UK inflation stood at 9.9% in August, down from its peak of 10.1% in July, according to new data from the Office for National Statistics.

This drop in the Consumer Price Index (CPI) comes after prices rose for 11 consecutive months and was largely due to the drop in crude oil prices, which led to a slight easing on the cost of energy bills, according to Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

Likewise, Ben Laidler, global markets strategist at eToro said that the 12% drop in petrol prices since July’s high of £191 per litre is also likely to have subdued the rapid rise in inflation.

He added: “UK inflation served up a welcome surprise today, providing a small glimmer of positivity for our faltering economy.”

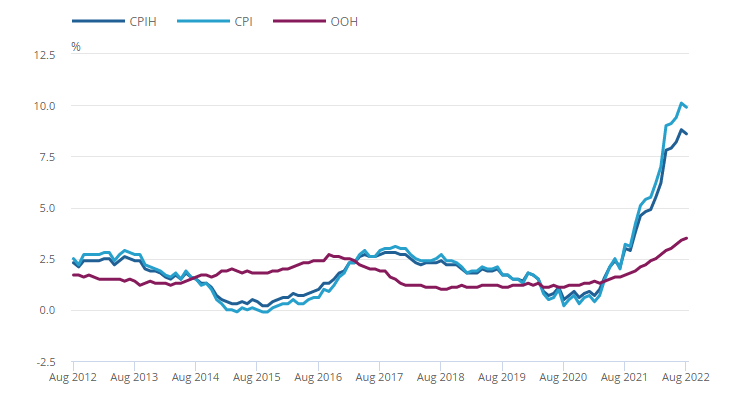

CPI inflation rate over the past 10 years

Source: ONS

This drop in inflation could ease pressure on policymakers ahead of the Monetary Policy Committee’s meeting next week, but Streeter said that the Bank of England (BoE) “can’t rest easy” just yet.

The cost of food and non-alcoholic beverages went up by 13.1% in the 12 months up to August, a significant increase from July’s rate of 12.7%, and core inflation is still at a 30-year high of 6.3%.

Nevertheless, Streeter anticipates that the BoE’s next interest rate hike, which was pushed back after the passing of Queen Elizabeth II, will be closer to 0.5 percentage points than the originally projected 0.75 percentage point rise following August’s more hopeful inflation results.

Moving forward, the freeze on energy bills announced by prime minister Liz Truss last week is forecast to have a dampening effect inflation.

Myron Jobson, senior personal finance analyst at interactive investor, said: “The government predicts that the measure could take four or five percentage points off inflation, which could (hopefully) render predictions of inflation reaching beyond 20% out of date.”

However, the £2,500 price cap that comes into effect in October is 27% higher than the current cap of £1,971, so households are not released from the cost-of-living squeeze.

Jobson added: “Inflation might not be biting as hard, and the government’s unprecedented multi-billion-pound cost of living support package will help alleviate the squeeze on household budget - but consumers will still need to strap in for a winter discontent for personal finances.”