As the end of the tax year approaches, there are reasons to be optimistic for the future, according to Gabriella Macari, chartered wealth manager at TILLIT.

The turn of the year has brought about a change of fortunes for investors, who suffered through a difficult 2022 but have made strong gains in January and February.

“Despite the markets remaining unpredictable, there are some bright spots on the horizon that could provide investors with some longer-term opportunities,” she said.

These include inflation showing signs of peaking, resilience in the US market and China lifting strict Covid lockdown rules, which “should be supportive of improving strained supply chains”.

Below, she outlines five picks made by the firm’s investment committee. However, as it is unlikely that we are headed back to the types of capital returns investors have enjoyed since the great financial crisis, she added investors should “more considered in their investment strategies and focus on the long-term” and noted that all of the picks are made with this in mind.

We begin with fixed income and the “flexible” M&G Global Macro Bond, which invests across the asset class.

Performance of fund over 1yr against sector

Source: FE Analytics

The fund’s holdings include sovereign and corporate bonds from both developed and emerging markets in line with the managers’ macroeconomic views, who also look to profit from interest rate and currency moves.

This high-conviction strategy, with the managers taking relatively large positions, is unusual in the bond fund space, and provides “well-diversified exposure to the global bond market and the active management style has potential in an ever-changing landscape,” said the TILLIT manager.

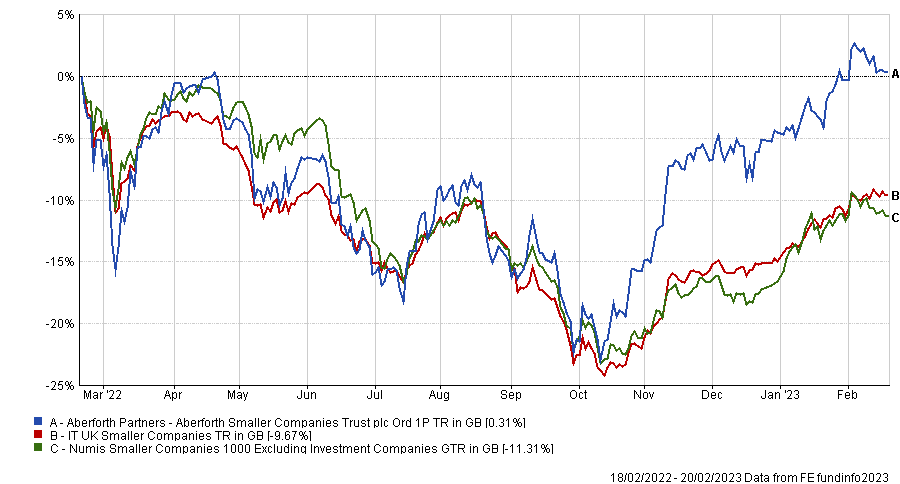

If you believe small and mid-caps are ready to close the gap with their larger counterparts, you might want to consider the Aberforth Smaller Companies trust, which looks for UK-listed small companies that are out of favour with the market.

Performance of trust over 1yr against sector and index

Source: FE Analytics

The team looks at dividends and a company’s ability to pay them, if not in the near term then at least in the future.

“Value-style investing has made a strong comeback after more than a decade of being out of favour and for investors looking for something contrarian, the Aberforth Smaller Companies Trust is a contender,” said Macari.

For those who have exhausted their UK exposure and are looking to invest somewhere else, TILLIT selected FSSA Global Emerging Markets Focus, an emerging markets fund with a focus on long-term growth, balanced with downside risk protection.

Performance of trust over 1yr against sector and index

Source: FE Analytics

Decisions are based on the fundamental company analysis and there are no fixed country allocations.

“The strategy has a bias towards domestic growth over exporters, which means it should be less sensitive to changes to the US dollar and foreign exchange moves,” said Macari.

“Compared to other emerging market funds, this strategy has a more conservative approach, so while it may lag its peers in a risk-on environment, it should hold up better than most peers in a falling market.”

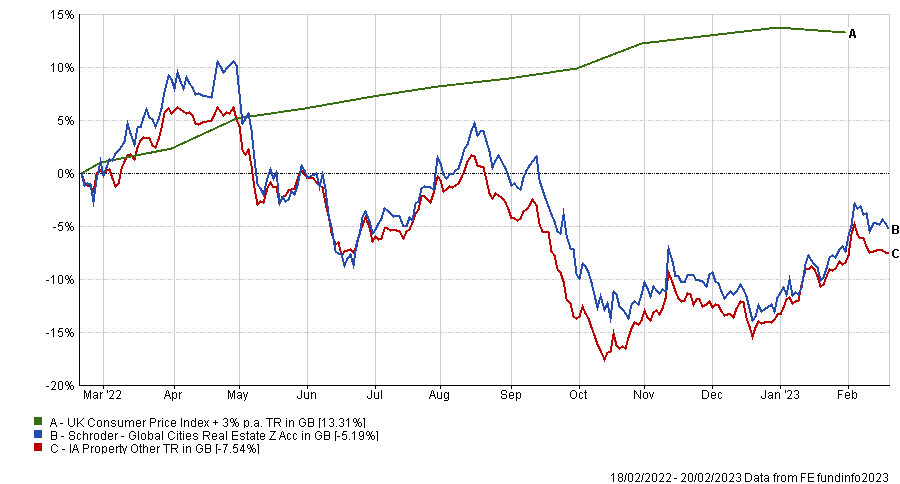

Away from traditional asset classes, one option in the alternatives space is Schroder Global Cities Real Estate, a fund of funds investing in real estate investment trusts (REITs) and developers around the world.

Performance of fund over 1yr against sector and index

Source: FE Analytics

In the shorter term, REIT performance is closely correlated with equity markets and REIT managers can (and often do) employ gearing within their strategies. This means that in the shorter term, investors can expect that REIT performance to be more volatile than directly held property funds and property assets, Macari warned.

“However, over the medium- to long-term, REIT performance is more correlated with direct property assets, providing exposure to diversified property assets around the world. In addition, the fund doesn’t carry the same liquidity risks as open-ended physical property funds.”

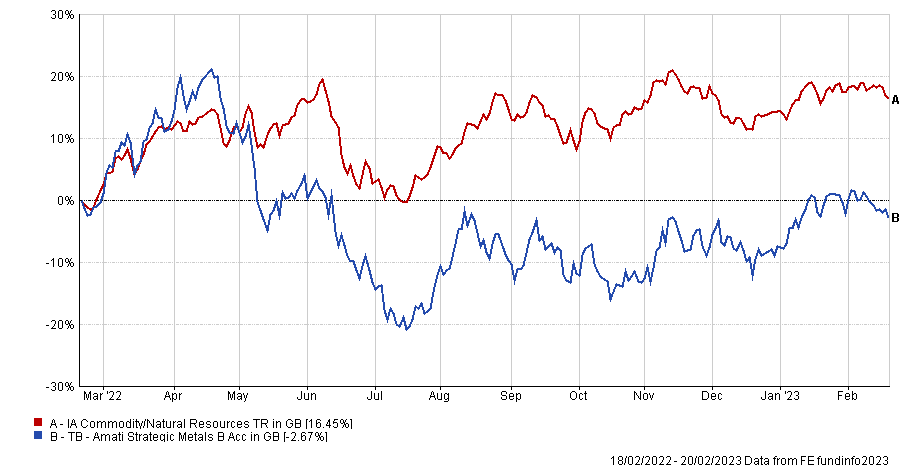

Lastly, metal mining is often seen as the powerhouse of technology and the energy transition. TB Amati Strategic Metals might be the right specialist fund for investors looking for equity exposure to a combination of precious metals, base, and specialist metals rather than a fund focused on a single more common commodity such as gold or silver.

Performance of fund over 1yr against sector and index

Source: FE Analytics

The fund invests in small- and mid-cap mining companies exposed to precious, speciality and industrial metals operating predominantly at the early phase of the value chain, typically avoiding large mature companies that are almost wholly reliant on higher commodity prices to enhance the value of their businesses.

“The unique, specialist, expertise of the managers Georges Lequime and Mark Smith is another attraction of this fund,” said Macari.