Junior ISAs give parents the opportunity to invest in their children’s future without taxes biting into their savings pot. With an investment horizon of up to 18 years, investors can take a lot more risk than most adults could afford to in a regular stocks and shares ISA.

Here, expert fund pickers tell Trustnet what parents should be adding to their children’s Junior ISAs to maximise returns over the long term.

Investors may want to start off by considering the Goldman Sachs India Equity Portfolio, recommended by Tom Sparke, investment manager at GDIM.

As its name suggests, the $1.8bn fund invests solely in Indian equities, giving investors exposure to one of the biggest winners of the coming decades, according to Sparke.

He said: “We have never seen a demographic shift of this size before, and the investment opportunity present in India is one of the biggest in history.

“A huge, youthful population totalling more than a billion people will be shifting towards earning, consuming, and spending significantly more.”

He said that India is likely to be one of the best performing economies over the long run, so investors utilising the lengthy investment horizon of a Junior ISA needn’t worry about volatility over the short term.

The Goldman Sachs India Equity Portfolio is up 240.8% over the past decade, beating the MSCI India benchmark by 85.2 percentage points.

Total return of fund vs sector and benchmark over the past 10 years

Source: FE Analytics

It was the second best performing fund in the IA India/Indian Subcontinent sector over that period, beating its peer group by 71.1 percentage points.

Current manager Hiren Dasani has not been with the fund that whole time, but it has delivered top-quartile returns and beaten both the benchmark and sector since he took over in 2017, climbing 52.4%.

Goldman Sachs India Equity Portfolio is the best placed fund that investors looking to benefit from India’s growth can buy, according to Sparke.

He added: “The Goldman Sachs fund is our preferred option because it has strict outperformance goals and a focus on domestic enterprises of various sizes that will influence the nation's destiny.”

Investors who are looking for exposure to another long-term trend in their Junior ISA may want to consider the EdenTree Green Infrastructure fund, which was chosen by Victoria Hasler, head of fund research at EQ Investors.

She said that clean energy assets are forecast to receive $10.6trn by 2050, providing an array of opportunities for “investors who are willing to be patient”.

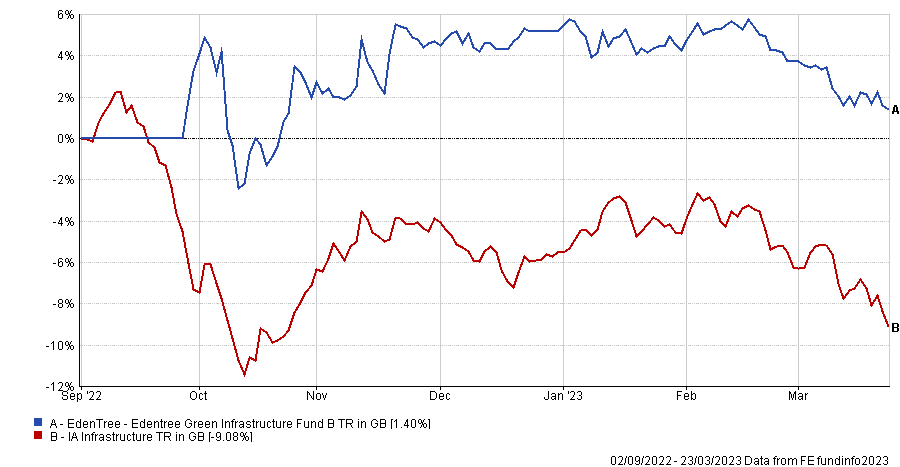

The newly launched fund managed by Tommy Kristoffersen has been on the market since September last year and returns are up 1.4% in its first few months. It is early days, but its peers in the IA Infrastructure sector dropped 9.1% over the same period.

Total return of fund vs sector since launch

Source: FE Analytics

This is Kristoffersen’s first fund, having previously worked as an analyst on EdenTree’s Multi Asset Strategies and European Equities team as well as Jupiter’s Absolute Return team.

Hasler said that the fund is diversified across a broader range of assets than would typically be seen in other environmental, social and governance (ESG) portfolios.

“The fund invests across energy generation, energy storage and efficiency, natural capital and complementary assets that are used as diversifiers and include things like carbon allowances and offsets, social housing, care homes and green logistics and warehousing,” she said.

Although investors have more freedom to take risk in a Junior ISA, Hasler said that EdenTree Green Infrastructure could offer a high return over the long term with little volatility thanks to its infrastructure focus.

She added: “Whilst we expect the fund to provide good financial returns over time, benefitting from the opportunities available, it should also provide a less volatile return than traditional equity investments.”

Emma Wall, head of investment analysis and research at Hargreaves Lansdown, agreed that the global effort to reach net-zero carbon emissions provides a lucrative opportunity over the long term.

She went down the passive route, recommending Legal & General Future World ESG Developed Index as an ideal fund for a Junior ISA.

Wall said: “An index tracker is one of the simplest ways to invest, and this one could be a good addition to a broader investment portfolio aiming to deliver long-term growth in a responsible way.”

The passive fund is up 46.8% since launching in 2019, beating other funds in the IA Global sector by 13.7 percentage points.

Total return of fund vs sector since launch

Source: FE Analytics

Wall pointed out that this tracker excludes tobacco companies, coal producers and other controversial companies, removing some ESG risk from the portfolio.

Analysts at Square Mile Research went one step further, stating: “We like this fund because not only does it exclude a large number of ‘sin' stocks, but it will be slightly overweight to stocks with strong ESG scores and underweight to stocks with poor ESG scores. Relative to the broad market this fund will have a better impact.”

It is more expensive than most passive funds in the sector, but this mixture of exclusions and overweights makes it worth the premium, they added.

Ultimately, the fund is still cheaper than the average active global portfolio and Square Mile said that they have “a high regard for Legal & General as a passive manager”.