Stephen Yiu has added Google owner Alphabet and Gucci owner Kering to the top-10 holdings of his £783m LF Blue Whale Growth fund.

The two companies have replaced global ecommerce & cloud services giant Amazon and medical technology company Stryker in the top-10 of the five FE fundinfo Crown-rated fund.

Whilst Alphabet isn’t a new holding for the fund, it has swelled to a top-10 position after an almost 40 per cent year-to-date rally in its share price off the back of strong results generated from its online advertising business.

“The first internet company whose name turned into a verb, Google has become synonymous with finding answers online,” FE fundinfo Alpha Manager Yiu said.

“Branching out into maps and email, the company now provides services that are so embedded in our lives that we can't imagine life without it.

“Capitalising on its near-monopoly in online search, the company is reinvesting its profits from digital advertising into the platforms of the future - including driverless cars and augmented reality - which we see fuelling its journey to a multi-trillion dollar company.”

This comes just weeks after Scottish Mortgage Investment Trust manager Tom Slater revealed that he had completely sold out of the online advertising giant on concerns over its scale being an impediment to future growth.

Alphabet has grown to become the fifth-largest public company in the world with a market capitalisation of $1.6trn. But Iain McCombie, manager of the Baillie Gifford Managed fund, recently argued many of its investments have turned out to be a bit of a damp squib.

Share price performance of Alphabet over 1 year

Source: Google Finance

The change in manager Yiu’s top-10 comes off the back of a lot of activity in the holdings of his flagship equity fund this year.

A few months ago he added Japanese multinational gaming company Nintendo and at the start of the year it was revealed that Italian luxury brand owner Moncler also surged to the top 10.

In less than six months, however, it seems that he has swapped Moncler out for French luxury brand company Kering. Year-to-date, the share price of Kering is up 27 per cent compared with a 14 per cent rise in Moncler’s share price.

“2021 is the Year of Gucci in the world of fashion, marking its 100th year since founding,” Yiu said.

“We expect this to be a boon for its holding company, Kering, which we expect will experience an unprecedented wave of brand awareness and sales through the many celebratory events, including a feature film starring Al Pacino and Lady Gaga.

“Kering, which also owns Bottega Veneta, Saint Laurent, Balenciaga and eight other luxury brands, appears particularly attractive for us as it catches up with other giants of the industry like LVMH and Hermes.”

The top-10 holdings make up over 50 per cent of the total value of the Blue Whale Growth fund and represent Yiu’s highest conviction picks in the portfolio.

In picking the companies to be included in the top 10, the team at Blue Whale use what it internally labels “The Beautiful Companies Concept”.

These are companies which have several “important criteria” that they believe makes them ‘beautiful’ and offer “significant upside” to the current share price.

Other top-10 positions in the fund include companies like Microsoft, Facebook and Adobe, which have been in the fund since the strategy launched in September 2017.

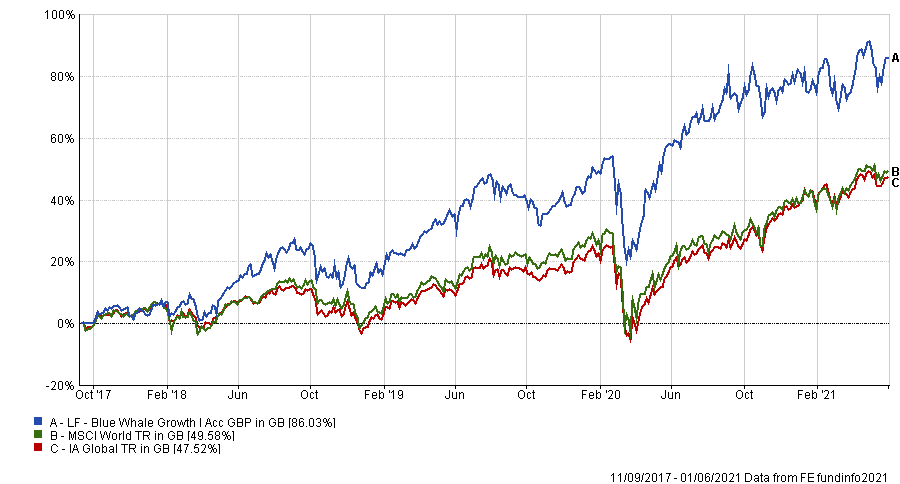

Since inception, Blue Whale Growth has delivered a total return of 86.03 per cent, compared with 47.52 per cent from the average IA Global peer, and 49.58 per cent from the MSCI World index.

Performance of the fund since launch

Source: FE Analytics

It has a 0.08 per cent yield and an ongoing charges figure (OCF) of 0.89 per cent.