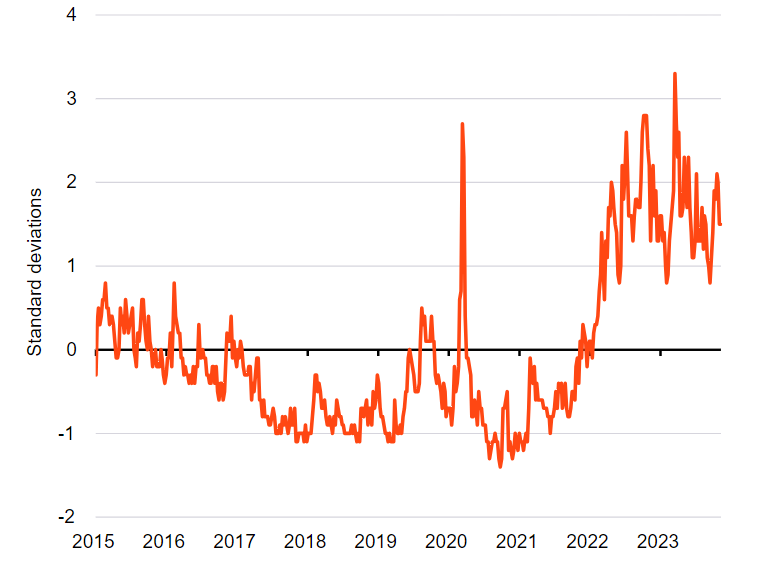

Investors should be bracing for an era of sustained volatility, BlackRock strategists have warned, as there looks to be little chance of markets moving past their current uncertainty even as central banks look like halting rate hikes.

A note from the BlackRock Investment Institute argued that the next phase of the market will be characterised by continued volatility, as investors swing between optimism of a soft economic landing and worries over prolonged high interest rates.

A recent example of this volatility is the shift in long-term US Treasury yields, which fell last week following the release of slower-than-anticipated inflation data. “Stocks rallied and yields on 10-year US Treasuries tumbled 19 basis points last week – [including] the biggest one-day move since the March US banking turmoil,” the firm noted.

US government bond volatility, 2015-2023

Source: BlackRock Investment Institute, with data from LSEG Datastream, Nov 2023

The current market narrative is centred on falling inflation combined with steady economic growth. However, BlackRock strategists are focusing on a deeper issue: “The problem: inflation is falling because rapid rate rises to combat it have pushed US growth trend below pre-Covid levels."

This suggests that continuous high interest rates are necessary to manage inflation effectively, especially considering factors such as the slowing labour force and geopolitical uncertainties.

“Markets appear to miss this bigger picture and we see more volatility ahead as they swing between hopes for a ‘soft landing’ and fears about higher rates and recession,” the strategists added.

In light of this outlook, BlackRock recently altered its stance on long-term government bonds: "We upgraded long-term treasuries to neutral on a tactical, six-to-12-month horizon last month because we now see even odds of yields swinging in either direction in this volatile environment."

This cautious approach stems partly from the potential end to the Federal Reserve's rate hike cycle, combined with factors such as looser fiscal policy and a slowing labour force growth that will force the central bank to keep rates higher for long.

“Long-term yields should eventually resume their march higher,” the strategist added. “Why? We expect the term premium, or the compensation investors demand for the risk of holding long-term bonds, to keep rising amid greater macro volatility, large fiscal deficits and high debt issuance.”

The US fiscal situation has already contributed to this volatility. The increased government spending during the pandemic and stimulus initiatives since, such as the Inflation Reduction Act, have caused government bond issuance to balloon in recent years. The higher interest rates from the Fed have increased government borrowing costs and added to the debt burden.

“If borrowing costs stay near 5% as we expect, the US government is poised to spend more on interest payments than on Medicare in a few years' time,” the BlackRock Investment Institute said.

“Investors are struggling to absorb the bond supply. Their indigestion spurred another surge in bond yields earlier this month after an auction for 30-year treasuries saw historically weak demand.”

Last week’s BlackRock Investment Outlook Forum, which saw the firm pull together around 100 portfolio managers, executives and experts to pinpoint investment opportunities and risks, ended up being focused on higher interest rates and volatility.

One take-home conclusion from the forum was the need for selective and dynamic investment strategies, rather than static and broad exposures.

“Volatility is a constant in the new regime, with markets quick to extrapolate single data releases,” the firm finished.

“We believe the Fed is ending its hiking cycle – and is set to keep rates high for longer. This underpins why we have turned neutral long-term treasuries and are overweight short-term treasuries and European government bonds for income.”