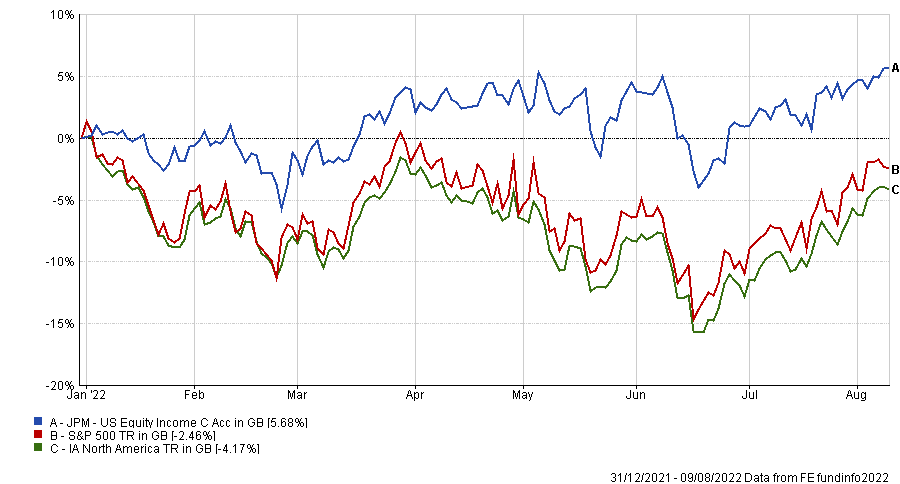

The JPM US Equity Income fund has thrived since the start of the year while many of its IA North America peers made losses – the fund is up 5.7% in 2022 so far, with the sector down 4.2% on average.

It has been a top quartile performer over the past six and 12 months, benefiting from the shift towards value investing that came with higher inflation and tighter monetary policy.

However, it has underperformed its peer group by 12.8 percentage points over the past decade as its value portfolio struggled to keep up with a growth-biased market.

Although short-term performance is strong, Trustnet asks experts which funds could be held alongside JPM US Equity Income for if markets flip back towards growth.

Total return of fund vs sector and benchmark since the start of the year

Source: FE Analytics

Ben Yearsley, investment consultant at Fairview Investing, highlighted that the US market is not typically the first choice for income investors. On face value, the dividends paid by US companies are not as appealing as other markets, especially the UK.

That being said, JPM US Equity Income invests in companies outside of the typical large-cap stocks that most IA North America portfolios tend to hold, which means it can find higher yielding companies, according to Yearsley.

For example, many US funds hold the big technology names that dominated markets for much of the past decade, whereas JPM US Equity Income’s exposure to the sector is 18.5 percentage points lower than the benchmark’s.

Yearsley would therefore suggest the M&G Global Dividend fund for investors looking to diversify their income stream more broadly.

This £2.2bn portfolio has an underweight US position of 44% compared to the MSCI AC World index’s 61% exposure, so could offer some diversitication for those who already have large allocations to the US.

It had a lower total return compared to the JP Morgan fund, up 178.1% over the past 10 years, but succeeded in beating the IA Global Equity Income sector by 36.2 percentage points over the period.

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Since the start of the year, M&G Global Dividend has continued to deliver investors a positive return of 3.5%, while the yield stands at 2.2%.

Alliteratively, investors could go for a more regional specific fund with Montanaro European Income (assuming they already have UK income exposure), according to Yearsley.

This relatively small £40m portfolio was up 155.3% over the past decade, but has fallen 17.5% since the start of 2022. It is yielding 2.9%.

Total return of fund vs sector over 10yrs

Source: FE Analytics

Andy Merricks, manager of the 8AM Global fund, on the other hand, said that JPM US Equity Income’s yield of 2% is “majorly underwhelming to most income seekers”.

He added that “like a number of non-UK equity income funds, the word ‘income’ is a little misleading”.

A good pairing could therefore be the Artemis US Select fund, because it is unconstrained by income demands.

It has a slightly growth tilt, with FAANGS such as Microsoft, Alphabet and Apple accounting for 16.5% of all assets, so it has suffered a 8.3% decline since the start of the year.

Long-term performance, on the other hand, has been strong, with returning 204.4% since the fund launched in 2014.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

Its growth bias could also diversify the portfolios of those who have value exposure in the US with the JP Morgan fund, according to Merricks.

He said: “The Artemis US Select fund may be worth considering as it is not restricted by income demands and thus holds stocks that may be more likely to benefit from style variations.”

Sam Buckingham, investment analyst at Kingswood Group, favours a value approach when investing in the US, especially with the current rate hiking cycle and inflation outlook.

JPM US Equity Income is an excellent vehicle to achieve value exposure in the region, according to Buckingham, but the style may not perform as well as it has so far this year moving forward.

“The US currently faces a recession and whilst value stocks tend to be associated with underperforming in economic downturns, we don’t necessarily believe this will be the case this time around due to the excessive premium growth stocks currently trade at in the US,” he said.

Diversity is an important aspect to consider, but an out and out growth fund could be a risky decision in the current market. Buckingham therefore went for a passive option, choosing the L&G US Index Trust.

By tracking the FTSE World USA index, it has climbed 337.2% over the past decade, outperforming funds in the IA North America sector by 50.9%. It is down 4.3% since the start of the year.

Total return of fund vs benchmark and sector over 10yrs

Source: FE Analytics

FundCalibre research analyst Christopher Salih, on the other hand, said the JPM US Equity Income fund is already a well-diversified portfolio.

He said: “It is up against the likes of the multi-cap and mega-cap names, many of which this fund won't own because of their very low, if any, dividends payments.

“The fund is usually fairly diversified, more so than many of the other popular US funds. This helps dampen volatility on the fund and allow for a range of different factors to support the dividend on the fund.”

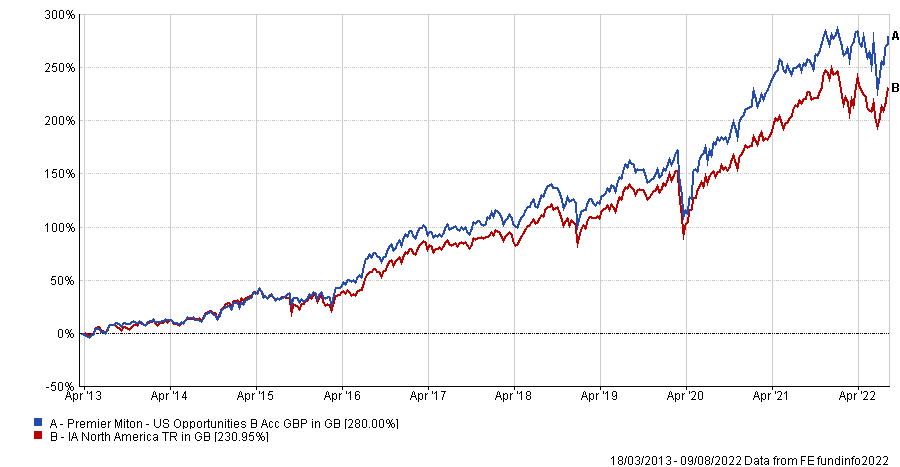

Salih would therefore go for a more concentrated portfolio to complement it – he chose the Premier Miton US Opportunities fund to hold alongside.

The £1.3bn portfolio run by FE fundinfo Alpha Manager Nick Ford is up 280% over the past decade, beating the IA North America sector average by 49.1 percentage points.

Total return of fund vs sector over 10yrs

Source: FE Analytics

It has fallen 0.9% since the start of the year, but it is still ahead of most its peers, which were down 4.3%.

Salih added: “The manager is very nimble and will move the portfolio and exposures around depending on their prevailing market view, which allows for sector outperformance and a different return profile.”