BlackRock is looking at launching an alternatives trust next year, according to Melissa Gallagher, co-head of investment trusts at BlackRock.

Sector allocations have not been finalised yet, but Gallagher confirmed that renewable infrastructure will be “a key focus” in its investment strategy.

The asset management firm has been in the process of developing its pre-existing fund range over the past few years and sustainability has been a central theme.

Last year, it converted the former BlackRock North American Income Trust into an environmental, social and governance (ESG) portfolio, changing its name to the BlackRock Sustainable American Income Trust.

Likewise, it updated the BlackRock Energy and Resources Income Trust from a 50/50 mining and energy portfolio to contain a 30% allocation to renewables.

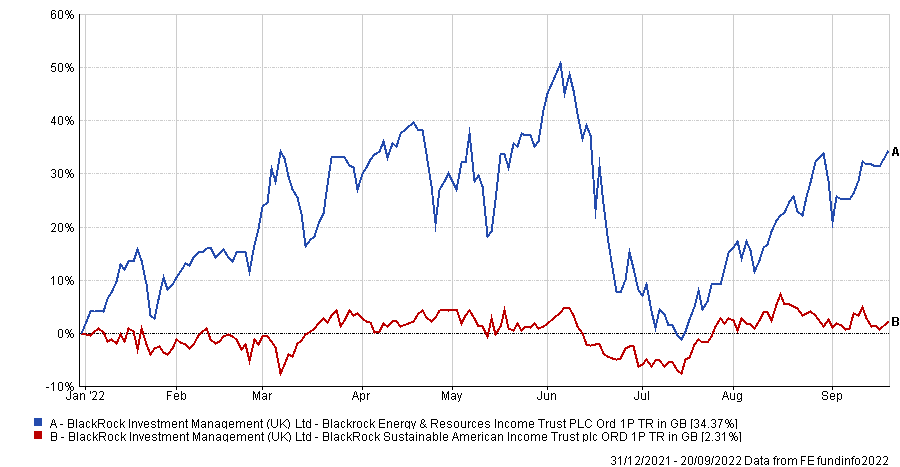

Despite the market downturn, the Energy and Resources and Sustainable American funds have made positive returns of 34.4% and 2.3% in 2022, which was partly helped by the ESG elements.

Total return of trusts in 2022

Source: FE Analytics

Gallagher said that BlackRock is “constantly looking at how we can make our trusts stay relevant”, and the next stage is to launch a new portfolio. They considered a number of investment areas before settling on alternatives as the most appealing opportunity.

“Any new fund launch has to be in the alternatives area,” Gallagher said. “We’d love to manage Asia or pure emerging market funds but in terms of new launches, a lot have been in the alternatives space so that’s an area we’re looking at from a new product perspective.”

Plenty of funds investing in alternatives and renewable infrastructure already exist in the market, so one challenge has been to find a fresh approach to the sector.

Many pre-existing funds in the market are concentrated on assets in the UK and Europe, so Gallagher said that the new trust could take a more global approach in order to stand out.

“It’s really important that each investment trust has a purpose, so we spend a lot of time really making sure that that differentiation from the rest of the market comes across,” she added.

Another reason BlackRock could opt for alternatives over other areas is because of its limited availability – it’s difficult for individual investors to get exposure to niche asset classes without going through a trust structure.

Gallagher said: “We asked ourselves, ‘if we were going to launch an Asia or EM fund, would we raise enough’? Previous launches have been in the old space and that's where the demand has been because you're giving investors access to something that they can't get directly themselves.”

BlackRock could initially aim to raise at least £250m for the new trust next year, according to Gallagher, which could be a refreshing change after no new initial public offerings (IPOs) in 2022.