During most investment cycles, different styles such as growth, quality and value, will outperform at various points depending on investors’ outlook.

After the extreme nature of the correction earlier this year, coupled with the last decade of quality/growth style outperformance, some investors might have expected value to outperform during the recovery as it did temporarily in Q2 2003 and Q2 2009 as markets recovered.

This time around however, given the elevated levels of debt, the 2020s may be similar to 2010s with low growth, inflation and interest rates, according to William Davies, global head of equities at Columbia Threadneedle Investments.

In his view, the potential for style shifts to impact performance has been amplified due to Covid-19, and that “a sustained period of quality outperformance is likely”.

Davies said the rally has been largely driven by central bank stimulus “along with the belief that this is a temporary situation and the corner will soon be turned”.

Although there has been something of a swing to value from growth in the past few weeks as the economy began to re-open, he cautioned against the view that this is a more permanent rotation of style performance.

Columba Threadneedle’s central forecast is that economic activity will not get back to end-2019 levels until the end of 2022.

Despite the clearly slowed economic activity ahead, global equity markets have already bounced back almost reaching their pre-Covid-19 levels.

Performance of MSCI World since the sell-off

.png)

Source: FE Analytics

Davies said: “While it is encouraging that we have seen progress across Asia and much of continental Europe in terms of low levels of new coronavirus cases, it is unlikely it will be a smooth ride from here.”

Indeed, there are still cases spiking in Hong Kong, Australia, and various states across the US.

“We are cognizant of the possibility of a second wave of Covid cases before we reach the holy grail of a scalable vaccine, and such a second wave could rock economies and markets alike,” he added.

He believes that the increased market setbacks and increased volatility within markets as the world emerges from lockdown is a clear indication that the recovery will not be linear between now and 2022.

Against this backdrop, he argued that the value style is not likely to outperform.

“At the end of the global financial crisis in 2009 we saw a sugar rush within markets, specifically for a couple of quarters from March that year where value stocks performed very well,” he explained.

“This is clearly being mimicked in some markets today, but following unprecedented levels of stimulus and government intervention the level of debt is going to be even greater than it was after 2009, so that rush of recovery is unlikely to persist.”

Instead, the Columbia Threadneedle global equities head believes markets will emerge into a world of low inflation, low growth and low interest rates, where growth is scarcer and in greater demand.

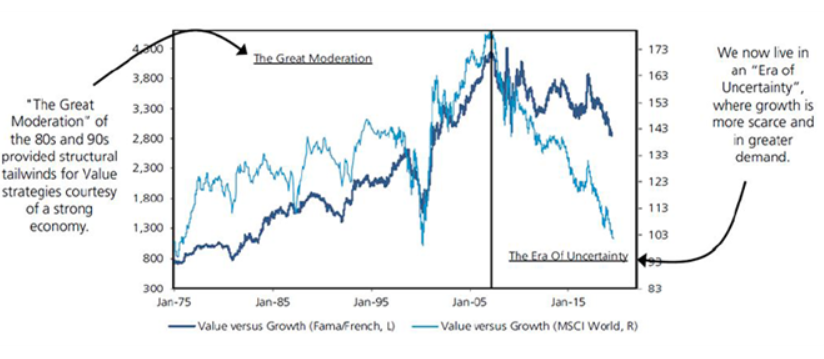

The shift in style cycle as shown by performance of Value versus Growth

Source: UBS Quantitative Research, Columbia Threadneedle

There has been some fear amongst investors that the slack monetary policy combined with large fiscal spend of governments will cause high levels of inflation.

However, Davies doesn’t see the fiscal deficit being inflationary, and pointed to the large amount of spare capacity in the economy.

Furthermore, if there is inflation, he said it will likely be accompanied by rising interest rates which will quickly dampen growth due to the higher costs of servicing debt levels.

Therefore, the 2020s could become similar to the 2010s where quality companies and those less cyclically orientated to perform better.

While certain value companies have started to look fairly attractive as the economy looks like ramping up, Davies cautioned against a rush to value and poorly performing companies irrespective of the outlook.

Even if value looks attractive at any point, which it might do at certain points in the future, he said investors need to be certain they are avoiding value traps.

“The companies that are financially, as well as operationally, leveraged appear very dangerous entities for us to be committing capital to at the present moment,” he explained.

When it comes to the question of where he is committing capital to, Davies outlined some of the companies that Columbia Threadneedle prefers in the period to come.

He said companies that are taking share from their dominant market positions, such as technology, communications, and large semiconductor companies, “are well positioned to continue to be winners going forward”.

“Companies that are operationally leveraged but have a strong balance sheet can be quite attractive, but they tend to be the quality economically sensitive or cyclical companies where we will already have positions,” he added.

Davies believes the outlook for global smaller companies remains excellent and that there will continue to be quality companies that have “the potential to grow into the behemoths of their respective industries over time”.

Their preference for quality manifests into a bias towards companies with strong market positioning and good business models.

“They tend to be leaders in their sector and possess some sort of economic moat that distinguishes them from their competition in a growing sector, allowing them to create high or sustainably rising returns,” he explained.

“We look for financial strength in the form of a solid balance sheet, high quality earnings and the ability to generate ample cash flows.”

Of course, Davies said these factors should come at an attractive valuation.