The Covid-19 pandemic has placed a spotlight on the healthcare and biotech sectors in a way the market hadn’t seen before, highlighting an “efficient, exciting and dynamic sector”, according to International Biotechnology Trust managers Ailsa Craig and Marek Poszepczynski.

The rapid development of Covid-19 vaccines is an example of the sector’s overall progress for the past 20 years, according to Craig, showing how it has become faster at testing, developing and approving new treatments, leading to more investment opportunities.

“[Everyone] is just much more educated about exactly how the process works, and how quick it is to get from lab to market and product now because of the Covid-19 pandemic. So it's not so much changed dramatically in the last 12 months – it’s been an ongoing theme for the sector,” Craig said.

It’s also increased investors awareness about the particular investment risks in this sector, such as issues with trial stages, she added.

During a global healthcare crisis, healthcare has become a hot topic for investors. With that in mind, Craig and Poszepczynski highlighted several long-term themes which they are focusing the £302.1m International Biotechnology Trust on and immediate headwinds to the sector.

One of the fundamental drivers to the healthcare and biotech sector is demographics, according to Poszepczynski.

He explained that once a person reaches 50 they tend to suffer more aliments and consequently consume more overall healthcare costs.

Currently the over 55’s age group account for almost 30 per cent of the US population, but they alone consume over 55 per cent of overall healthcare spending.

“I think the Covid pandemic has just emphasised that the elderly are more fragile and they are the ones that kind of take the bulk of the costs,” Poszepczynski said.

This trend of ageing populations is set to continue and even increase.

The investment opportunity in this case is investing in the companies providing a better quality of life for this age group and treatments relating to these demographic challenges.

“The tailwind is there,” Poszepczynski said. “The pricing discussions will always be there because this must be accommodated within other expenses that governments have. But having said that, they can see that good drugs will be paid for sure if you can increase lifespan, but we don't believe this will lead to lower quality drugs. […] But it just shows you that the sheer demographic moves we have in the world you still don't have time to talk about it, because you always talk about the next quarter or the next month. But I think this is worthwhile noticing that going forward this will happen and has happened.”

Another long-term theme the area the trust focuses on is treating rare diseases. International Biotechnology Trust has 33 has per cent of its portfolio invested in companies working on rare disease solutions, the highest allocation in the trust.

Poszepczynski explained that the space can be less competitive if a company is first to a treatment.

He explained: “If you come up with it with a treatment you're almost exclusive in the sense that you're probably the only one there or [have] very few competitors. So you can exert a higher price [power] and can actually address a very high unmet need because these patients seldom have anything at all.”

Arguably the Covid-19 vaccine were an example of this, where there was a high demand and willingness from governments to purchase the vaccine to meet a rapid and inherent healthcare threat.

While there are several long-term themes with positive momentum, there are some immediate macro headwinds to be wary of, the managers highlighted.

In the US especially – where the majority of the trust is invested – drug pricing has been an ongoing risk and has a new perspective with the election of president Joe Biden.

When he was vice president in the Obama administration, Biden supported the rollout of Obamacare – otherwise known as the Affordable Care Act.

“I think the aim for the Biden administration is increased access to drugs for everyone, as maybe the negative side that will potentially try to lower the prices,” Poszepczynski said.

Craig added: “I think the scariest thing would be … drug pricing. So that would impact our stocks for sure. Like I said, it's quite unlikely something really draconian would come in because they don't have this huge majority. But you know, it's definitely a scenario that we watch and monitor all the time.

“Under Trump fewer people had [healthcare] coverage. Obamacare obviously expanded coverage hugely to people in the US, that fell under a Trump and Biden wants to bring that back up again. I think he wants to improve on access to health care and obviously, because they have this insurance system versus our single system in the UK.”

But while the Democrats technically hold the majority in both the House of Representatives and the Senate it’s only a slight one, meaning that policy overall is expected to be more centrists and therefore it’s unlikely to see a major shift in drug pricing regulation.

Craig added that some of the long-term themes mentioned above could actually benefit from this situation.

She said: “And it's another reason why we invest in companies that address an unmet medical need, like cancer and rare disease, because we think it's unlikely that even a Democratic party would try and stop innovation.”

Essentially after a year of a national health crisis it would be unlikely for the incoming party to place headwinds on healthcare innovation.

“I think to come down on that and to stop that, especially after what's just happened we feel is less likely,” she said.

Craig and Poszepczynski recently became lead managers in on the International Biotechnology Trust after Carl Harald Janson stepped down in March. He will remain at SV Health Investors as a senior adviser.

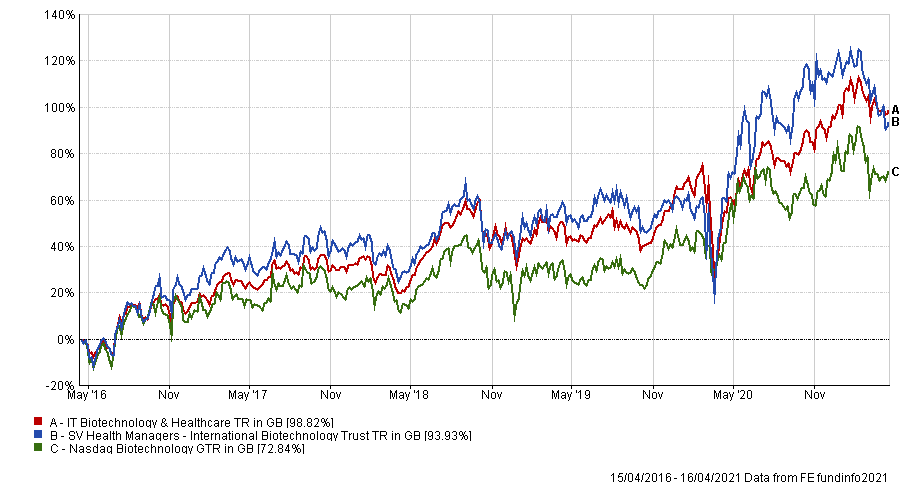

Over the past five years International Biotechnology Trust has made a total return of 93.93 per cent, underperforming the IT Biotechnology & Healthcare sector (98.82 per cent) but outperforming its Nasdaq Biotechnology benchmark.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

The trust currently has 3 per cent gearing and has a dividend yield of 3.9 per cent while running at a 1.8 per cent discount. It has an ongoing charge plus performance fee of 1.68 per cent, according to the Association of Investment Companies.