Dividend-focused investors don’t need to abandon their income discipline to participate in the artificial intelligence (AI) market surge, according to Stuart Rhodes, lead manager of the £2.4bn M&G Global Dividend fund.

“The past three years for any dividend manager have been tough,” he said. “It’s difficult to cling on and maintain a stable kind of payment structure compared to the returns delivered by the AI boom.”

That boom, largely led by the US mega-cap Magnificent Seven stock, has become a defining theme of global equity markets, with companies logging astonishing growth and returns.

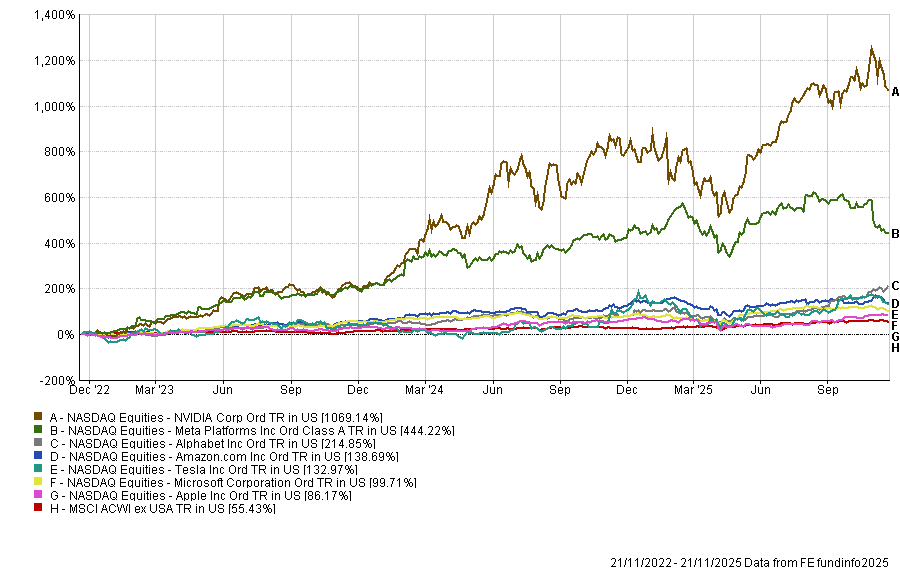

Performance of the Magnificent Seven vs MSCI ACWI ex USA over 3yrs

Source: FE Analytics

But this has also created a dilemma for income investors as they look to capture some of the upside without compromising dividend discipline.

“It’s just something we need to accept, embrace and take on – there’s no point moaning about it,” Rhodes said.

While the temptation to chase growth is strong, he said careful stock selection and valuation discipline will allow income strategies to capture tech exposure without overriding their core objective.

With some restrictions, it is still possible for a dividend-focused fund to own some of the Magnificent Seven.

“I can’t own Amazon and I can’t own Tesla, as they don’t pay dividends,” the M&G manager said. “Nvidia does but it offers a tiny dividend yield of 0.02%, which isn’t going to get the job done.”

More recently, Meta has begun to offer a dividend yield of 0.36%, while Microsoft “has paid dividends for a long time”.

M&G Global Dividend’s top holdings include Microsoft at 6.7%, which has a dividend yield of 0.76%. The fund also has a 3.9% position in Meta, which now offers a dividend yield of 0.36%.

Exposure to the AI surge isn’t restricted to the Magnificent Seven, with Rhodes citing other investment opportunities across the value chain, such as semiconductor company ASML.

“At various points over the past three or four years, ASML has sold off dramatically and offered more attractive entry points to be able to buy in at a reasonable price,” Rhodes said.

The company also currently offers a dividend yield of 0.74%.

The US-based Broadcom, too, was highlighted by Rhodes as an attractive company which has a big role to play in the build-out of AI while still meeting the criteria of the income-focused fund, with a dividend yield of 0.68%.

Meanwhile, Taiwan Semiconductor Manufacturing Company (TSMC) has long been on Rhodes’ radar for its “immaculate dividend record”. It features in the top holdings of the M&G fund at 4.7%.

“TSMC makes all Nvidia’s chips, meaning there is no Nvidia without TSMC,” he said.

“The company has always had a big valuation discount because everyone is worried that China might invade Taiwan at some point – of course, that is a big risk for any investor to consider. But TSMC also isn’t allowed to buy back shares, so all it can do is pay dividends out.”

Although this proves there are ways for dividend-focused funds to invest in companies exposed to high-growth themes like AI, Rhodes said it is important to stick to the fundamentals – meaning sensible valuations with consistent dividend profiles.

“This is getting harder in the tech space because they are all moving up [valuation-wise],” he acknowledged.

Despite the ever-growing valuations, Rhodes said he does not think markets are experiencing an AI bubble.

“It is very tempting for people like me – a dividend manager – to call it a bubble because it is not too much fun trying to compete against this level of performance, but I think it’s important to acknowledge the power of this cycle,” he said.

“My definition of a bubble means there is nothing there, [while] there is clearly an AI wave coming which is real and going to have an impact.”

Rhodes compared today’s AI surge to China’s mining super-cycle of the early 2000s: long-lasting, powerful, but eventually painful when it turned.

“None of us know how long this [AI] cycle is going to go but the other side will be painful with an aggressive fall in capital.”

As such, diversification remains important, with other companies in M&G Global Dividend’s top holdings including global packaging company Amcor, methanol supplier and distributer Methanex and British multinational tobacco company Imperial Brands.

These companies offer dividend yields of 6.22%, 2.10% and 4.97% respectively.

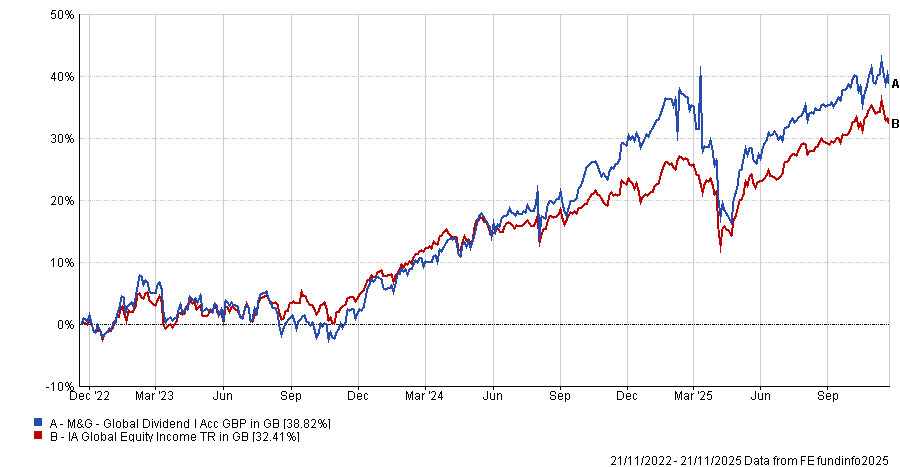

Performance of the fund vs sector over 3yrs

Source: FE Analytics