Dividend-paying companies offer an attractive source of income but many funds investing in them are vulnerable in volatile markets, according to Matthew Page, manager of the Guinness Global Equity Income fund.

They focus too much on high yields, but Page and his co-manager Ian Mortimer look first for good businesses before considering their dividend.

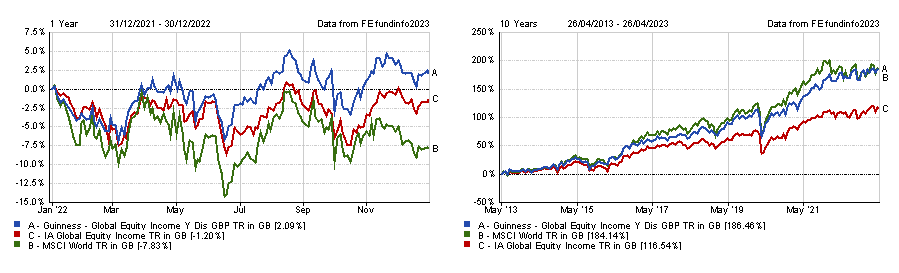

Over the past decade, their €4.5bn portfolio was the fourth best performing fund in the IA Global Equity Income sector, climbing 186.5%.

Page told Trustnet why this process of prioritising strong companies over their dividend yields helped it rise 2.1% in the rocky markets of 2022 while its peer group sank.

Total return of fund vs sector and benchmark in 2022 and over the past 10 years

Source: FE Analytics

What is your investment process?

This fund was launched in 2010 as a reaction to the financial crisis – we had lived through that pain and saw what had done poorly and what had done better.

We really tried to think about how we could build a portfolio that would be able to weather the next big economic storm and not only survive but come out the other side and thrive.

We did a lot of thinking about the types of companies that managed to survive best in that sort of environment – that could grow, compound and deliver good returns – and we ended up with dividend-growing companies.

How does your approach differ from your peers?

The traditional approach to dividend investing is to define a universe of companies that have got a minimum level of dividend yield and then select your favourite companies within that to build a portfolio with an attractive yield.

The problem with that is if you just start by looking for high yields, you risk buying companies that are at risk of actually cutting their dividends. We saw that was a painful place to be.

For us, we don't start by looking at dividend yield, we start by looking for companies that consistently generate high return on capital every year and that is a very high hurdle rate – it screens out 95% of companies straight away.

You end up with a portfolio with profitability that is double that of the MSCI World, which usually trades at a discount because of our value discipline, and that grows its dividend every year.

Did many of your holdings cut their dividend in 2020?

Only one company out of 35 cut their dividend in the in the pandemic year and we actually had 28 that grew their dividend.

If you compare that to the FTSE 100 or EURO STOXX, then half of the companies in those two indices either cut or cancelled their dividend that year.

Do you think the equity income sector is lacking that defensive quality?

We certainly see that a lot of funds for dividend investing are about giving you the highest possible dividend yield and worrying less about capital preservation or indeed capital growth.

Our view is that if they're growing their business, then that should drive share prices up over time, and if we overlay our value discipline on top of that, hopefully we can get some multiple rerating.

We have a lower dividend yield requirement (we have owned things yielding 1% for example), but that has meant we've been able to own more North American companies that have lower dividend yields but very good dividend growth.

If you looked at the average global equity income fund, you'd find quite a high exposure to continental Europe and a lower exposure to the US.

You cut exposure to the UK from 18.6% to 5.2% over the past year – why was that?

That was really a consequence of bottom-up stock selection. We have a one-in one-out approach and whenever we add a new company, it enters the portfolio at a 3% position which we can rebalance over time.

The main reason for that reduction was because we sold three UK businesses, which were our two tobacco holdings – Imperial brands and British American Tobacco – and our position in BAE Systems.

We saw a sharp value rally in the first half of 2022 and those names rerated quite highly, so we decided to bank those and move on. We replaced those with a couple of US consumer staples companies.

What was your best performer last year?

The best performing position was BAE System, so by selling it, we were essentially banking a profit on that one. That contributed 0.9% to performance.

We also had great success with Novo Nordisk, which is a Danish healthcare company that's the market leader in insulin. It has had great success recently with its new obesity drug Wegovy.

Obesity products were around 5% of the company's revenues three years ago, but they're now about 15% going on 20%, so it’s a fast growing business. It contributed about 0.6% to performance last year.

Share price of BAE Systems and Novo Nordisk over the past year

Source: Google Finance

If defence spending is higher from now on, would you consider re-entering BAE?

I wouldn't rule out us owning defence companies in the future, but the time to buy them is when they’re out of favour and, at the moment, markets expect faster profit growth for these companies.

When we sold BAE, it was trading at a 10-year peak because the outlook for defence spending had changed. We may be in a new regime for the next decade where those might be the average multiple, but we just felt last summer that it was quite unclear how much longer this conflict might go on for.

It seems very obvious now that it's gone on for a longer time, but back then it wasn't so certain so we felt we had to balance the risks.

What was your worst performer last year?

The worst performing company was a US consumer discretionary called VF which owns brands such as North Face, Vans and Timberland.

People were feeling the pinch of the cost-of-living crisis so therefore they were less likely to go out and buy these sorts of premium brands.

They were having to work through inventory and that was a real drag on cash flows. It was down about 60% over the course of 2022, but I think we’re through the worst and the outlook is more optimistic, so we're sticking with it.

That took about 2% off performance last year. We outperformed the benchmark by about 10 percentage points but VK was a meaningful detractor.

Share price of VF over the past year

Source: Google Finance

What do you enjoy doing outside of work?

Any excuse to get outdoors really – I recently got a Boxer dog called Cookie and she gives me a good excuse to get out for lots of walks.