Investors who held the Baillie Gifford International fund over the past decade would have made above average returns over the period, but performance has slacked in recent years.

The £1.4bn portfolio – which is the open-ended version of the Monks investment trust strategy but without the private equity – was up 244.4% over the past 10 years, towering 77.3 percentage points above its peers in the IA Global sector.

Long-term performance may be strong, but the recent past has been less forgiving, with the fund slipping from the top quartile over the past one, three and five years.

In fact, returns over the past one and five years have been below the sector average as Baillie Gifford’s growth-driven strategy has struggled through the recent market downturn.

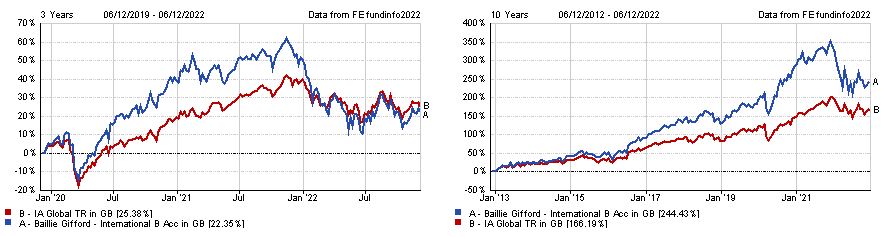

Total return of fund vs sector over past three and 10 years

Source: FE Analytics

Many investors who hold the fund may be wondering how it can perform outside of the low interest rate and low inflation environment of the 2010s, which led to a growth-oriented market.

Some could even argue that new investors could benefit from buying the dip before a recovery, but Ben Yearsley, director of Shore Financial Planning, said that a return to positive returns is not on the cards yet.

“Baillie Gifford has clearly had a tough past year or so with many of its funds underperforming,” he added. “Its high growth style of investing is way out of fashion and doesn’t look like returning any time soon.”

Those who already hold the fund should continue to cling on through the volatility as it is likely to perform well over a 10-year horizon. However, now is not a good entry point for new investors as returns could get worse before they get better, according to Yearsley.

Although the fund’s performance has taken a tumble in recent years, Darius McDermott, managing director of Chelsea Financial Services, said that the resilience of its management team is a positive sign.

Rather than abandoning their investment discipline in a value dominant market, the managers have continued to invest in growth opportunities, which should reward them over the long term.

Malcolm MacColl and FE fundinfo Alpha Manager, Spencer Adair, have been running the fund since 2010, with Helen Xiong joining the team last year.

McDermott said: “There is nothing wrong with underperformance when the style of a fund is out of favour – we’d be more worried if we saw the team panic and move away from their traditional high growth style of investing.”

Investors who hold Baillie Gifford International should continue to do so given they may risk crystalising their losses by selling out now, he added, but for new investors, it entirely depends on an individual’s outlook on where inflation and interest rates are headed next year.

He said: “If inflation remains persistently high, and rates rise, you don’t want to be near long duration growth assets. By contrast, if you feel inflation has peaked and may fall rapidly in 2023 then we could easily see a return to a growth style that Baillie Gifford has so successfully employed in the past.”

This is the case for Andy Merricks, fund manager at 8AM Global, who said that we could be approaching an attractive entry point as performance is likely to rebound once market conditions improve.

However, he warned that the turning point for markets is unlikely to happen in the immediate future, so investors are better off drip feeding in rather than making and large investments too early.

Merricks added: “If you have not already deserted the Baillie Gifford International then I personally see little point in doing so now. If you are holding it, a bit more patience may prove rewarding (although it may take a while to get back to where it has been) and it may actually be a buy or anyone considering entering the market in the coming months.”