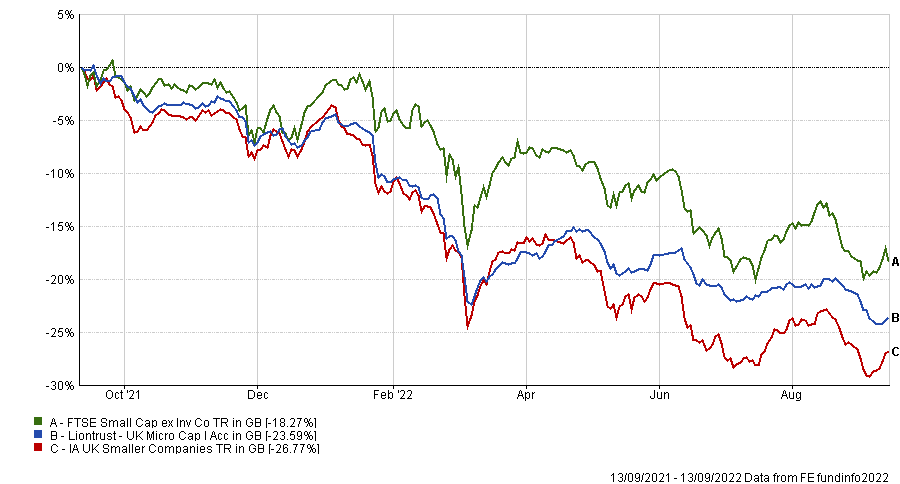

Micro- and small-caps have been through a difficult year so far, but might still offer opportunities despite the volatility.

Several areas of the market have been suffering from the new high-inflation, growing-rates environment and smaller companies have fared worse than their large-cap counterparts, with the IA UK All Companies sector down 8.3% and IA UK Smaller Companies losing 23.5% year-to-date.

Below, Alex Wedge, who joined Liontrust in March 2020 and became a co-manager of Liontrust UK Smaller Companies and Liontrust UK Micro Cap funds at the start of 2021, discusses where he finds opportunities in the sector and how he manages risk.

Performance of fund against sector and benchmark over 1yr

Source: FE Analytics

Can you sum up your process for picking stocks?

We hunt for intangible assets, which we believe are the factors that provide barriers to competition and pricing power to companies, rather than more physical assets like property, equipment, buildings and similar. In particular, we look for intellectual property, distribution channels and recurring income – every company we own has to show a strength in one of these areas.

The second step would be to test our theory using Canaccord Genuity's Quest system, which Terry Smith originally helped to create. We look for companies that make higher cash flow returns on capital. Lastly, we seek owner-manager companies, so companies with equity ownership.

In what sectors do you tend to see all these parameters coming together?

Intellectual property we often find in software and healthcare companies. Distribution for us means digital distribution networks and being ingrained in your customers’ business through software, rather than a physical presence or an office network.

Here, Rightmove would be a good example, as it is ingrained into estate agents without having offices around the UK. The small and micro-cap range has a few examples of this kind.

And to the last point, recurring income, we typically find in software companies that sell their products as a software as a service and on a recurring basis, or fee-based financial companies.

Are there any sectors that you won’t invest in?

Yes, but not through an exclusion-based style. We don’t invest in those sectors that don't display intellectual capital or intangible assets. We don’t own any high street banks or physical property companies (we own some estate agents, sales and leasing businesses, but no housebuilders or the companies physically owning the properties). We also tend not to have much or any leisure and hospitality equities.

The big underweights have been real estate and general consumer staples.

What have been the best and worst stock picks of the past year?

There’s a company called Tribal Group that does software for universities, which we particularly like for its mission to accompany students “from admission to graduation”.

It’s a really sticky software, with customers often staying for about 25 years, which means the stock ticks both our intellectual property and recurring income boxes.

We have owned it since its micro-cap stage and now we also hold it in the smaller companies fund.

On a share price point of view, Kitwave Group is another one that has done well. It does small value deliveries for corner shops and it’s been very resilient.

One of our worst companies has been CMO Group, an online builder’s merchant that had profited from a boom in consumer spending when people were stuck at home and wanted to re-do their homes and there’s been an unwinding of that trend as the markets have come under more pressure.

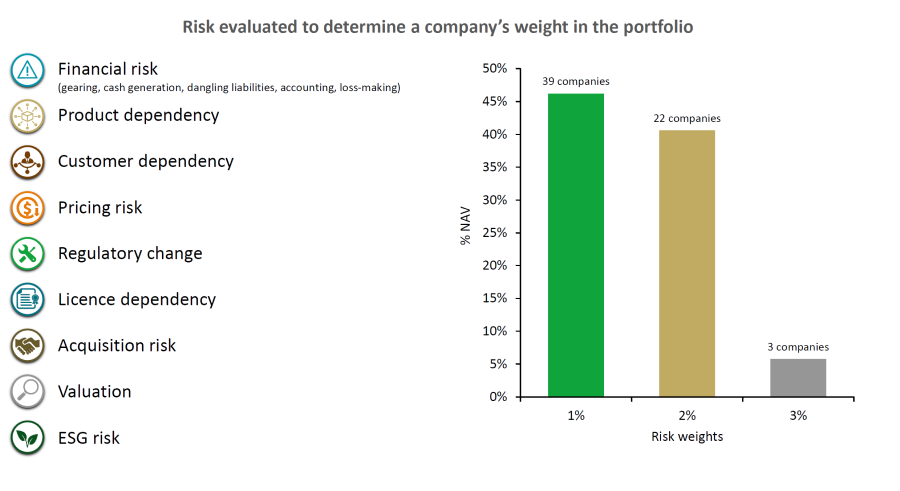

How do you manage risk?

We tend to look at risk at a portfolio level through position size rather than conviction, aiming to have the least amount of money in the riskiest stocks as we perceive them, based on some risk factors [illustrated below].

But at a company level, we buy businesses with strong net cash positions, with risks that will largely be the same as much larger businesses. What we love about owner-managers who own equity in the business is that they tend to be quite conservative: they don't like taking on debt and tend not to do big acquisitions.

Risk evaluated to determine a company’s weight in Liontrust UK Micro Cap

Source: Liontrust as at 29/07/2022

How did you meet the Liontrust team?

During my previous career as a stockbroker I used to sell ideas to [co-managers] Anthony [Cross], Victoria [Stevens] and Matt [Tonge].

I was a holder of the fund, so not only did I know the stocks in the fund very well already, but also those in the broader universe.

What do you do outside of fund management?

I'm a big sports fan, partly from my armchair partly on the field, and one of the things I took up as a Covid hobby was open-water swimming in the great lakes and ponds we have down in Surrey.