There will be an exponential acceleration in the take-up of renewable energy and a faster-than-expected conclusion to the age of oil & gas, according to a new report from independent financial think-tank Carbon Tracker.

In 2020, BP’s chief executive Bernard Looney warned the coronavirus crisis and the hit to the global economy meant we may have already reached peak oil demand.

Yet while the oil price has bounced back by more than 150% from its lows of last year as the global economy has re-opened, the team at Carbon Tracker has warned investors against trying to find further value in this market over the medium to long term.

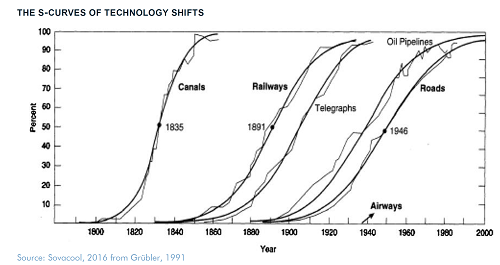

It claimed oil’s decline will not mirror the steady increase in demand for the commodity over the past century or so, but will be more likely to follow in the footsteps of other previously vital infrastructure assets that became obsolete almost overnight, such as canals and telegrams.

The volume-cost dynamic

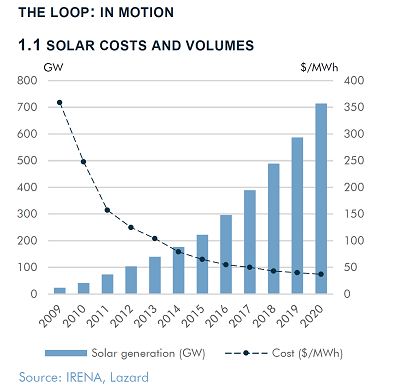

The group said that as renewable volumes rise, costs will fall, increasing demand and creating an economy of scale. This explains why, for every doubling of production over the past decade, the cost of solar and lithium-ion batteries has fallen by 28% and 18% respectively, it said.

“Improvements in these technologies are continual: solar efficiency records (commercial and lab) are broken year on year,” said Carbon Tracker.

“The diameter of the largest commercial wind turbine has gone from 90m in 2010 to 220m in 2021. And in turn, solar capacity has grown on average at 35% a year and wind at 15% since 2010.”

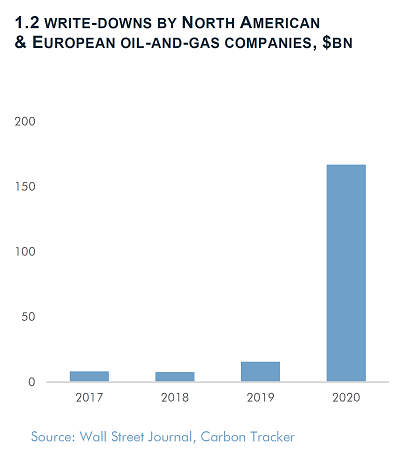

With oil & gas, the opposite is happening, as falling demand has left fossil-fuel firms with overcapacity.

“That leads to lower utilisation rates, higher unit costs and stranded assets. As sales stagnate, they struggle to repay loans and are obliged to sell off parts of the business to survive. This pattern is made more dramatic by incumbents failing to see peak demand and planning for continued growth,” said Carbon Tracker.

The same pattern has also affected other fossil fuels, such as coal. Half of the US coal sector collapsed within two years of peak global coal demand in 2014.

Better technology

As technologies build on top of each other, they spur each other on: more electric vehicles mean lower battery costs and increasing renewable penetration, creating a more efficient sector.

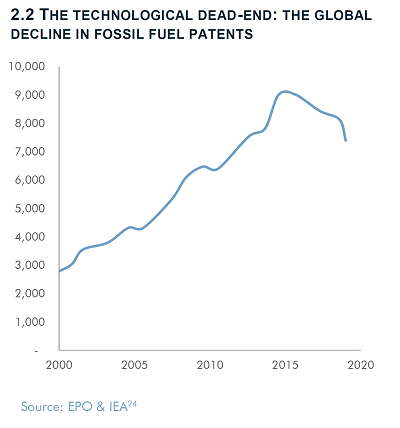

Carbon Tracker noted low-carbon technologies are still young, but that data from the European Patent Office (EPO) showed a 50% increase in the number of patents in this area in the past 10 years.

“As innovations around clean energy increase, so the value of clean energy technologies rises,” said the report.

“For example, as smart grid innovations rise, the grid gets more demand-responsive, so the problem of intermittency reduces, and more renewables get rolled out.”

In contrast, Carbon Tracker noted the number of fossil fuel patents is down 18% since its 2015 peak.

This is because the innovation potential of an industry becomes exhausted over time and “the wit and will” of engineers are directed to the growth sectors of tomorrow at a time when incumbents need them most, the report said.

“Car companies have already dramatically shifted their investments, with most of the key players such as VW and Volvo having declared an end date for the sale of internal combustion engine (ICE) cars,” it added.

“As more engineers and capital continue to switch tracks in response to diminishing returns, the industry decline process will be accelerated.”

Expectations will grow

Expectations are central to the process of economic change: when enough people hold them, they become self-fulfilling. Carbon Tracker said this meant that the more people think renewables are the future, “the more that they become it”.

Meanwhile, it warned fossil-fuel expectations had entered a vicious spiral: as the incumbent predictions of business-as-usual have been continuously shown to be incorrect, forecasters have been forced to change their models.

“Forecasters of imminent peaks and steep cost reductions have been outside the mainstream for many years. But this has all changed in the past year or so,” it said.

Finances are better

As growth draws in more capital, the cost falls, enabling more expansion. Meanwhile, declining growth scares investors, and falling share prices have forced fossil-fuel companies to cut investment and change strategy.

Carbon Tracker noted that ExxonMobil and Chevron have both faced major shareholder rebellions in recent months, while BP and Shell are reducing capital expenditure on fossil fuels and increasing their allocation to renewables.

The report added: “As financial market participants realise that they are overexposed to the fossil fuel system, there is the real risk of a ‘Minsky Moment’ where they all sell.”

Changes in society

The act of copying your neighbours and peers – a phenomenon referred to as social contagion – is as empirically sound as it is intuitive.

As more people embrace renewable technology as a possible solution to the climate crisis, it becomes more attractive due to learning and network effects.

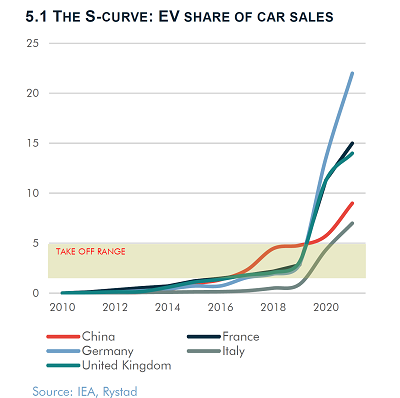

Carbon Tracker noted this can be seen in the take-up of electric vehicles: “As more people buy EVs, so more charging stations are built and so more people adopt. As more adopt, more people see and talk about them and adoption rises.”

Yet changing social norms can move something out of fashion as quickly as they can move it in, with plastic a good example. IPSOS polling suggested between 70% and 80% of the public wants to reduce plastic usage, including a ban on single-use plastics.

“Policy can reinforce behaviour change, as observed with the UK plastic-bag charge that has caused sales to fall by 95% since 2015,” said the report.

Politicians are on board

As the renewable industry grows, so too does its political clout. It has more jobs, more money, more public support, thus more lobbying power.

Carbon Tracker noted that renewable-energy jobs now outnumbered those in fossil fuels in many areas, with the transition gathering pace.

“Country by country, the green coalition is beginning to outmuscle the fossil fuel coalition at the same time as the economics of clean get ever more attractive,” it added. “The implication is the inevitability of an ever more aggressive policy response.”

Geopolitics are favourable

Both China and the US aim to lead the technological and energy economy of the future, and Carbon Tracker said that the motivation is energy independence.

“Four out of five people live in counties that import fossil fuels, so most of the world has a strong incentive to shift to domestic renewable energy,” it continued.

“China is far ahead of the US (and the rest of the world) in the production of batteries, solar and electric vehicles, but the US leads China when it comes to low-carbon patents. The Biden Presidency is seeking to close this gap and regain geopolitical leadership.”

It added that, just as many countries were able to play the US off against the USSR in the Cold War, they will be able to play the US off against China in gaining support for renewable deployment.

The report concluded: “So the revolution begins. As one tipping point is breached, so the next tipping point moves forward. The 2020s will be a decade of cascading change. Investors and policy makers need to understand the dynamics of change if they are to take advantage of the new world that is rapidly opening up.”