A handful of growth and smaller companies funds have vastly outperformed when markets rally, according to data from FE Analytics taken from the past five years.

As global markets struggle to find footing amidst higher inflation and the prospect of higher interest rates, global growth stocks have led a recent decline downwards.

Although a higher discount rate for global equities appears to be the overwhelming consensus for investors now, there is a possibility that inflation moderates and interest rates do not rise as much as much as expected.

In this scenario, much of the bad news that has been priced-in, could be quickly undone and markets might experience a violent rally upwards.

Indeed, over the past five years, both the 2018 global equity decline and the 2020 coronavirus market crash both proved to be good buying opportunities for longer-term growth investors.

However, there are some global equity funds that rally much more than others when markets move upwards – as measured by their upside capture ratio. This ratio calculates the percentage of the market gains captured by a fund during periods of market strength.

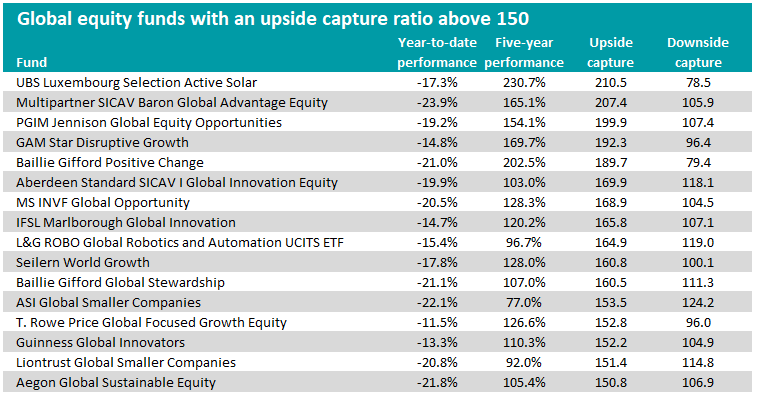

Out of the 324 equity funds in the Investment Association’s Global sector with a five-year track record, there were 16 funds that had an upside capture ratio above 150, meaning they outperformed their peers by more than 50% when markets went up.

Source: FE Analytics

Over two thirds of the funds above hold an FE fundinfo five-crown rating, putting them within the top 10% of funds in terms of their outperformance of their benchmark over three years.

The rest of the funds all have a four-crown rating, except for the single exchange-traded fund (ETF) that featured in the list: the L&G ROBO Global Robotics and Automation UCITS ETF.

Out of these 16, there were four funds with a downside capture ratio below 100, meaning they also lost less than the global average in periods when it was declining.

The fund with the highest upside capture ratio over the past five years was the UBS Luxembourg Selection Active Solar fund, which had an upside capture ratio of 210.5%.

This meant that for every period the sector went up, this fund outperformed by more than twice its peers. It also had the lowest downside capture ratio in the group of 78.5, meaning that it lost less in periods when it was declining.

Run by Pascal Rochat and Arnaud Chambaud, this fund invests in companies across the solar energy value chain. But after experiencing a 173.8% surge in 2020, the fund has declined by 33.4% over the past 12 months.

Another fund with a high upside capture ratio coupled with a downside capture ratio below 100, was the Baillie Gifford Positive Change fund.

Managed by FE Alpha Rated managers Kate Fox and Lee Qian, this fund invests in companies that can deliver positive change in one of its four environmental, social and corporate governance (ESG) themes.

It has benefited from large positions in electric vehicle manufacturer Tesla, as well as its investments in Covid-19 vaccine manufacturer Moderna and semiconductor giants ASML and TSMC.

However, despite a low downside capture ratio of 79.4, the fund has not fared so well in the recent sell-off, down 21% year-to-date versus the IA Global sector being down just 9.4% over the same period.

It is also worth noting that all the funds in the list above have fallen more than the peer average so far this year, but the downturn in stocks has spared very few funds. More than 95% of the 479 funds in the global sector are negative year-to-date.

Another fund that featured in the list was the Multipartner SICAV Baron Global Advantage Equity fund, which exhibited the second highest upside capture ratio of the past five years.

Run by Alex Umansky, a former manager of the Morgan Stanley Opportunity fund, this all-cap fund buys companies with “open-ended” growth opportunities.

Some of its largest long-time holdings have included Alphabet and Amazon, but more recently some newer holdings have swelled to the top-10.

These include companies such as Amazon-backed electric vehicle start-up Rivian Automotive and ZoomInfo, a software company that sells access to a database of information about businesspeople.

Elsewhere in the list, the ASI Global Smaller Companies fund and the Liontrust Global Smaller Companies fund were two smaller companies portfolios that featured.

Although smaller companies are generally more favoured during ‘risk-on’ market environments, they are also more vulnerable to market shocks. This explains why both global small-cap funds exhibited high upside capture ratios, coupled with downside capture ratios above 100, meaning that they have also fallen more than the broader sector during periods of market weakness over the past five years.