Investment trusts have raised a record breaking amount in 2021, but those buying UK companies have been left behind, data from the Association of Investment Companies (AIC) has found.

Fundraising by existing companies, otherwise known as secondary fundraising has already surpassed the previous 2019 record of £8.7bn with a quarter to go, hitting £8.7bn at the end of September.

Richard Stone, chief executive of the AIC said: “Healthy fundraising by investment companies this year is a sign that they have bounced back from the pandemic and are continuing to meet investors’ needs.”

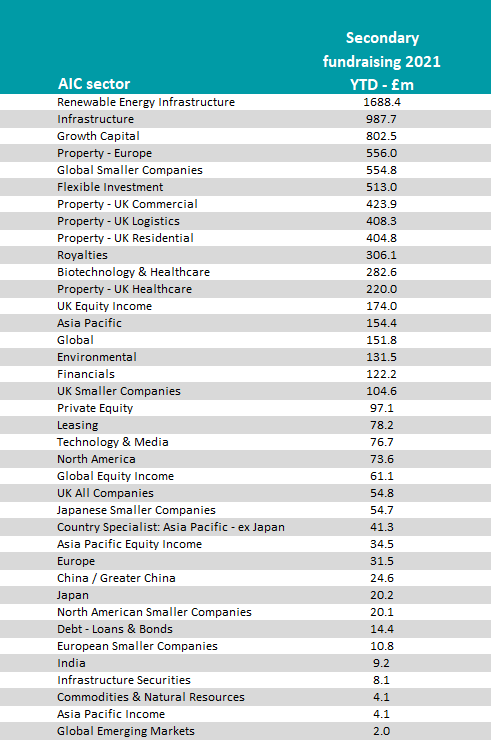

But trusts investing in UK stocks haven’t shared in this rally with the major UK equity sectors ranking in the bottom half of the list.

Source: AIC/Morningstar

Those in the IT UK All Companies sector raised £54.9m, around half of IT UK Smaller Companies trusts’ total of £104.5m. Investment companies in the IT UK Equity Income raised the most at £174m.

Annabel Brodie-Smith, communications director of the AIC, said that fund raising from trusts in the IT UK All Companies sector has been “subdued” this year despite the sector’s overall performance “bouncing back strongly over the past 12 months, up an impressive 64%.”

Currently trusts in the main UK sector have an average discount of 7% , well above the 1% discount average for investment companies overall.

There are two main reasons for this antipathy towards the UK. Firstly, Brexit continues to take a toll on the UK market, despite a final exit and long-awaited trade deal at the start of the year.

Tom Stevenson, investment director for personal investing at Fidelity International, said that the true impact of Brexit has been “disguised during the worst of the pandemic.”

He said it has now come to the fore again in the form of majorly disrupted supply chains and labour shortages.

Gill Hutchison, research director and co-founder of The Adviser Centre, agreed, saying that when the UK voted to leave the EU in 2016 “it sent UK stocks into a tailspin,” and since then UK and EU relations have been “on the rack.” This made the aversion foreign investors have felt towards the market understandable.

The ongoing disinterest in UK assets has caused a lot of frustration for UK fund managers, she said.

Sue Noffke, Schroder Income Growth fund, confirmed that Brexit had had a tangible negative impact on UK assets, depressing the valuations of the UK stock market.

Many managers have argued that these discounted valuations make the UK a buying opportunity. Indeed Hutchison said that this is currently the only main appeal for the domestic market.

“This makes some UK stocks very attractive for those with a longer-term investment horizon and a war chest to deploy,” she said.

But the AIC’s Brodie-Smith pointed out that this opportunity depends on “whether the UK’s recovery can be sustained.”

The second reason is the growth versus value battle. For the past decade growth stocks have firmly led markets as investors sought out companies to capitalise on the low interest rate and loose monetary policy environment.

This continued during the initial Covid sell-off in 2020 and the following rally, leaving UK stocks behind due to its lack of growth and technology stocks options.

Performance of MSCI ACWI Value vs MSCI ACWI Growth over 10yrs

Source: FE Analytics

This investor bias shifted when Covid vaccines were announced at the start of November 2020, however.

Providing a way out of the pandemic and adjacent economic environment, the vaccines moved markets into a recovery phase causing a surge into value investing, which the UK benefitted from.

Performance of MSCI ACWI Value vs MSCI ACWI Growth over 1yr

Source: FE Analytics

But this value rally has given way to growth again in the past six months due to rising concerns about a Delta variant and inflation. Over this time the MSCI ACWI Growth index has returned 7.7%, more than the MSCI ACWI Value counterpart, 4.6%.

These concerns have made investors more defensive, Stevenson said, and has resulted in overseas investors taking an underweight to the commodity and value biased UK.

In contrast to the UK, at the top of the table trusts in the Renewable Energy Infrastructure sector raised the most, adding £1.7bn up to the end of September.

The sector has been the top fundraiser for the past two years, indicating the continuously growing interest in sustainability and environmental, social and governance (ESG) investing.

Wind energy, solar farms, energy storage and ‘green infrastructure’ have made the sector highly relevant with the upcoming COP26 meeting where UN members will discuss how to cut global carbon emissions further.

Hutchison said that in this climate investment managers are “in a race” to launch or convert funds into products which lend themselves to ESG investing. “Renewable infrastructure is one area that lies in the heart of this dynamic,” she said.

Additionally, governments are increasingly focused on green infrastructure policies to tackle their own climate change agendas.

“Given that this is government sponsored activity, we are unlikely to see interest in these companies wane anytime soon,” Hutchison said.

The biggest fundraising by an induvial trust was Baillie Gifford’s Schiehallion, which raised £502.5m.

The Guernsey domiciled fund is run by Peter Singlehurst, Mark Urquhart and Robert Natzler. It invests in private businesses which the managers think have transformational growth potential and have the ability to become publicly traded.

Other high-fundraising trusts were Digital 9, Renewable Infrastructure Group, Smithson and Tritax Group.