In the 15 years since the start of the global financial crisis, the best performing funds have made returns measured in the hundreds of percentage points – but the anniversary comes at a time when investors are worrying about a new potential crisis.

The global financial crisis began in earnest on 9 August 2007, when French bank BNP Paribas froze three of its US funds and highlighted problems in the US subprime mortgage market. This marked the first seizing up of the financial system and banks quickly became reluctant to lend to each other.

Investors ultimately lost trust in the banking system and governments had to bail out struggling lenders. Central banks stepped in restore confidence in the market and to shore up the global economy by dropping interest rates to historic lows and launching the first quantitative easing programmes.

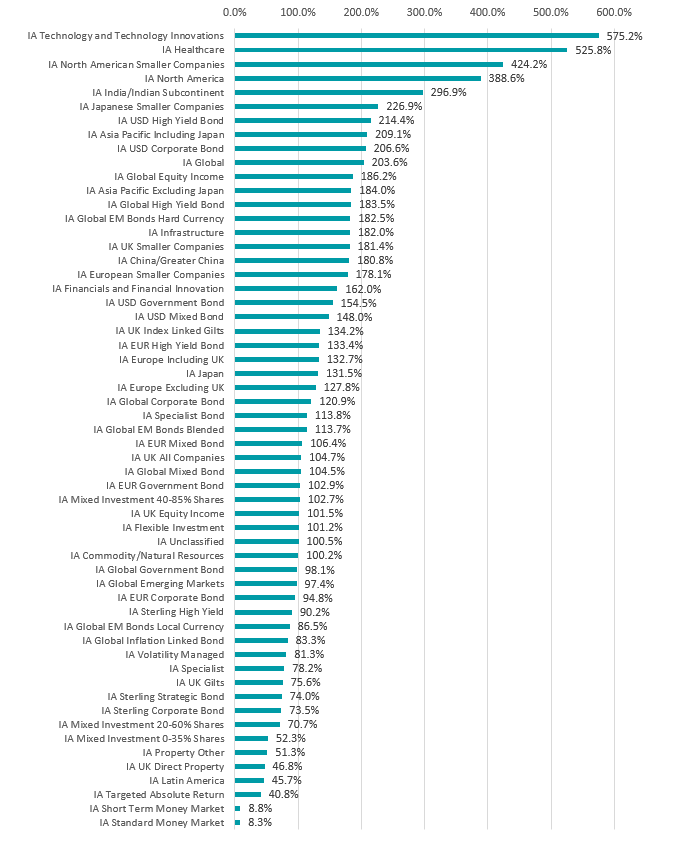

This lead to a bull market that lasted more than a decade, as bond yields were pushed to record lows and investors snapped up growth stocks. As the chart below shows, the 15 years since the opening days of the financial crisis have handed some significant returns to investors.

Total return by Investment Association sector since start of GFC

Source: FE Analytics

The average fund in the IA Technology and Technology Innovations sector is up 575.2% since 9 August 2007, reflecting the fact that tech stocks were – until recently – the strongest part of the stock market.

The high return of the IA North America and IA North American Smaller Companies sectors is linked to this, as many of the leading tech names are based in the US.

But these parts of the market have come under pressure more recently as rising inflation and interest rates have made investors less interested in growth stocks such as the tech giants.

Global funds have held up well, with the average member of the IA Global sector up more than 200% since the start of the financial crisis.

UK equities, on the other hand, have been out of favour with investors for some time and are much further down the performance rankings. The average IA UK All Companies fund has made 104.7% over the past 15 years, while the IA UK Equity Income sector is up 101.5%.

At the bottom of the rankings (aside from money market funds) is the IA Targeted Absolute Return sector with an average 15-year return of 40.8% followed by IA Latin America (45.7%) and IA UK Direct Property (46.8%).

Source: FE Analytics

These trends are clear when it comes to funds that have made the highest returns since the start of the financial crisis, shown in the table above.

Invesco EQQQ Nasdaq 100 UCITS ETF leads the pack with its 1,120.3% total return. The $6.2bn ETF tracks the Nasdaq index, which is dominated by tech stocks such as Apple, Microsoft, Amazon and Alphabet.

As would be expected, tech is a common theme among the funds in the above table with the likes of AXA Framlington Global Technology, Fidelity Global Technology, Candriam Equities L Biotechnology, Polar Capital Global Technology and L&G Global Technology Index Trust making more than 800% over the past 15 years.

But it must be kept in mind that many of the funds on the above list have struggled in 2022 as the market has turned away from growth investing. Invesco EQQQ Nasdaq 100 UCITS ETF, for example, is down 18.2% in 2022 so far and sits in the bottom quartile of the IA North America sector.

With markets selling off over 2022, Hargreaves Lansdown senior investment and markets analyst Susannah Streeter said there are obvious comparisons between now and the situation 15 years ago.

“On the face of it, there are parallels to be drawn with today, given the volatility wracking equities, movements in the bond markets signifying potential recessions and red-hot property prices showing signs of cooling,” she said.

Streeter highlighted some good news during the current volatility, such as banks being better capitalized and able to cope with a sharp deterioration in economic outlook and households being less likely to “dig themselves deeper into more debt”.

“The not-so-good news is that central banks have fewer tools at their disposal to deal with today’s looming economic storm. Back in August 2007, interest rates in the UK were at 5.75%, which provided the Bank of England with plenty of room for manoeuvre. In the years that followed, the rate dropped rapidly to stimulate demand in the economy and a mass bond buying programme was launched to reduce borrowing costs,” she continued.

“Today those levers can’t be used as they are creaking under the strain of being pulled to get us through the pandemic. With interest rates lowered to ultra-low levels, the era of cheap money has helped fuel the fires of inflation which central banks are now desperate to put out. So, instead of heading into a downturn with the expectation there will be another lifeline thrown to pull the economy out of a crisis, the aids currently deployed are being withdrawn rapidly.”

Streeter pointed out that the Bank of England appears to be willing to slow economic growth to bring down inflation, which is making investors nervous. At the same time, higher interest rates increase the risk of the housing market rapidly deflating and many homeowners are reliant on ultra-cheap yet short-term mortgage deals that will need to be renewed in a higher rate environment.

Furthermore, she noted several other “clear and present dangers on the horizon” that could threaten stability such as emerging markets being hit by continued increases in commodity prices, fresh Covid waves creating additional headwinds for growth and more turmoil in China’s fragile property market.

“Economic uncertainty and market volatility can be unnerving for investors, but tough times have been shown not to last forever, and markets eventually recover,” Streeter finished.

“With inflation appearing to run rampant and a recession looming there are clearly tougher times ahead for consumers and companies but it’s important for investors to think about their long-term strategy and stay resilient when markets are jittery. We don’t know exactly what is round the corner but keeping calm and carrying on, instead of impulsively selling, might benefit you in the long run when prices eventually recover.”