In volatile times, mitigating losses is key for many investors and the Jupiter Merlin Balanced fund has a long track record of doing just that.

Despite its focus on not losing money, however, it maintained a first-quartile performance against the IA Mixed Investment 40-85% Shares sector over the past 10 and three years, and it was in the second quartile over five.

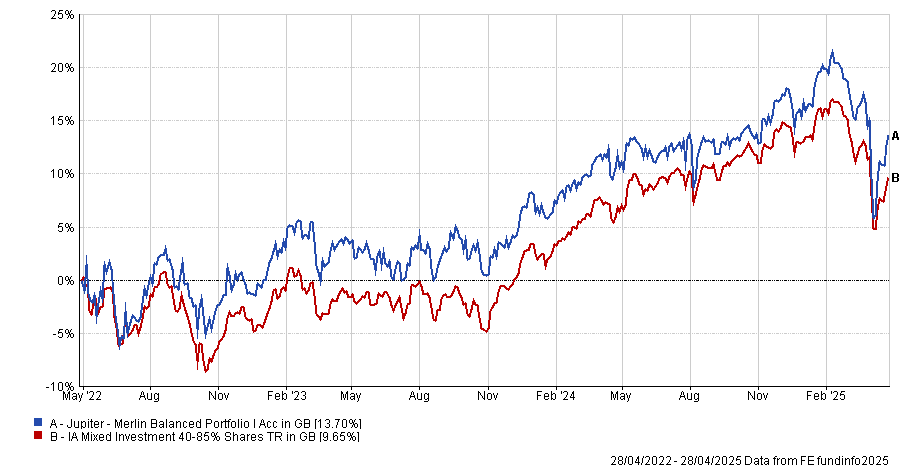

In the past 12 months, performance has come off a bit, but it recovered quickly over the six months to today, as the chart below shows.

Below, the manager discusses how the US trade was no reason to make tactical calls, why he has no direct allocation to emerging markets, Asia and China funds and shares his perfect pairing for investors who want exposure to UK value strategies.

Performance of fund against index and sector over 3yrs

Source: FE Analytics

What is your investment philosophy?

There are inefficiencies in markets that talented, active managers can exploit. We try to find a range of those talented managers and build them into a diversified portfolio looking across styles, sectors and geographies.

One of the best ways to outperform over the long term is to not lose as much when markets fall, so that's a key aspect we look at. We select managers who have mitigated losses better than peers on the downside, which tends to come in the form of a valuation discipline.

How do you make sure your fund is diversified?

Our portfolios are not made with a cookie-cutter approach. We want to be flexible and invest as much as we can in those areas we believe are offering the most compelling opportunities at any specific time.

That might mean biasing towards a particular style and geography or remaining agnostic to what peers and benchmarks may look like. We're very happy to not have any exposure to one area or another.

What areas are you avoiding at the moment?

Historically, we had up to 25% in emerging markets and Asia, as we did in the early 2000s. Today we are concerned about China, so we don't have any dedicated exposure to emerging markets, Asia and China.

This is partly to do with corporate governance – if you are investing in China, do you really own the assets? Can you apply any type of corporate governance approach to holdings in China?

That was a view we took back in 2022 and haven't reversed it as yet, with all the concerns about the trade war with the US. Historically, Asian emerging markets have tended to do less well during a period where the dollar has been strong, and that has certainly been the case until relatively recently.

Do you think China will lose the trade war?

We don’t have a particular view on that. Even if China does do well in the trade war, or some type of solution is achieved, you still have the problem of the corporate governance angle.

The People's Bank of China do what the Communist Party tells them – its core focus is not looking after minority shareholders who happen to be based in the UK.

Has the trade war prompted any shifts in your allocation?

No, our exposures have been reasonably consistent in recent years, with a tilt to more quality and value-orientated managers. We've been somewhat underweight the US across our portfolios and significantly underweight the Magnificent Seven, which been a bit of a headwind but things have started coming back our way of late.

That goes back to the inefficiencies that we are trying to exploit within our portfolios – we want to take advantage of markets when they tilt too far one way and we have thought tech valuations were excessive for some time, so we have been tilted to quality compounders and value for some time already.

What were your least and most successful investments in the past year?

The past 12 months are split quite neatly in half. Until the tail end of October, the biggest detractors were our exposure to Japan, which cost us about 1% on a relative basis, and our bias to global value and quality compounders, which cost us about 2%.

From October onwards, however, Japan (through the Morant Wright Nippon Yield fund) was one of our best performers, adding about 1.5% of total return, together with gold, which contributed 0.5%.

Over the full year, they were up 8.5% and 8% respectively, beaten by the Aegon High Yield bond fund, which was up 9%. UK value managers also did well, with the Man Income fund up 8.5% and the Jupiter UK Income fund up about 13.5%.

What role do these two UK value strategies play in your portfolio?

There's nothing wrong with having a blend of different managers. You don't want all your eggs in one basket. These two funds do things in a slightly different way, as demonstrated by the fact that there's a 5 percentage-point difference between the two over the 12-month period.

Man Income invests in undervalued earning streams and assets and dips more down into the mid-cap space; Jupiter UK Income is only really trying to focus on undervalued returns and tends to be more of the larger cap-end of the spectrum. We have just shy of 10% in the Man Income fund and about 3.5% in the Jupiter UK Income fund.

What do you do outside of fund management?

I've got three wee kids, twins who are six and one who's four, so I spend quite a lot of time with them. I help coach my sons’ under-six rugby team, try to keep fit and hope at some stage I'll get back on the golf course.