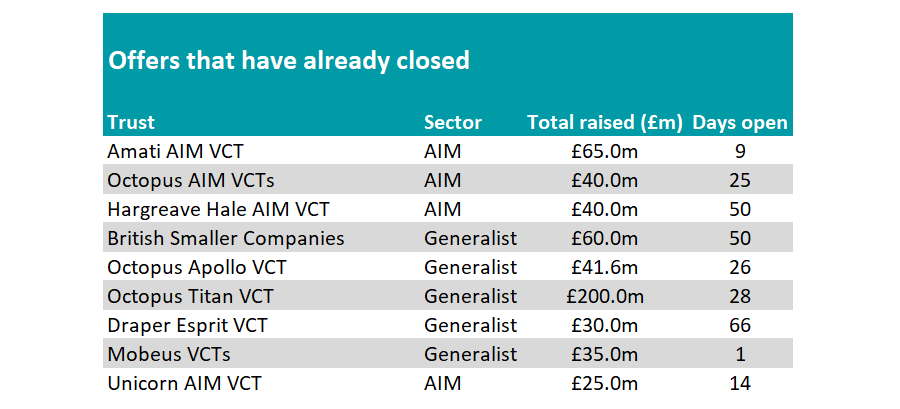

A third of venture capital trust (VCT) fundraisings have already closed after tax-savvy investors snapped up shares in record time, according to data from Wealth Club.

Last week, Amati AIM VCT became the ninth trust to fully subscribe its cash raise, taking just nine days to do so. It follows on from other popular trusts such as Mobeus and Unicorn AIM, which were closed after one and 14 days respectively.

So far this year, more than £836m has been raised by these tax-efficient trusts, almost double the £428m invested over the same period last tax year and surpassing the £779m raised in 2005/06 – the biggest year on record.

Source: Wealth Club

Alex Davies, founder of Wealth Club, said: “If you consider that this is all with the six busiest weeks of the tax year still to run, it is possible VCTs will break the £1bn mark this year and what a fantastic milestone that would be for British businesses and investors alike.”

These trusts have proven popular among high net-worth individuals, who can get 30% income tax relief on up to £200,000. This can be offset during the tax year that they are bought, although shares must be held for a minimum of five years afterwards.

Dividends and capital growth are also tax free, however VCTs typically buy early stage private companies, which is a high-risk approach that investors will need to be comfortable with.

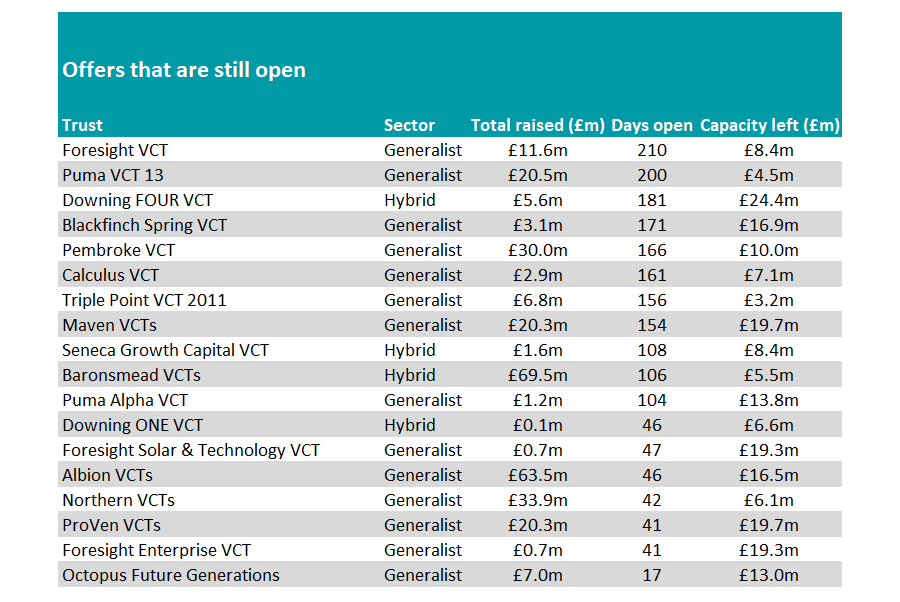

“Investors, squeezed by increasing taxes on pensions, dividends and buy-to-let investing, are quickly waking up to the idea of VCTs. But those considering their options at the end of the tax year need to be quick, as capacity within the most popular VCT offers is dwindling fast,” said Davies.

In total there is £221m left available with no new issuance expected, with investors snapping up around £5m worth of shares each day over recent weeks.

Source: Wealth Club

Like with any other investment, performance has been mixed. The IT VCT Specialist: Health & Biotech sector has been the fourth-best performing peer group over the past five years among all qualifying investment trust sectors, making an average return of 87.3%.

The IT VCT AIM Quoted sector has also done well, with trusts making an average gain of 64.1% over five years. However, Technology, Environmental (pre-qualifying) and Generalist (pre-qualifying) sectors struggled, making losses over that time.

Davies highlighted the Baronsmead VCTs, which he said are among the largest and most diverse of all options still available, ranging from AIM-quoted companies, management buyouts and smaller early stage growth companies, and exposure to three UK equity funds managed by Gresham House. Between them the two VCTs have a portfolio of more than 100 companies.

“The diverse investment portfolio and relatively low minimum investment (£3,000) means this could be a good starting place for investors looking to dip their toe in VCT investing for the first time,” he said.

Albion VCTs are another good option still available to investors. These focus on healthcare and business-to-business software companies at the larger end of the spectrum, ideally with revenues of more than £1m a year, although will also consider a smaller number of earlier-stage companies.

“The portfolio also contains some mature asset-backed investments such as renewable infrastructure assets and schools. These more mature income-generating assets help to underpin the dividend,” he said.

For investors that want to buy into premium consumer brands, Pembroke VCT is a strong option, as the trust buys niche business-to-business opportunities. Previous successes include the sale of juice and nut milk brand Plenish to Britvic in 2021, while current investment Popsa (which makes photobooks) has been named among the UK’s fastest growing companies.

“Pembroke VCT offers something quite distinctive and may appeal to investors who prefer to invest in companies they can touch and feel on a daily basis. However, as a newer VCT, its portfolio is relatively concentrated with over half its money invested in just ten companies, which makes it higher risk,” Davies said.

Last up, Northern VCTs have partnerships with 19 universities and blends more mature management buyout investments with early stage businesses.

More than half of its assets now sit within the growth capital strategy and recent performance has been encouraging, with wonky veg box company Oddbox a notable success.

“The VCTs sold part of their investment in 2021, realising 10 times return just 18 months after investing,” Davies said, noting that the trusts are run by “seasoned” investors who have a good long-term track record.