Funds run by Slater Investment Management have come out top over the past decade, but tracker funds won over the more recent past, according to data from Trustnet.

The past 10 years was one of prosperity for portfolios that leaned into stocks benefitting from low interest rates and an economy that was tentatively rising.

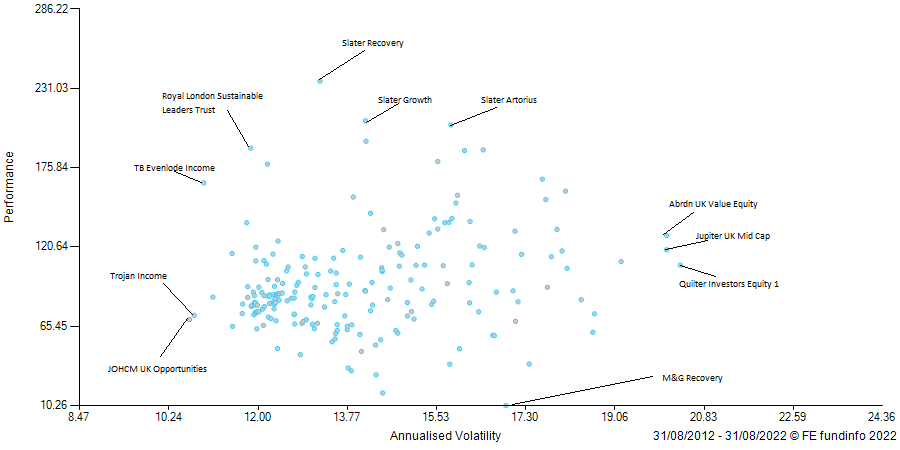

Over this time, funds run by Slater Investments held all three top spots in the IA UK All Companies sector, as the below chart shows.

Scatter chart of IA UK All Companies funds over 10 years

Source: FE Analytics

Slater Recovery has been the best performer of the stable, returning 234.8%, while Growth and Artorius follow with 204.9% and 200.6%.

They were the only funds to make investors more than triple their money over the decade, while the Recovery fund managed to achieve this with the lowest volatility of the three.

However, for investors unable to stomach too much volatility, the Royal London Sustainable Leaders Trust and TB Evenlode Income funds gave investors an even smoother ride while producing top-quartile performances. Indeed, they appear in the top left-hand side of the chart, indicating higher returns with lower volatility.

For those that were truly risk averse, Trojan Income and JOHCM UK Opportunities were the two least volatile in the sector, although returns lagged.

Both are known for their defensive nature and tend to have more cash than rivals as they seek to take advantage of falling share prices – of which, up until recently, was very rare.

At the other end of the spectrum, value funds such as abrdn UK Value Equity and mid-cap specialists such as Jupiter UK Mid Cap were among the most volatile.

These portfolios have suffered markedly in 2022 and have been among the most sold-off in what has been one of the most volatile periods of the past decade, rivalling Brexit and Covid.

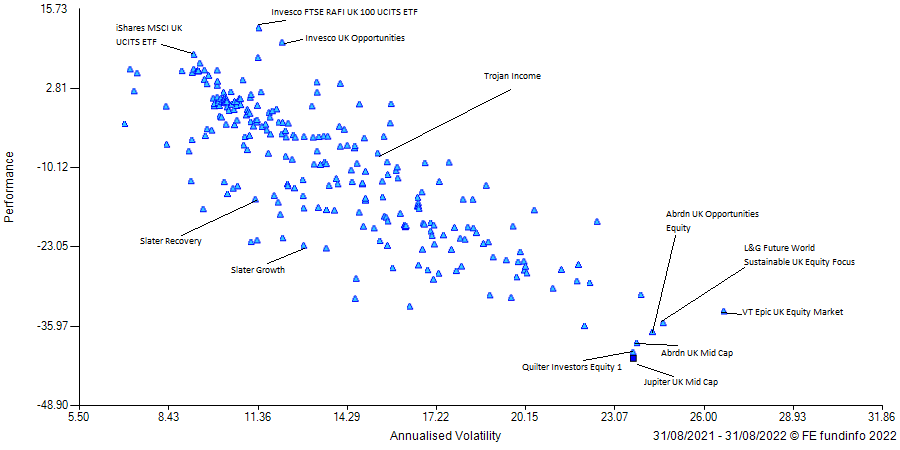

Indeed, as the below chart shows, a plethora of mid-cap funds sit in the bottom right-hand side of the scatter chart over one year, indicating lower returns and higher volatility.

Defensive funds such as Trojan Income have fared better. Indeed, these funds have come into their own somewhat over 12 months as the higher volatility has led to a disconnect in prices that has allowed them to deploy cash that had been held in reserve. The fund, which has held as much as 8% in cash over the past three years, is now down to around 1%.

Scatter chart of IA UK All Companies funds over 1yr

Source: FE Analytics

Some of the best portfolios over 12 months have been passives, which have benefited from the resurgence in oil majors such as BP and Shell.

The war between Russia and Ukraine, subsequent sanctions on the aggressor from the West and Russia’s move to weaponise its oil and gas pipelines into Europe has caused a sudden shock to supply, which has caused energy prices to soar.

Indeed, the iShares MSCI UK UCITS ETF and Invesco FTSE RAFI UK 100 UCITS ETF are among the top performers over the past year, as BP and Shell are two of the largest in the index.

Invesco UK Opportunities has been another to do well this year. Run by Martin Walker, the portfolio is heavily weighted to oil (15%) as well as financials (14.8%), which have risen on the back of higher interest rates from the Bank of England.

Industrials, which are up on potential government spending to boost economic growth, also make up a reasonable weighting of 13.9%.

Meanwhile previous winners such as Slater Growth and Slater Recovery, which have typically been underweight these stocks, have lost money for investors, although still sit in the middle of the pack among their peers on a risk-adjusted basis.