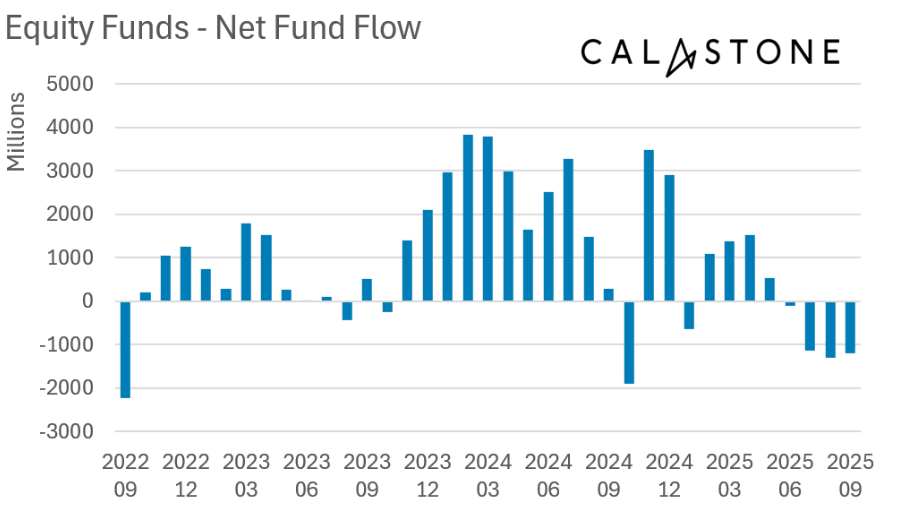

Investors pulled £3.6bn from equity funds in the third quarter of 2025, marking the largest quarterly outflow in the Calastone Fund Flow Index’s 11-year record.

Withdrawals from equity funds reached a net £1.2bn in September alone, leaving year-to-date inflows effectively flat at £126m. This compares with a £22.7bn inflow in the same period a year earlier.

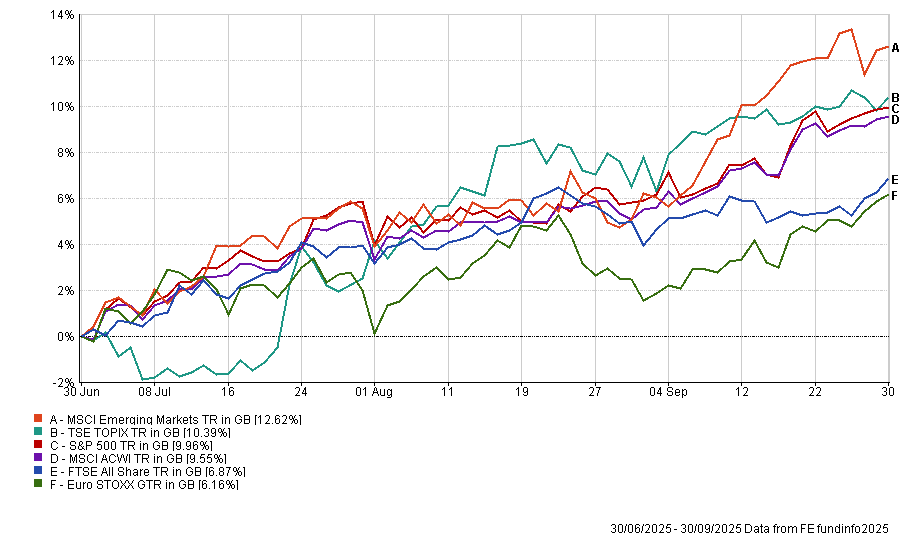

This came as stock markets around the globe pushed to new record highs, on the back of interest rate cuts, easing macro concerns and robust earnings.

Performance of equities in Q3 2025

Source: FE Analytics

Edward Glyn, head of global markets at Calastone, said: “It is really unusual to see markets reaching record highs while investors are moving decisively for the exits across such a broad range of funds.”

The data show investors exiting equities across nearly all regions and sectors despite major indices trading near all-time highs. Glyn noted signs of speculative excess, especially in US markets driven by technology and artificial intelligence (AI).

“Frankly, nobody knows when the next market correction is coming, or even if one is at all imminent,” he said. “Some parts of the US market in particular do seem to be exhibiting signs of irrational bubble behaviour, particularly those perceived to benefit from the AI boom.”

He added that while market corrections are difficult to predict, “share prices can defy fundamentals for a long time and that is costly for investors on the sidelines”.

Every major equity fund category saw outflows in September except those focused on Europe. Investors added £203m to European equity funds, marking a fifth consecutive month of inflows. However, each month’s total has been smaller than the last.

Net fund flows to equity funds

Source: Calastone Fund Flow Index – Oct 2025

Global equity funds recorded £203m of outflows in an “unprecedented” fourth consecutive month of net selling, investors withdrew £146m from North American funds and Asia-Pacific funds extended their streak to a 29th consecutive month with £209m in net outflows.

UK-focused funds shed a net £691m, while China, Japan, emerging markets, small-cap and sector-specific strategies all saw net redemptions.

Glyn said Europe remains attractive to investors seeking lower valuations. “Only Europe is benefitting most clearly from a rotation towards lower valued stock markets,” he said.

UK equity funds continued to face selling pressure despite the domestic market reaching record levels. Glyn said persistent pessimism around the British economy is weighing on sentiment.

“The doom loop of negative commentary on the UK economy with its dire fiscal position, soaring credit spreads, lack of growth and impending tax rises may now be winning out. Outflows are on the rise again,” he said.

He noted that, although selling from UK funds had slowed in recent months, broader market caution is now reaccelerating withdrawals.

Fixed income and money market funds were the main beneficiaries of the flight from equities in September.

The two asset classes attracted a combined £895m of inflows, with £610m directed to bond funds, mainly corporate and flexible mandates. Money market funds absorbed £285m as investors sought capital preservation.

“The safe-haven status of money market funds and today’s attractive yields on bonds make them an obvious place for investor cash to flee to when nerves over equity markets abound,” Glyn said.

Property funds, which had seen outflows narrow over recent months, endured renewed weakness in September. Investors withdrew £85m, the largest monthly outflow since April 2025.