Investors in energy funds should brace themselves for a bumpy ride as ever-changing commodity prices often sway returns, according to Chris Tanner, manager of the JLEN Environmental Assets Group.

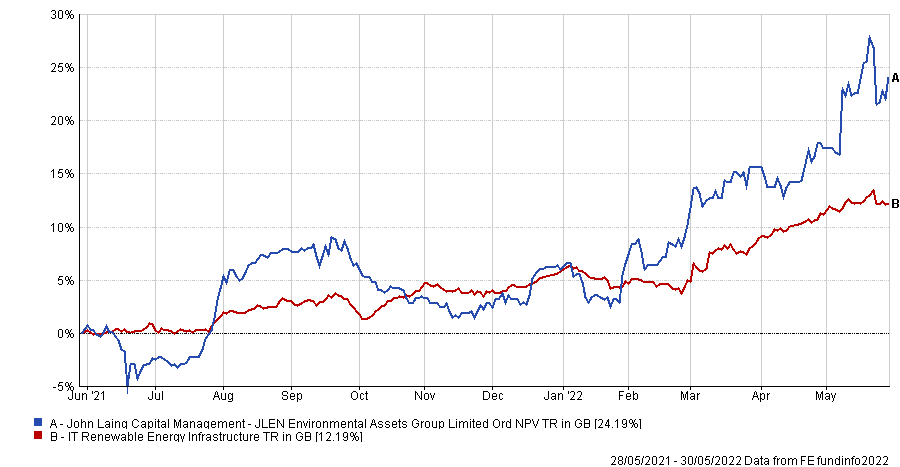

His £722m trust is up 90.6% since it launched in 2014, beating its peers in the IT Renewable Energy Infrastructure sector and this outperformance has continued in the past year, with returns 12 percentage points higher than the sector at 24.2%.

Although higher energy prices have been good for the trust in recent months, Tanner said that he must prepare for when demand drops again.

Here, he tells Trustnet how he protects the portfolio against cyclical downturns and why more interest in renewables has saturated the market.

Total return of trust over the past twelve months

Source: FE Analytics

What is your investment process?

We have the most diversified portfolio within the listed renewable sector. The technologies represented within the portfolio span from wind and solar to more recent additions like battery energy storage and low carbon transport.

Many other portfolios are pure plays and span a number of technologies, but they tend to be more renewable energy focussed.

Within our portfolio, we have the wind and solar assets, but we also have gas producing assets that produce biomethane as well as some assets that are not power generating at all.

Have you noticed more funds appearing in the renewables space?

There is a great deal of competition in some parts of the market and we have to work hard for the opportunities we pursue. I would love to be in a world where it was a buyers’ market but that's not the case.

There are a large number of funds in the renewable energy sector and that’s just on the listed site. There’s also a lot of private funds prepared to take up direct positions.

What’s the biggest risk facing the trust?

It's been a roller coaster ride on power prices over the past few years. At the start of the pandemic, power prices were very low indeed and really depressed by a lack of demand. You fast forward to now and electricity prices have tripled over the course of that time.

The current period of very high gas and electricity prices is not something we've seen at these levels before.

That’s been really good for all funds in the sector but we should all be aware that just as they’ve come up quickly, at some point they’ll come back down again.

For us, it's about maintaining a broad spread of assets and underlying revenues so that we're not overly dependent just on merchant power revenues.

How do you prepare the portfolio for those cyclical declines?

We’ve seen periods of very low prices and periods of higher prices, and that’s just the way it is. What we try to do on that front is hedge our exposure to merchant prices.

At the moment, only about 30% or so of our underlying revenues are connected to merchant power. Most of our revenues come from green subsidies or other contractual arrangements, so we're not that focused on energy prices.

We won't be able to get away from it entirely – by the very nature of our energy generating assets we will always have some level of exposure – but we can do things in terms of hedging energy prices and looking for new infrastructure models that move us away from having a very concentrated portfolio that relies on energy prices.

What has been your top stock pick over the past year?

I think our investment in the Cramlington biomass facility has worked very well for us so far. I believe we invested in it back in the summer of 2021.

It’s a combined heat and power facility that not only generates electricity, but also has private wire arrangements with nearby businesses to provide them with heat and electricity.

It's a very energy efficient proposition that makes the most use out of all of the various resources coming from that facility.

Our net asset value (NAV) was up about 15% in the March update, and Cramlington was one of the major contributors to that big uplift.

Have you sold out of any holdings?

We had some French wind assets, Parc Éolien Le Placis Vert and Energie Eolienne de Plouguernevel, that I think were only producing about eight megawatts and we took the decision to sell them in the back end of 2021.

It was sub-scale from our perspective because there are costs associated with maintaining assets and they had a disproportionately high cost.

We looked at other opportunities coming out in French wind and found that the risk adjusted returns weren't there for us. Once we got to that conclusion, it made sense for us to sell.

What is your most exciting stock?

I think that our investment in CNG, which does biomethane refuelling of heavy goods vehicles, is a very interesting move.

For us, it has a very interesting investment thesis because there are clear financial benefits for fleet operators but there is also a very strong environmental improvement compared to using a diesel equivalent.

We also like companies where we can enhance the value of assets. For example, Vulcan flowed gas at a rate of 450 cubic metres when we bought it. Now it has more than 1200 because of operational improvements.

What do you like to do outside of stock picking?

I enjoy playing football – I coach a junior team and like having a kick about myself. I get a lot of joy out of that.