Artificial intelligence (AI) has emerged as one of 2023’s strongest investment themes, after the launch of ChatGPT and other large learning model technologies showcased how transformative these innovations could be.

This means that the stocks connected with these technologies have rallied in price, generating some of the year’s strongest gains as investors pile into the trend. However, there are concerns that this hype has gotten away with itself and moved into bubble territory.

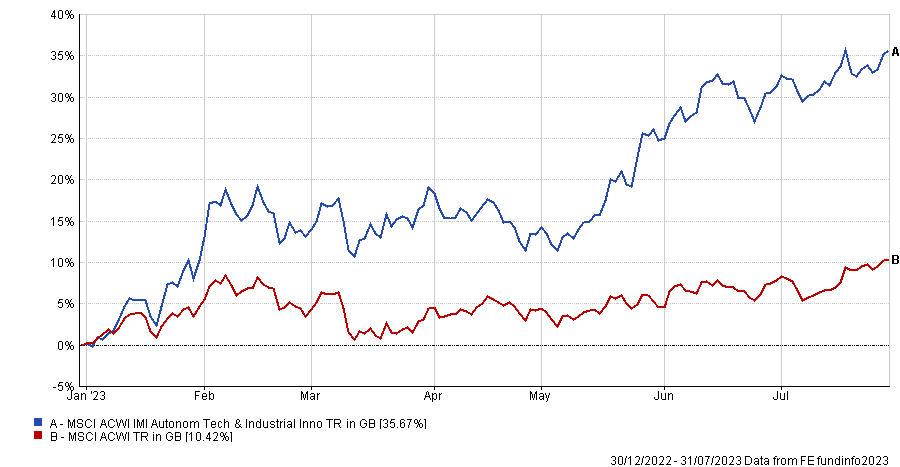

Performance of automation stocks vs MSCI AC World over 2023

Source: FE Analytics

Chris Gannatti, global head of research at WisdomTree, said: “History shapes our views and we are always seeking analogs comparable to current events. Even if we know that ‘past performance is not indicative of future performance’, we are still comforted when we draw parallels to the past. Many are now drawing parallels of the current tech enthusiasm to the dawn of the internet.”

Gannatti highlighted some of the hallmarks of 2000s tech bubble, which included companies putting the suffix ‘.com’ on their names regardless of their activities; new metrics such as webpage visits or clicks being used to demonstrate success in the absence of profits; and stretched price-to-earnings ratios meaning hundreds of billions of dollars of market capitalisation were supported by “dreams of wild future profits”.

How does this compare with today?

He noted that some companies are putting ‘AI’ in their names, but these tend to be companies that have real business reasons for doing so. In any case, this is not yet happening in huge numbers.

Investors are looking at new metrics when assessing AI stocks, such as the intensity with which firms are using AI or engaging with data. However, Gannatti added: “Because people remember the 2000-02 tech bubble period, we doubt that investors will also then say that ‘earnings don’t matter’ or ‘revenues don’t matter’ – or at least that could still be some time away.”

Finally, while big indices such as the Nasdaq and S&P 500 are being driven higher by a handful of the largest companies, the WisdomTree strategist noted that all of these firms are ‘real businesses’ with revenues, cash flows and profits.

While some might look at a stock such as Nvidia – one of the main beneficiaries of the hype around AI – and think its multiple is too high for the growth they expect to see, Gannatti argued that this is very different to the situation in the tech bubble.

He pointed out that Nvidia is not “selling the dream of making a chip one day” – Nvidia chips are being sold in droves today and company is the clear leader in providing the graphics processing units (GPUs) that allow AI to run.

“Even if the market could very well be ripe for a near-term correction after a nearly six-month run, and even if that run was accompanied by a hype cycle in AI, we are not seeing signals that the broad technology stocks are in bubble territory,” he added.

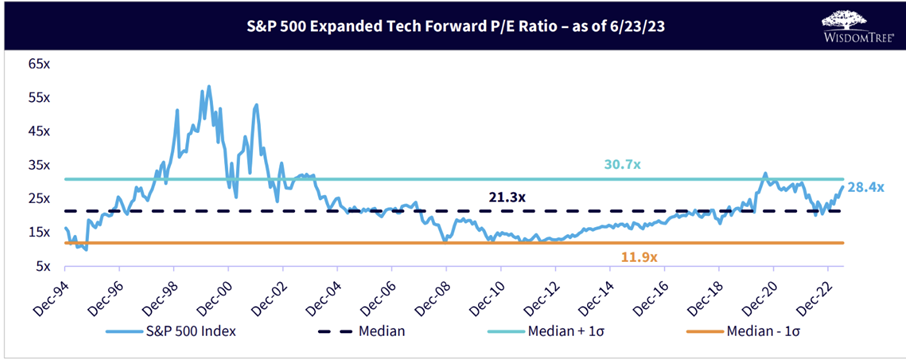

To illustrate the point further, WisdomTree created an ‘expanded tech’ sector that includes not only traditional information technology stocks such as Microsoft and Apple but those found in sectors such as consumer discretionary (Amazon) and communication services (Meta Platforms and Alphabet). Other household names such as Etsy and Netflix are included as well.

Source: WisdomTree, Factset and S&P. Historical forward P/E since 31 Dec 1994

In 1998-2000, this sector was trading on a forward price-to-earnings (P/E) ratio of more than 55x. Looking at the two spikes in the above chart, WisdomTree explained that the first is down to the surge in share prices and euphoria around tech, while the second was a consequence of the fall in forward earnings expectations when it became clear the tech bubble was bursting.

“Looking at what the same index is currently trading at in terms of forward P/E at present, it is still below 30x,” Gannatti said. “28.4x is not ‘cheap’, so we are not seeking to indicate that tech is currently cheap in any way.”

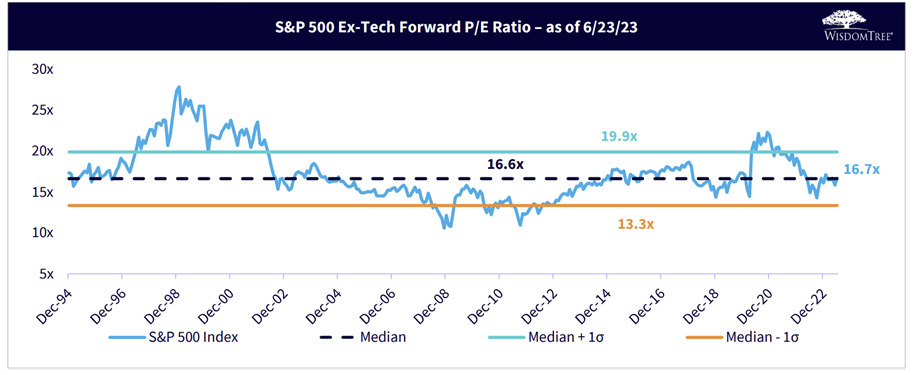

Stocks outside of the extended tech sector never broke a 30x forward P/E ratio during the tech bubble. They are currently at 16.7x, which is close to average over the full period – not cheap, but not in expensive territory.

Source: WisdomTree, Factset and S&P. Historical forward P/E since 31 Dec 1994

“The bottom line: a bubble is not just ‘a bit expensive’ but, rather, a bubble represents a situation where there is a clear case that prices have gone extremely far beyond fundamentals. Forcing ourselves back to a classic figure, forward P/E ratio, we don’t see evidence of that being the case,” Gannatti said.

“Signals of a greater degree of froth could entail seeing a much more robust IPO (initial public offering) market in specific AI companies, which may happen in the future but is not here yet. We are not saying that one day there cannot ultimately be a bubble – we are all still human, and human behaviours create bubbles – but what we are seeing at this moment is not yet there.”