ Bell’s Hughes agreed with him that this way of investing will not only become more utilised but “over time, ESG will become a mainstream way of investing”.

But, he said that with no concrete definition of what it entails to be a ESG fund investors need to tread carefully and properly consider their investments.

“ESG options will continue to grow but right now it’s really important to look carefully at the options available,” he explained. “There is no standard definition of what ESG is and therefore different funds will take different approaches, and therefore it is vital to ensure that investors understand how their stated ESG principles are being applied.

“At the same time, I’m much more focused on those managers who have ESG in their DNA and have been doing it for many years – like Liontrust and Royal London – rather than those managers who have just had the epiphany and are launching ESG strategies left, right and centre.”

One thing both experts agreed on was that ESG and sustainable investment isdefinitely here to stay.

“ESG covers a broad spectrum of attitudes, some are fundamental to investing such as good corporate governance, whereas others are linked with consumer behaviour and investors’ attitudes but underlying it all is a basic ethos that companies which want to be around in 20 or 30 years’ time need to think about ESG,” said Lowcock.

“The shift in the fund management industry is unprecedented and there is momentum behind it. ESG is either a style you adopt completely because of your personal principles or an investment style you incorporate into your portfolio just as you would growth or income, value or momentum styles. It is here to stay and is an excellent way to tap into long-term sustainable businesses.”