June was a positive month for investors in funds and trusts, with the majority of sectors closing the period with a positive average return.

Energy was a key theme both geopolitically (with a volatile oil price following the attacks on Iran) and in the investment world, where energy-focused investments stood out.

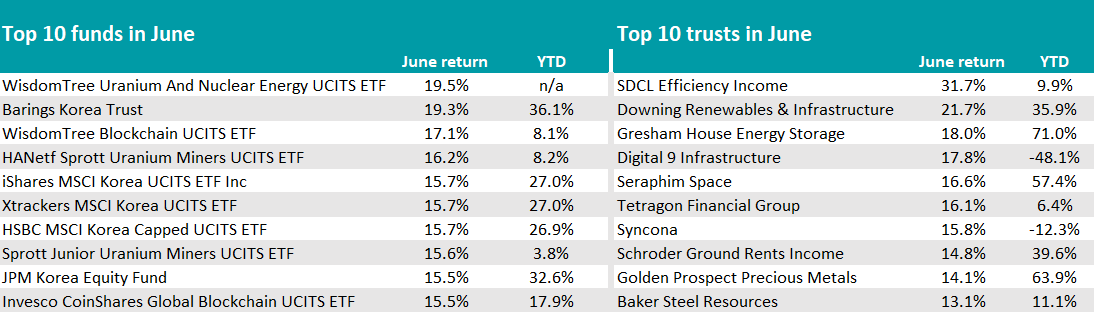

Grabbing centre stage was the SDCL Efficiency Income trust, with the best performance of the month (31.7%). Two more IT Renewable Energy Infrastructure strategies – Downing Renewables & Infrastructure (21.7%) and Gresham House Energy Storage (18%) – completed the top-three trusts.

A similar trend was reflected in the open-ended space by the WisdomTree Uranium And Nuclear Energy UCITS ETF, which topped the funds ranking with a 19.5% return. Exchange-traded funds (ETFs) investing in uranium miners were also high up in the list, with HANetf Sprott (16.2%) and Sprott Junior (15.6%) being the two main ones.

Source: FinXL

The other story of the month was Korea, whose equity market has delivered the strongest first-half performance in 20 years, as Fairview Investing director Ben Yearsley noted.

“The KOSPI index had a good run post the Korean election results and on hopes of an imminent US rate cut that tends to lift all of Asia and emerging markets,” he said.

With a gain of 19.34%, Barings Korea was the second-best fund overall, followed by iShares, Xtrackers and HSBC ETFs that track the country’s stocks, as well as the JPM Korea Equity fund, which returned 15.5% over the month.

The third theme this June was technology.

The third-best performance overall in the open-ended space came from the WisdomTree Blockchain UCITS ETF (17.1%), with Invesco CoinShares Global Blockchain UCITS ETF not too far off – demonstrating the prevailing sentiment was to be risk-on.

“Optimism has not been dented, but will be tested this month with the ending of the 90-day pause in US-imposed tariffs,” Yearsley warned.

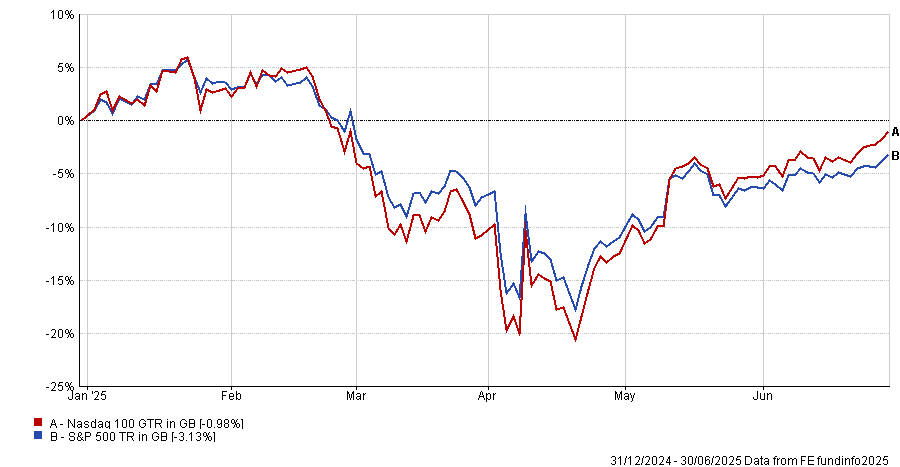

There were no signs of that fear in June, with the S&P 500 and the Nasdaq both closing the month at fresh record highs. The most notable active funds in the space were Liontrust Global Technology (11.3%) and Polar Capital Global Technology (11.1%).

The whole technology sector has staged a major rebound after a challenged first quarter, but returns for UK investors were “more than wiped out” by dollar weakness, with very few hedging their equity exposure.

For Yearsley, if the trend is for a weaker US dollar, then “investment strategies might need to be rethought”.

Performance of indices over the year to date in pound sterling

Source: FE Analytics

Commodities and natural resources funds also picked up in June, with a resurgence of names such as SVS Baker Steel Electrum and Pictet Clean Energy Transition within funds, and Golden Prospect Precious Metals and Baker Steel Resources in the investment trust universe.

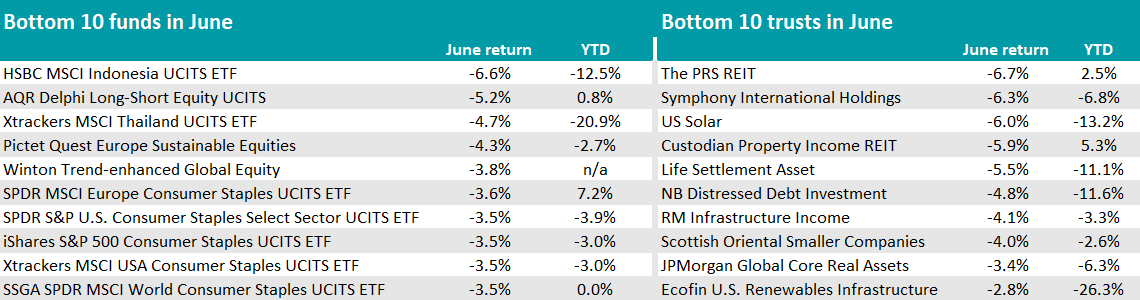

At the foot of the tables last month was a cohort of funds focused on the consumer, as fears around heightened inflation due to US tariffs started to drive the narrative.

It affected European funds such as the SPDR MSCI Europe Consumer Staples UCITS ETF and IA Global funds such as the iShares S&P 500 Consumer Staples UCITS ETF, but especially US funds, as the table below shows.

Source: FinXL

“The last six months has been one of the most fascinating yet random in the last decade,” Yearsley noted.

“AI, Trump, wars, more Trump – actually Donald Trump has impacted many areas, with AI possibly the only one he’s not been involved in. Even then, China’s resurgence in the tech space has been largely down to having to innovate without the latest US chips.”