For investors navigating the multi-asset landscape, the choice between those that pick stocks and those that invest in other funds is far from straightforward.

Multi-asset funds can be viewed as one-stop shops, providing investors with all the asset allocation diversification they could possibly need. But each fund does things in its own unique way.

For example, on the one hand, a multi-asset manager may choose to invest in other funds (known as a fund of funds). Others will prefer to back their own decisions, rather than rely on outside expertise, and select individual stocks themselves.

Both have their positives and negatives. For the stockpickers, they have greater control over what they own and can move quickly when markets change. For the fund of funds enthusiasts, the portfolios tend to be much more diverse.

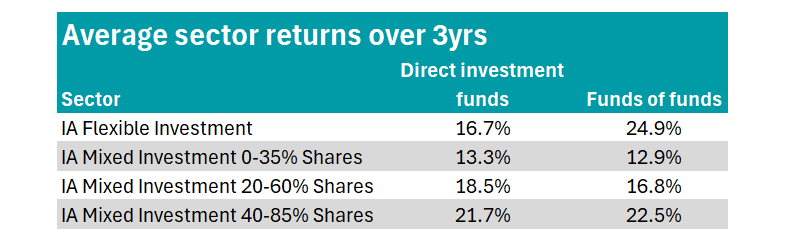

But which has made more money? To answer this, Trustnet looked at the three-year total returns of stockpicking multi-asset funds and fund of funds across the IA Flexible Investment, IA Mixed Investment 0-35% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 40-85% Shares sectors.

As shown in the table below, on average, fund of funds underperformed their stockpicking counterparts in lower-risk sectors but beat them in higher-risk sectors.

Source: FE Analytics

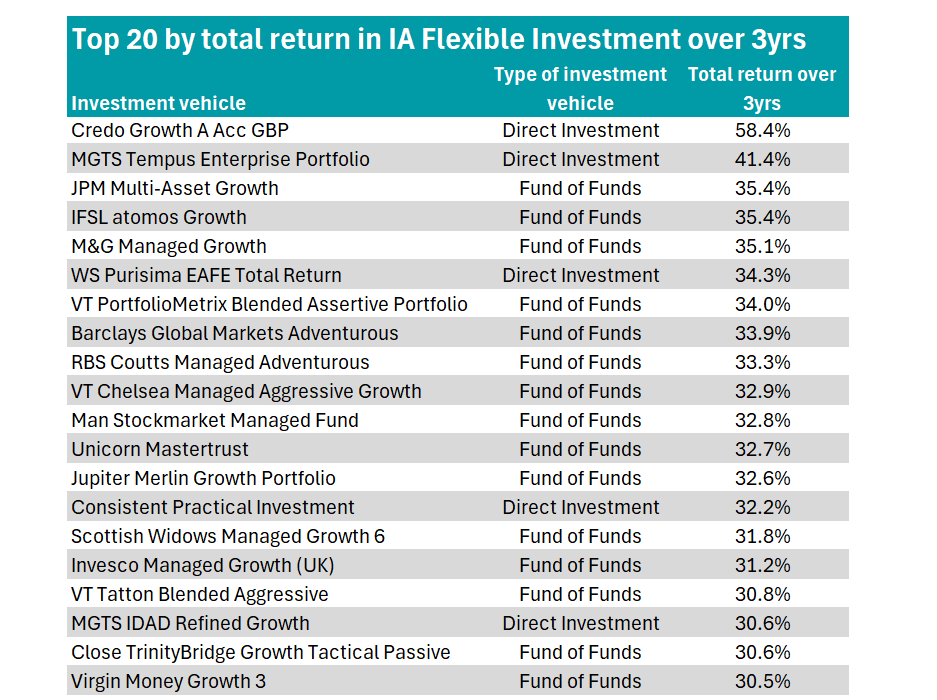

IA Flexible funds

IA Flexible Investment funds allow managers complete freedom in how they allocate assets, meaning there could be vehicles investing 100% in equities and others investing 100% in bonds within the same sector. As such, the performance and risk profiles of funds within the sector can vary dramatically.

Over three years, the top 20 best performers were dominated by fund of funds options, with only five stockpickers in the mix.

Source: FE Analytics

JPM Multi-Asset Growth was the top-returning fund of funds over three years, managing a 35.4% gain and 8.3% volatility.

Managed by Jonathan Cummings, Nick Malangone and Ion Berasaluce, the biggest allocation made by the fettered multi-asset fund of funds was 33.1% to JPM Global Research Enhanced Index, which is managed by Alpha Managers Piera Elisa Grassi and Raffaele Zingone. All of the US ‘Magnificent Seven’ stocks feature in its top 10, alongside other tech companies benefiting from the artificial intelligence (AI) push, such as Broadcom.

Also of note was M&G Managed Growth. It sat in fifth place over three years but was the top-returning fund of funds across all four sectors studied over both five years and 10 years – gaining 73.4% and 168.1% respectively.

A quarter of the vehicle’s assets are invested in the UK, followed by the US (22.1%), Japan (9.8%) and Germany (7%), with over half of its assets (52.8%) invested in mega-caps and large-caps.

Despite fund of funds’ overall dominance at the top of the table, stockpicking multi-asset fund Credo Growth was best overall.

It made 58.4% over three years – beating the sector’s average return for direct investment funds and fund of funds by over 40 percentage points and 33 percentage points respectively.

The £113.3m portfolio has an FE fundinfo Crown Rating of five (out of five) and is managed by Credo co-founder Roy Ettlinger. Although classified as a stockpicking fund, it also includes BlackRock ICS US Dollar Liquidity Core, which offers dollar exposure through its investments in a broad range of fixed income securities.

However, the overall average return of direct investment funds in the IA Flexible Investment sector was dragged down by notable underperformance from a handful of funds, including NB Uncorrelated Strategies, which lost 21.7% over three years.

Equity banded sectors

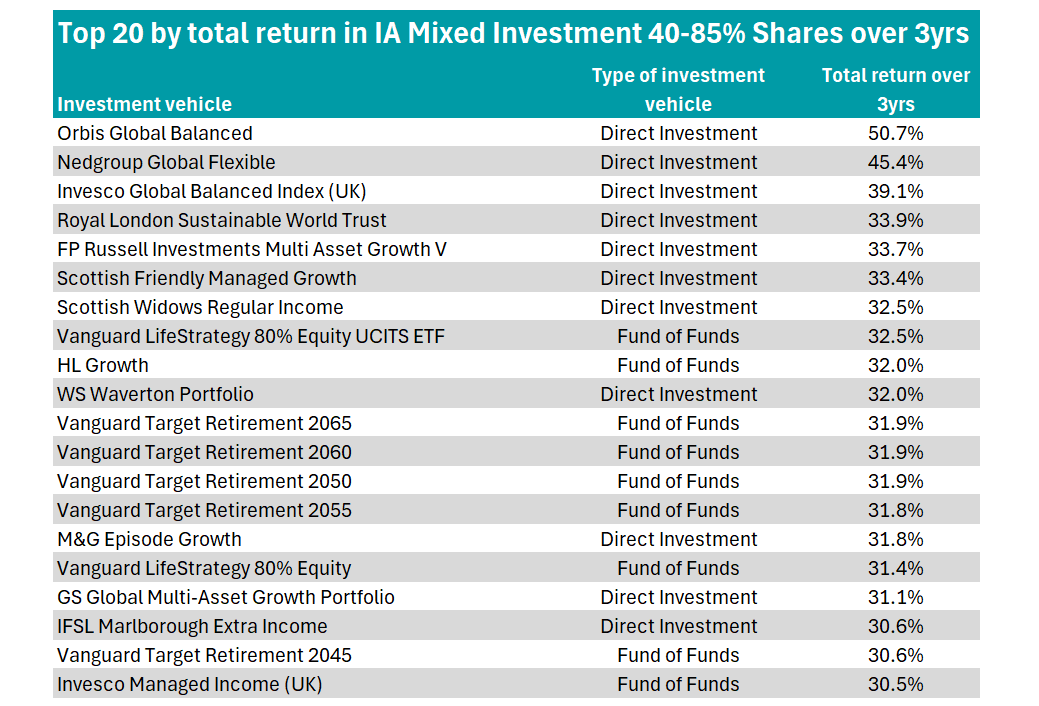

In the IA Mixed Investment 40-85% Shares sector it was more of a mixed bag, with less than a percentage point difference between the average three-year return of direct investment funds versus fund of funds.

Just over half of the top-returning portfolios in the sector picked their own assets, as the table below shows.

Source: FE Analytics

Orbis Global Balanced, managed by Alec Cutler, delivered the best returns of sector, gaining 50.7% over three years.

RSMR analysts cited the £1.2bn multi-asset fund’s “fundamental, long-term and contrarian investment approach”, which they said is implemented in a “consistent manner and supported by organisational design”.

Among its 130 holdings are industrials and materials companies such as Siemens Energy and Barrick Mining, alongside the iShares Physical Gold ETC which gives the fund direct gold exposure.

It also delivered the strongest returns of all vehicles across the four sectors over five and 10 years, gaining 99.8% and 200.7% respectively.

On the top end of the sector’s equity limit, the fettered Vanguard LifeStrategy 80% Equity UCITS ETF was the best-performing fund of funds over three years, gaining 32.5% – although this was some 18 percentage points behind Orbis Global Balanced.

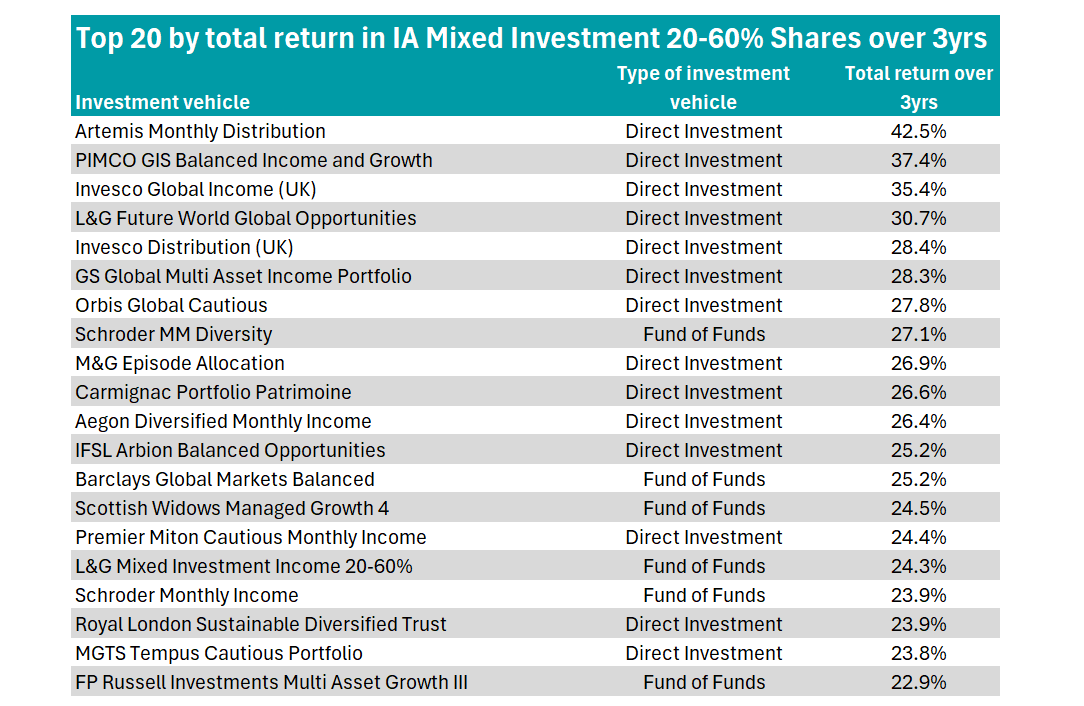

When looking at the IA Mixed Investment 20-60% Mixed Shares sector, the tables turn, with direct multi-asset funds making up14 of the top 20 listed below.

Source: FE Analytics

The £1.4bn Artemis Monthly Distribution fund led the way with a 42.5% return over three years – and 115.6% over a decade.

RSMR analysts highlighted its “attractive historic risk-adjusted returns”, high level of income distribution and differentiated stock selection – with around a third of the fund invested in Europe excluding UK. The fund is 55% allocated to bonds and 45% to equities.

The top three in the sector was rounded out by fellow direct investment funds PIMCO GIS Balanced Income and Growth and Invesco Global Income (UK).

The first fund of funds in the sector comes in eighth place, with Schroder MM Diversity around eight percentage points behind the Pimco and Invesco funds over three years.

Meanwhile, for the most cautious investors, there was a 19-percentage point difference between the vehicles with the best and worst return over three years in the IA Mixed Investment 0-35% Shares sector.

The top three for total return over three years were all fund of funds, with L&G Mixed Investment Income 0-35% gaining 21.9%, followed by L&G Mixed Investment 0-35% (20.2%) and Jupiter Merlin Conservative Select.

Direct investment vehicle AXA Defensive Distribution brought up the rear, gaining 0.9% over the assessed period.