Well-established, dividend paying businesses have been cast as the tortoises of the equity world for the past decade or longer, steadily shoring up their balance sheets while tech hares shoot past them.

Even managers with a value tilt admit that growth has been the place to be ever since the financial crisis, at least, that is, until central banks started hiking rates.

Fran Radano, who manages The North American Income Trust, concedes that “when rates are zero and capital is free, you want to be in growth. When rates are zero, valuation doesn’t matter. When there is a cost of capital and money isn’t free, that makes it a more difficult backdrop.”

Borrowing costs have risen dramatically this year, however, making capital allocation much more important and bringing valuations back to the fore. This could lead to a sea change in the types of companies – and equity funds – that will do well going forward.

“With money expensive, having a great balance sheet like Home Depot is worth more than it was a few years ago. Companies can go on the offensive with that balance sheet,” Radano pointed out.

While Radano said that this is “not a great story to tell at a cocktail party”, it means the companies he buys have many qualities that investors should covet, such as increasing dividends, strong balance sheets and low levels of debt. “These are not venture capital, change the world stocks, they are established businesses,” he said.

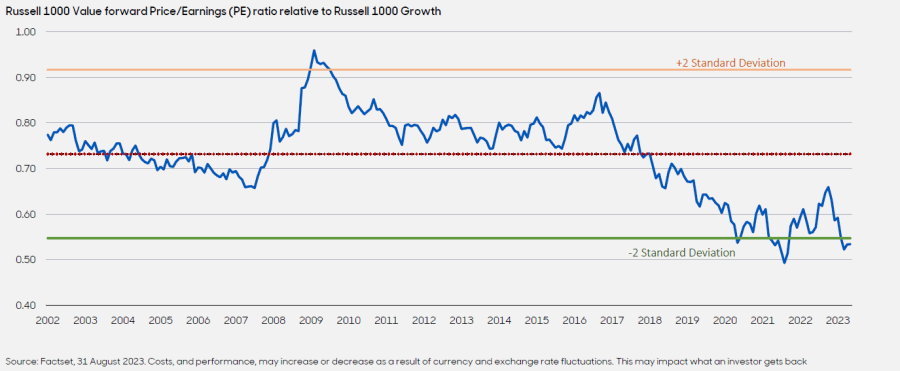

To illustrate how unloved the value story is currently, value stocks are trading at 13-14x earnings, whereas growth stocks are trading at 25-26x, which is at least ~1.5 standard deviations above the historical norm, as the below chart shows.

Radano expects the spread between value and growth stocks to start narrowing once the US Federal Reserve stops hiking rates and markets grow accustomed to a new normal with interest rates at about 4%. “We have great companies trading below 15x earnings. Genuine Parts is trading at 14x,” Radano said. “To me, that’s crazy.”

Genuine Parts is a recent addition to the portfolio, replacing Home Depot, which Radano sold a couple of months ago because it was trading at well over 20x earnings. He expects demand for Home Depot’s products to fall because fewer people are moving house given that long-term mortgage rates have gone up, and people overspent on home improvements during lockdown.

In selling Home Depot, which he still believes to be a great company, Radano faced a dilemma shared by many fundamental investors running concentrated portfolios. “It doesn’t feel great to sell Home Depot because you don’t have to worry about it. Generally, it does the right things. It has a good balance sheet so has been able to spend and invest.”

Radano finds it useful to imagine what stocks he would pick if he was starting a new fund with a blank sheet of paper. “Would Home Depot make the portfolio? Probably not.”

Over the past 12 months, the North American Income Trust has also sold out of TC Energy, VF Corporation, CI Financial, HanesBrands and Hannon Armstrong Sustainable Infrastructure.

The £481m trust now holds 36 stocks, having added Enbridge, Essential Utilities, Keurig Dr Pepper and the aforementioned Genuine Parts.

Genuine Parts has paid a growing dividend for 67 years, has a strong balance sheet and is attractively valued. The auto sector has been out of favour so Genuine Parts had a couple of slow quarters and Radano took advantage of the mispricing. “It’s the third time we’ve owned it in 11 years, which is rare for a low turnover portfolio,” he noted.

At an industry level, Radano favours capital intensive industries with high barriers to entry, few competitors and pricing power, such as railways, waste disposal and industrial air products. Capital intensity can be a double edged sword and is not an advantage in every sector, so he looks for different attributes in each industry.

Genuine Parts fits into this narrative of high barriers to entry. Its NAPA Auto Parts brand has a huge supply chain so it can get spare parts to garages faster than its competitors. “If your car breaks down you have to fix it, recession or not. It’s completely non-discretionary,” Radano explained.