Funds such as Fidelity Special Situations, Schroder Recovery and VT Cape Wrath Focus have some of the strongest track records of outperformance when the market is being led by value stocks, research by Trustnet suggests.

UK equities have been firmly out of favour for the past five years as Brexit cast its shadow of uncertainty. However, the latest Bank of America Global Fund Manager Survey shows investors are becoming more interested in UK equities, while BlackRock recently announced that it has gone overweight the UK.

Meanwhile, a decade of ultra-low interest rates and lacklustre global growth meant the value style of investing fell behind as investors favoured growth and quality stocks, a trend which intensified across most of 2020.

But some argue that value will bounce back once the global economic recovery takes hold, following the eventual roll-out of coronavirus vaccines and a move back towards a more ‘normal’ way of life.

With this in mind, Trustnet has looked across the IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies sectors to find funds that have outperformed when value stocks have been rallying.

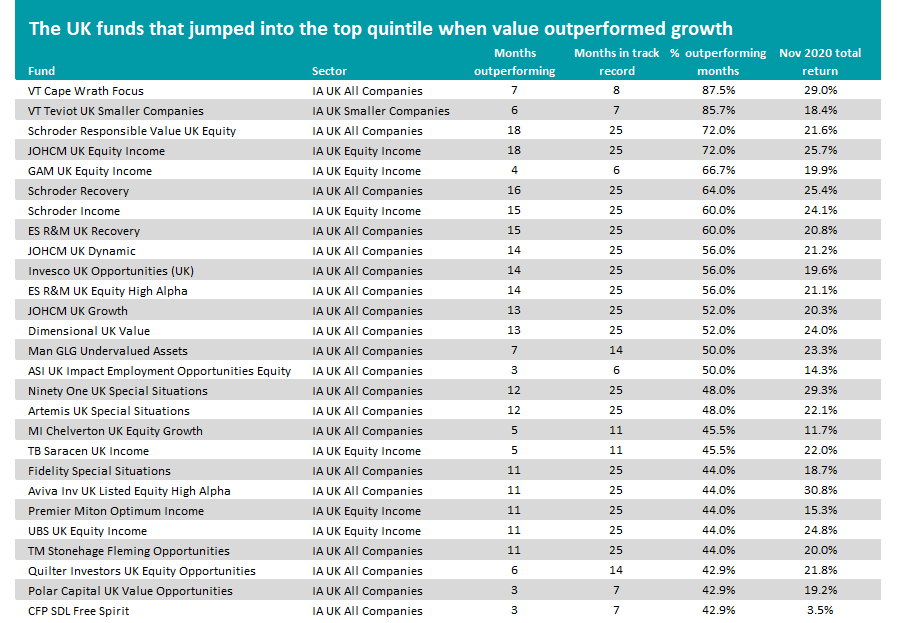

To do this, we went back to the start of 2008 and identified each month that the MSCI United Kingdom Value index outperformed the MSCI United Kingdom Growth index by more than 2 percentage points; there were 25 in total. We then examined each fund’s quintile ranking during all the months it was active to see which jumped to the top of the sector when value was leading the market.

Source: FinXL

Source: FinXL

There are 27 funds out of 379 that have been in the top quintile of their respective sector in more than 40 per cent of the months that value was rallying and they can be seen in the table above.

They are ranked in order of the portion of months they were in the first quintile, but it’s important to note that not every fund has a track record covering all 25 months we examined. We’ve also put each fund’s return in November 2020, when the MSCI United Kingdom Value index rose 17.4 per cent and beat its growth counterpart (which was up 5.7 per cent) by a wide margin.

In first place is VT Cape Wrath Focus. It only launched in October 2016 and has therefore only been active in eight months when the value index beat growth by more than 2 percentage points – but it was in the top quintile in seven of these months, or 87.5 per cent of the time.

Managed by Adam Rackley, VT Cape Wrath Focus’ investment objective explains: “The fund follows a value philosophy, looking for situations in which investors have over-reacted to events and valuations no longer reflect company fundamentals.

“The best opportunities often are found after a period of disappointment has created emotional reasons not to invest. Every investment requires a clear catalyst, which impacts on earnings, or the multiple the market applies to those earnings.”

The £4m fund has made a total return of 22.40 per cent since inception, putting in it in the second quartile of the IA UK All Companies sector for what was a challenging period for value investors.

Performance of VT Cape Wrath Focus vs sector and index since launch

Source: FE Analytics

VT Cape Wrath Focus is built around a very concentrated portfolio, with just under 70 per cent held in small-caps. This can make it a riskier option, reflected in the fact that its annualised volatility (29.03 per cent) and maximum drawdown (44.22 per cent) since launch are among the highest of the peer group.

In second place is Andrew Bamford and Barney Randle’s £91.9m VT Teviot UK Smaller Companies fund. It has a track record that includes seven of the months when value beat growth by more than 2 percentage points and it was top quintile in six of them (85.7 per cent).

This is a fund that invests in UK equities, smaller companies and value stocks – three areas of the market that have been relatively unloved for much of the recent past. But since launch in August 2017, it has made a 67.38 per cent total return – putting it in the top quartile of the IA UK Smaller Companies sector, where the average member is up 32.85 per cent.

While the above two funds only have a track record covering a portion of the 25 months Trustnet examined in this research, there are 17 than made it onto the list and were active in all of them.

FE fundinfo Alpha Manager Alex Wright’s £2.4bn Fidelity Special Situations fund is the largest fund on the list and one of the best-known UK value strategies; it was top-quintile in 44 per cent of the months when value outperformed. Wright has a strong track record of applying a contrarian approach, especially when it comes to smaller companies.

Square Mile Investment Consulting & Research, which gives the fund an ‘A’ rating, said: “In our opinion, this fund is a compelling proposition run by a highly motivated and passionate investor. Ultimately, there is a lot to like here, especially the fact that the manager has remained consistently true to his investment style.

“He is supported by one of the UK's most substantial equity research teams and we believe that this style of investment can continue to add value relative to its FTSE All Share benchmark but, given the impact that the approach applied can have on returns, it may be better suited to investors with a longer-term investment horizon.”

Nick Kirrage and Kevin Murphy run the £1.6bn Schroder Income and £1bn Schroder Recovery funds, which were in the top quintile in 60 per cent and 64 per cent of the value-led months, respectively.

The FE Investments team said: “The managers have a long term, successful track record in value investing, with the support of a sizeable team and systems, which also affords them direct and access to lead members in company management teams.

“This ensures thorough and ongoing company analysis, which allows them to move into positions quickly when stocks sell-off aggressively. They can thus sometimes be too early into positions, which can cause short-term underperformance. Their contrarian positions have, however, tended to pay off very well over the long term. Their process has evolved to include features that aim to counteract human biases, which is an attractive addition.”

Other well-known funds that have jumped to the top of the UK equity sector when value has outperformed include JOHCM UK Equity Income, Invesco UK Opportunities, Artemis UK Special Situations and Ninety One UK Special Situations.