The FTSE 100 turns 40 years old in January. In this time it has been exceptionally profitable to back, rising from 1,000 at the start of its life to 7,660 (ish) at the end of last month.

This 660% capital return is equivalent to 5.2% per year, according to data from AJ Bell. This does not take into account dividends paid, which pushes the total return much higher.

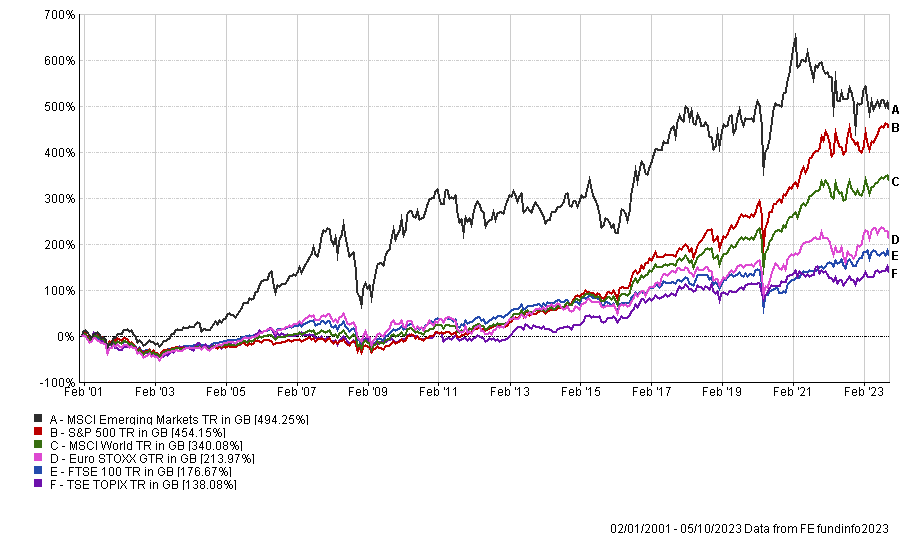

However, since the turn of the century it has been tough sledding for domestic investors. On a total return basis, the FTSE 100 has made a paltry 175.7%, beating only the Japanese Topix index – famed for its decades of lost returns.

It is quite damning that the UK market has only beaten the Japanese index by fewer than 40 percentage points over the past 23 years.

It has lagged the MSCI Emerging Markets (494.3%) and S&P 500 indices (454.2%) significantly, while also failing to beat the Euro Stoxx (214%).

Performance of indices since 2000

Source: FE Analytics

Yet the total return is positively sparkling compared with the turgid 9.7% the FTSE 100 has made in capital terms since it hit 6,930 on 31 December 1999, with most of the index’s gains since then coming from dividends.

It is perhaps no wonder that investors have given up, choosing to take their money elsewhere. Indeed, September marked the 28th consecutive month that investors ditched the UK, according to data from Calastone.

AJ Bell investment director Russ Mould said: “Critics will argue the FTSE 100 has ossified since the turn of the century. This opens up the FTSE 100 to accusations that it has not done enough to move with the times and become too dependent upon a small number of behemoths that have been in the index for a long time.”

Yet since its inception, there have been myriad changes. In fact, Mould pointed out that just 14 of the 100 companies at its launch remain under their same name, while a further 12 are still there, just under a different banner.

“The other 74 have either fallen down through the ranks into the realms of mid- and small- caps, been acquired, been broken up or (in three instances) gone out of business, as the index has taken on a less domestic and more international flavour,” he said.

So is now the time for a UK resurgence? Ask any UK fund manager and the likely answer is a resounding ‘yes’. They point to figures showing the UK has fallen so far that the valuations versus their overseas peers are as low as they have ever been.

This could boost returns either through a re-rating, or through corporate action (mergers and acquisitions) – with bids coming in at much higher prices.

There is also support from the government, which has been outspoken on the need to get capital flowing to UK companies if the market is to get back to its halcyon days. Its hope is for fewer international takeovers and for more domestic entrepreneurship.

UK managers have been trumpeting their home market for years with little to show for it. While the definition of insanity is doing something over and over again in the hopes of a different result, there is real hope that this time is indeed different.