Many predicted a global recession early in 2023, but the global economy has proven to be more resilient than expected so far. Yet, Mike Riddell, manager of the Allianz Strategic Bond fund, still expects a recession to happen in the coming months.

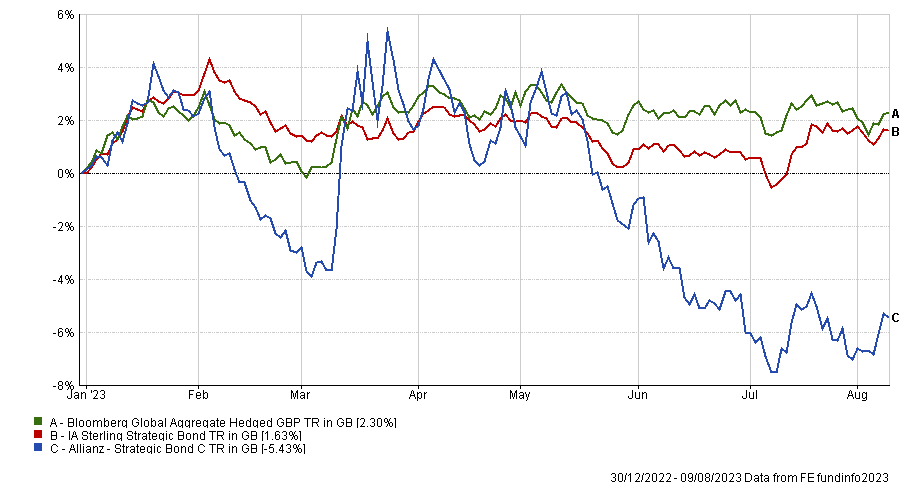

Year-to-date, the fund has underperformed, but Riddell is not alarmed. The fund is designed to have a negative correlation with risk assets, such as equities, which have defied expectations in 2023.

Performance of fund YTD vs sector and benchmark

Source: FE Analytics

Below, the manager explains why a recession is likely and how the portfolio is positioned for this scenario.

Can you explain your investment process?

We are a bond fund that behaves like a bond fund. Within the strategic bond sector, most funds tend to be correlated with high yield credit and that means they're also much more correlated to equities.

We aim to have a very low correlation to risk assets over a three-year period. Since 2016, we have had a near zero correlation with equities.

What do you do differently from your peers?

We tend to be a lot more defensive. Our benchmark is purely investment grade, which is quite unusual. This means we will tend to do worse than our peer group when risk assets are doing well and when government bonds are selling off, but we will tend to do better when risk assets are blowing up or when there's a recession for example.

Another really important point is that strategic bond funds are supposed to be flexible. The whole idea of these funds is that they can move around as we go through the economic cycles. Most funds do not use this flexibility. They tend to be longer credit at all times and don't ever really change it.

For instance, if we believe that risk assets are very cheap, then we can buy those. It's just that we don't always own them.

Can you give an example of when you used this flexibility?

Our benchmark is the global aggregate index, which is the biggest bond index in the world. It's almost entirely made of developed markets, but we can go into other areas as well.

Just 18 months ago, we thought emerging markets were very cheap, so we had more than 25% of our fund in EM debt. As a flexible bond fund should, we can move far away from our benchmark when we think there's value somewhere else.

How is the portfolio positioned at the moment?

The way we invest is global macro and top down. We start with our views of where we think the global economy is going. At the moment, we have a very high conviction that there will be a global recession. We don't know exactly when but we are confident it will happen within the next six to nine months. As a result, our portfolio is positioned to do extremely well if there is a recession.

The way we are expressing our views on recession is by being very bullish on government bonds and bearish on risk assets because we think neither of these are priced for a recession. If there is a soft landing, this is already what is priced in by markets, so we shouldn't lose much anyway.

Where we would lose from here is if global growth accelerates in the next six to nine months. The US economy has recently picked up a little bit, but if this becomes a long-term trend and inflation starts to rise again, then this would be very bad for our portfolio. But I see this as very unlikely.

What makes you think there will be a recession?

We think recession risks are greatly underestimated. It takes at least 12 months for interest rates to have an impact on the economy. It's taking a bit longer than we expected and there are reasons for that, but we think it is inevitable.

There are many things out there already indicating that we are in a recession. If you look at parts of the global economy, such as the industrial cycle manufacturing business surveys, they are at levels you only see in recessions. The labour market is still very tight and we'll need to see some weakness in it before we go into a proper recession.

I think we're already seeing signs that the labour market is cooling. There are headlines every day about businesses laying people off. I think it is just starting to turn now. I would be extremely surprised if the unemployment rate is not materially higher by the end of this year.

The only real reason we haven't had a recession yet is because inflation and commodity prices have been moving lower and gas prices have collapsed in the past four months. This has actually given a short-term boost to the global economy.

What have been your best and worst calls in the past 12 months?

The worst call of the past 12 months was getting very bullish on global government bonds from the second quarter of last year. We thought that yields had got to the point where there were too many interest rate hikes priced in. What actually happened is that the market has priced in far more rate hikes and yields kept going up until around the autumn of last year. So, being very long duration, very bullish on government bonds and long on interest rate risk was a painful trade for us.

A better call we've had is avoiding gilts until very recently. Gilts have been one of the worst performing bond markets in the world year-to-date, but particularly over the past year. We had very little exposure, almost nothing, but that has changed very recently. In the past month, we have been adding quite a bit to our gilt exposure because it looks like inflation is likely to come down in the UK and the Bank of England is close to the peak of interest rates.

What is your biggest concern at the moment?

There's still a risk of another inflation shock. This would most likely come from the situation between Russia and Ukraine or other political risks elsewhere. It could be China or even the Middle East.

If we have another inflation shock, that would mean that central banks can't cut rates, even if we're in a recession, and they would probably have to hike rates.

As things stand, in the absence of any further shocks, we're pretty confident inflation is going to be very sharply lower. It has already been in the US over the past nine months and we think we'll see this increasingly in Europe and the rest of the world.