The Bank of England’s (BoE) Monetary Policy Committee (MPC) have voted 8-1 in favour of raising interest rates by 15 basis points to 0.25% after its meeting on Thursday, the first time since August 2018 that it has made an increase.

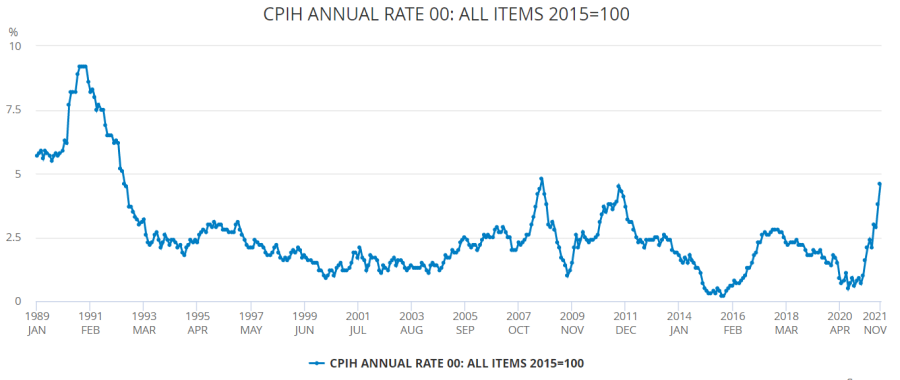

Pressure has been mounting on the BoE to act in recent months and data from the Office for National Statistics (ONS) yesterday revealed inflation had risen to 5.1% in November, the highest it has been in a decade and far above the 2% target imposed by the Bank.

It has been holding off from raising interest rates due to slow economic growth, with GDP rising just 0.1% in October, but decided to act earlier than many had expected.

Indeed, analysts did not anticipate any changes until February, but the BoE’s prediction that inflation would reach 5% in spring came about a lot sooner than expected. If this interest rate increase fails to slow inflation enough, additional increases could be made next year, experts have said.

Vanessa Hale, head of insights and residential research at Strutt & Parker, said: “This rate rise may not be significant but it is a clear statement of intent. The rise has been a long time coming, and with inflation now at decade-high levels, there really is little alternative.”

David Roberts, head of Liontrust’s global fixed income team said he was “surprised, but pleasantly so” by the news, as there were concerns that the Bank would err on the side of caution.

“With [the retail prices index] RPI running at 7%, unemployment falling fast and fears that further lockdowns would only fuel further price rises, delaying rate hikes would surely have been a mistake,” he said.

“Higher rates now might take the edge off that, not least if it helps push sterling up to curb imported inflation. Indeed, higher rates now could give twin benefits, namely less need to raise further in the future, and room to cut, should the need arise.”

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said that all eyes would now turn to when the next rate rise could take place.

The Omicron variant of concern could cause further supply chain issues, which would cause price to rise even further, while if there were further lockdowns, people could be forced to spend more online again, but full UK custom regulations will also be required on goods coming in from the EU in January, suggesting more supply shortages with red tape and checks at ports.

“The Bank hadn’t expected inflation to peak at 5% until the spring, but it’s already nudged above that rate and is expected to head towards 6% by next April and it won’t want to be seen as behind the monetary policy curve. So the indications are that fresh hikes will arrive in relatively quick succession, but only when the latest covid storm starts to subside,” she said.

UK inflation since 1989

Source: The Office for National Statistics

Homeowners are likely to be the demographic most impacted by the rise in interest rates. Mortgage bills will go up by £262m a year due to the increased borrowing rate, according to AJ Bell.

Laura Suter, head of personal finance at AJ Bell, said: “Mortgage payments are the biggest outgoing for most homeowners, meaning this is a very unwelcome present under the tree for everyone.

“The 74% of mortgage customers who are on a fixed-rate deal will be protected from today’s increase, for now. But anyone whose rate is expiring soon will have to face higher rates when they come to re-mortgage.”

On the stockmarket, high street banks spiked following the MPC’s announcement, with shares in Lloyds up 6.2% while Barclays rose 5.4%.

Paul Craig, portfolio manager at Quilter Investors, said today’s news was a “wake-up call” for investors to “check if they really want to own what they have in their books for the long-haul”.

Away from the BoE, in the US the Federal Reserve (Fed) last night announced it will reduce its quantitative easing by doubling its monthly tapering on bonds from $15bn (£11bn) to $30bn and end the tapering programme in March 2021, three months earlier than planned.

Fed officials also estimated that interest rates will be increased three times throughout 2022 at a rate of at least 0.25 percentage points each.

These measures are intended to bring the rate of inflation to 2.7% in 2022 and down further to 2.3% by 2023. Though high, these estimates are much closer to the 2% annual target than current inflation levels.