October was a month of upheaval, at least in the UK, as Liz Truss announced her resignation as prime minister after a tumultuous stint in charge of the Conservative party.

New leader Rishi Sunak has come in, with chancellor Jeremy Hunt by his side, hoping for a longer and more fruitful time in charge than his predecessor.

On an economic front, inflation numbers have ticked above 10% again in the UK, but it was not just a domestic story, with prices rises running rampant in Europe and the US, although it is slightly cooler across the Atlantic than on the Continent.

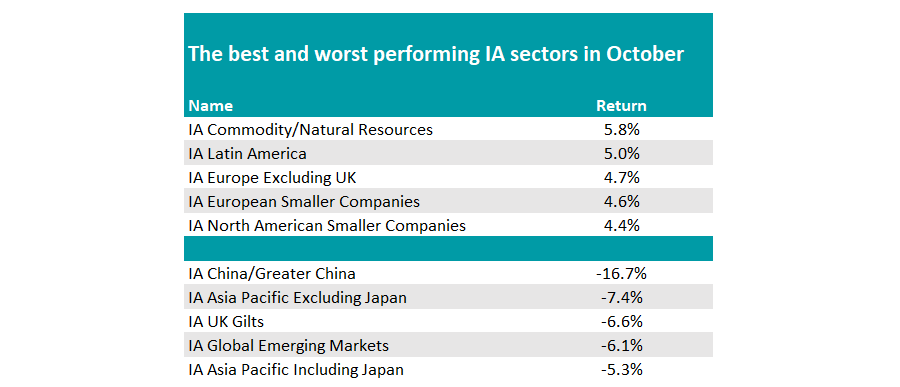

Turning to markets, at a sector level, IA Commodity/Natural Resources and IA Latin America funds did well as anything connected to commodities proved popular again in October. Europe also had a strong month despite the ongoing war in Ukraine.

Source: FE Analytics

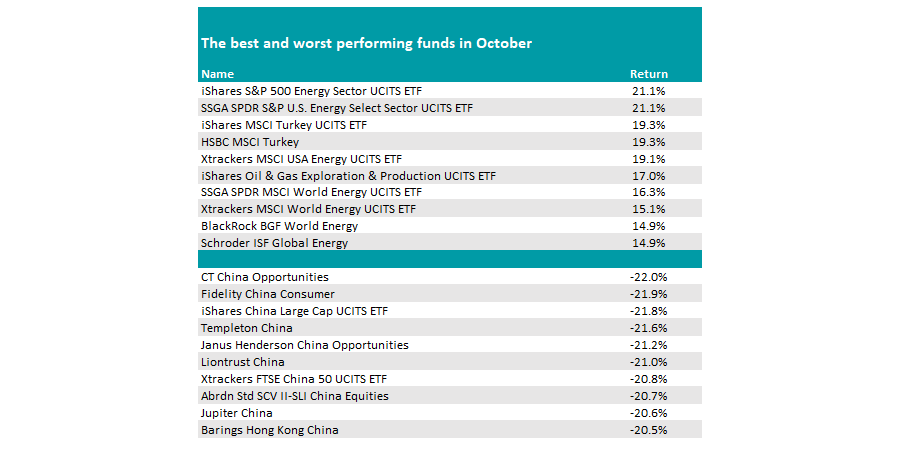

In China, president Xi cemented his hold on power, although markets did not take kindly to the news. Indeed, there was no relaxation of the government’s net zero Covid policy, which impacted stocks in the region. Indeed, all of the top 10 worst-performing funds of the month invested solely in China.

Ben Yearsley, director at Fairview Investing, said: “China had a shocker – dragging both emerging markets and Asia down with it. The Hang Seng fell 14.7% in local currency terms and 17.3% in sterling.

“President Xi’s grip on power intensified during the past five year congress in October and with slowing GDP and no end to the zero Covid policy, investors took fright. Columbia Threadneedle China Opportunities was the worst performing fund last month falling 22%.”

Conversely, energy funds were the clear winners, with eight of the top 10 funds investing in the sector as investors shrugged off talk of windfall taxes in various countries.

“This is probably because it is so hard to tax global profits easily (just look at the global tech titans to see the same problem). Old school value continues to do well out of energy and, whilst not featuring in the top 10, there were a number of European funds sitting just outside it,” said Yearsley.

Source: FE Analytics

There was some reprieve for gilts as markets calmed down following the end of the Truss saga, with the UK 10-year finishing with a yield of 3.51%. There was also a boost from currency, as the pound rallied 3% against the dollar, benefiting domestic earners.

“What the forex markets give they can also take away. After sterling plummeted following September’s ‘kamikwasi’ Budget, there was always going to be a rebound as it has been massively oversold. That unfortunately hits investors’ overseas investments, as it did last month with some decent equity returns hit by sterling strength. As the Bank of England continues to play catch up you could see sterling continue to rise,” said Yearsley.

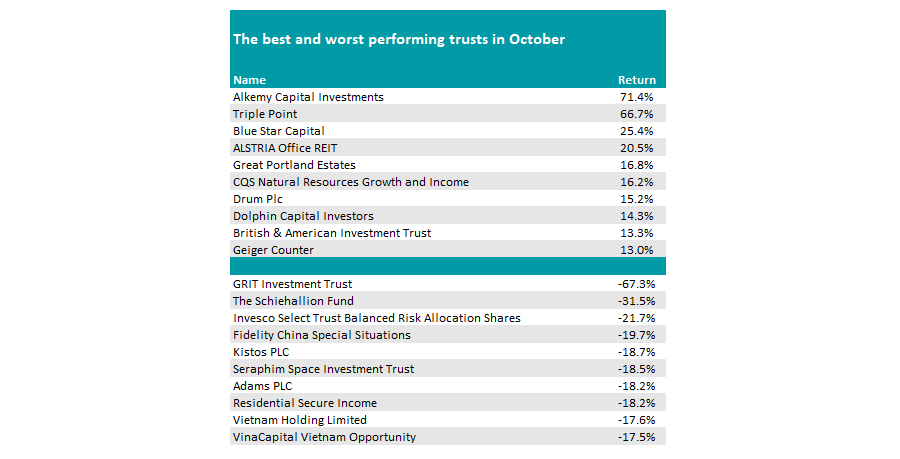

In the investment trust space, there were similar patterns. At a sector level, European peer groups performed well, with the European Smaller Companies sector taking the top spot. UK Equity & Bond Income was second, although there is only one trust in the sector.

Source: FE Analytics

Among individual trusts (excluding venture capital trusts), real estate investment trusts (REITs) performed well, as did CQS Natural Resources Growth and Income as commodities surged.

Baillie Gifford’s The Schiehallion Fund was among the worst performers, alongside dedicated China trusts and more niche operators such as Vietnam and space equity portfolios.