Investors should consider pairing their global equity trackers with private equity, renewables, global small caps or fixed income strategies, according to Matthew Read, senior analyst at QuotedData.

Despite a heightened volatility in global markets this year, trackers have remained some of the most popular funds among investors, according to recent Trustnet data. However, they expose investors to concentration risk, said Read, as the indices they follow are dominated by tech and US businesses.

To avoid putting all their eggs in one basket, investors should embrace other asset classes that are driven by different factors. So below, Read identified some examples of trusts that could make effective complements to an existing global equity tracker allocation.

Private equity

Firstly, he pointed to Patria Private Equity as a great trust to start with on an “unjustifiable discount”, Read said.

He explained that it’s delivered “phenomenal long-term performance”, beating its benchmark (the FTSE All Share) by 160 percentage points. Despite this strong long-term performance, it runs at a “compelling” 30% discount to its net asset value (NAV), he explained.

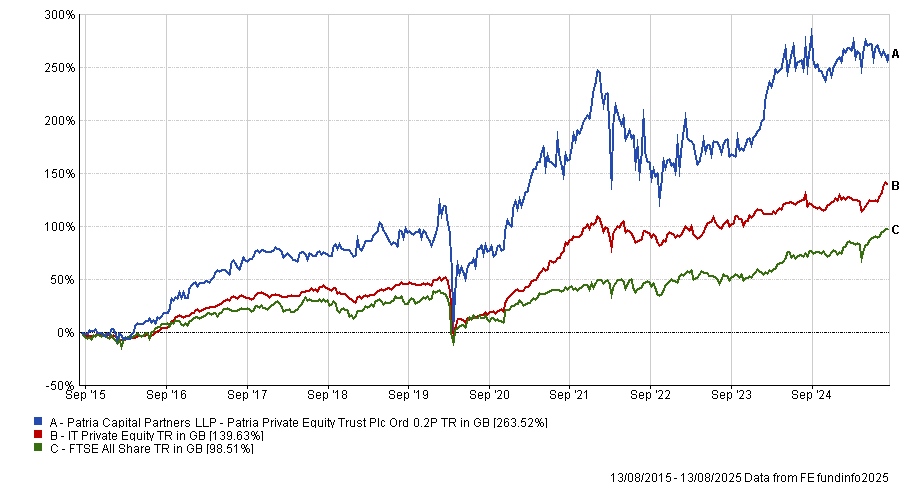

Performance of trust vs sector and benchmark over the past 10yrs

Source: FE Analytics

Additionally, Patria distinguishes itself from some of its private equity peers by also providing some level of income. By investing primarily in mature and established businesses, the managing team has the excess cash flow needed to support a "enhanced dividend yield" of around 3% that has consistently grown over the past decade.

“People often dismiss the income potential in private equity due to their capital growth focus, but the asset class has moved on dramatically and Patria is a great example of it,” he added.

As an asset class, private equity “gives a fundamentally different sectoral and market profile”, which helps differentiate it from a global equity tracker. For example, Patria has an emphasis on European and UK markets where private equity deals are “far less contested” than in the US.

This gives the trust extremely different drivers than the average global equity tracker, which is currently very US-focused.

Renewables

Next, Read pointed to Bluefield Solar Income as a “best-in-class renewable vehicle on a daft discount that could even serve as an investor's core holding”.

It has performed well over the long term, with the strategy up 77.3% over the past decade, while the average peer lagged by nearly 40 percentage points, as demonstrated by the chart below.

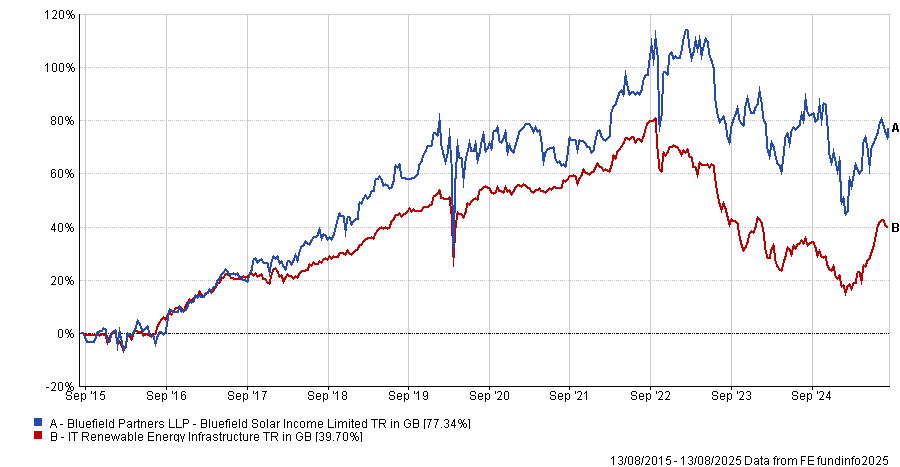

Performance of trust vs sector and benchmark over the past 10yrs

Source: FE Analytics

It paired this with “a solid revenue” of around 9%, providing both capital growth and a reliable income that investors can use to complement their growth-focused equity tracker.

The team is also “doing all the right things” by working to improve the quality of its portfolio by implementing wind energy securities. This helps “bring stability to the income profile” because wind tends to outperform when solar struggles and vice versa, giving investors’ confidence that it will deliver over the long term, Read explained.

He continued that it is another type of asset with very low correlation to global equities, with performance driven by factors other than company earnings or the release of new products. For example, Bluefield Solar benefits from wider macro goals such as the pursuit of net-zero, which will “need to be done, irrespective of whether politicians are on board with it”.

Global small caps

Read continued: “The other big thing that is missing with your global equity tracker is small-cap exposure.” In this space, he identified Herald Investment Trust as a favourite.

The trust has a long-term time horizon, aiming to invest in growing companies as they scale in size and performance. This has led the portfolio to favour UK businesses, where this type of companies is more common compared to the US, he said.

The trust continues to hold companies even after they exit small-cap territory, such as FTSE 100 tech firm Diploma PLC, which is still one of their top 10 holdings, he noted.

This “pure capital-growth focus” seems to have paid off over the long term. Over the past decade, it is up by more than 230%, a supranormal performance compared to the average peer.

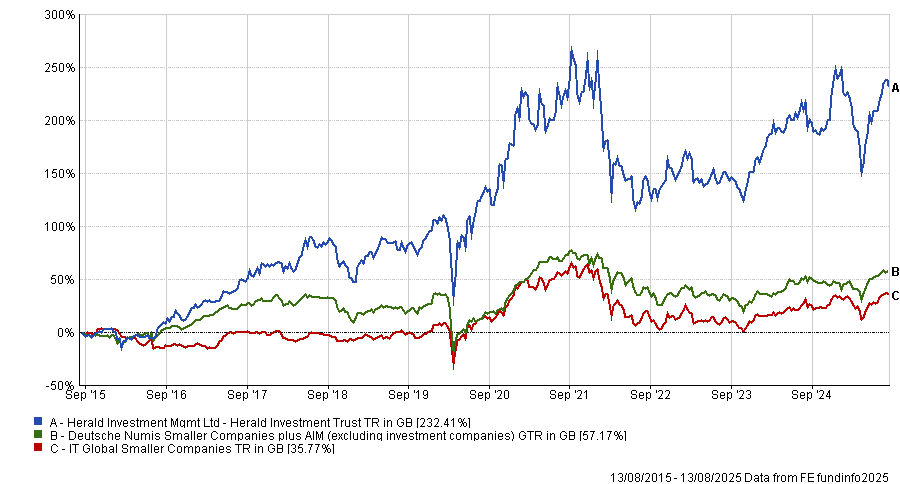

Performance of trust vs sector and benchmark over the past 10yrs

Source: FE Analytics

“It’s an extremely credible strategy with no real debt on their capital structure of any kind,” Read concluded.

Fixed Income

Finally, fixed income should serve as “a great way” to broaden the types of assets in a portfolio. The analyst pointed to Invesco Bond Income Plus as one of his “go-to options”.

With a “compelling” current yield of around 8%, the trust is “a solid starting point” for investors' income exposure, he explained. While he noted that “it provides less capital growth than some other fixed income strategies”, managers Rhys Davis and Edward Craven have delivered second-quartile results or better in the IT Debt – Loans and Bonds sector over most time frames.

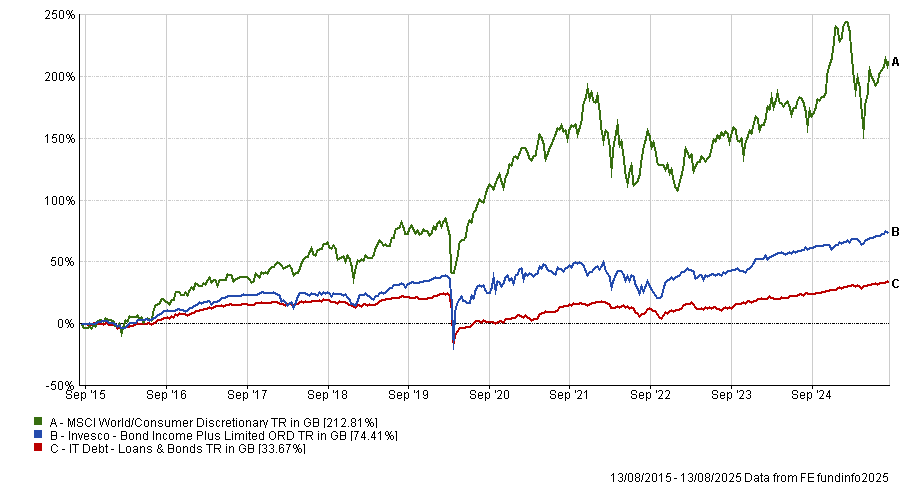

Performance of trust vs sector over 10yrs

Source: FE Analytics

Read conceded that it historically trades at a slight premium to its peers (currently 1.8% above NAV), but this is “acceptable” for the quality of its assets.

It also benefits from its emphasis on larger, more liquid issuers, for example banks such as Lloyds and Barclays. This gives it the ability to achieve high income while remaining relatively stable and reducing the risk of default.

“In an environment where equities are doing well, it's going to underperform, but when equities are not doing as well, it will outperform. That’s diversification at work,” Read concluded.