Buy-and-hold investing has become riskier in today’s market as valuations leave little margin for error and balance-sheet strength matters more than ever.

That is the central warning from Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund, who said investors cannot assume that long-term compounders will outperform simply because they are held for many years.

“It's more dangerous now to just buy and hold, but that's what our mandate is. We call it ‘buy to hold’, because we have the intention to hold the names we have, but if facts change, we change our mind,” he said. “We don't rely on the multiple expansion, we rely on the organic growth and the bottom earnings per share growth for our returns.”

Smit’s approach to buy-to-hold focuses on valuation, as “you can only buy with the intention to hold if you get a fair valuation for the stock”. But, because “you're not going to get cheap valuations in this market”, you have to rely on fair valuations.

In fact, low prices are a bit too good to be true.

“When you see a very cheap valuation, you have to make more than double sure there isn't something wrong. Chances are if you see something very cheap, it will be a low-value business,” he said.

There are stocks today with higher dividend yields than price-to-earnings (P/E) ratios – a red flag signalling that the stock might be dangerously over-distributing earnings.

The balance sheet will likely be weak and over-geared, leaving free cashflow serving creditors rather than shareholders. In such situations, the manager said, dividends may be cut. So, valuations are better assessed relative to historical levels rather than absolute numbers.

Google parent Alphabet is the type of company that fits Smit’s criteria more – in fact, it’s the largest position in the fund at 8.5%.

It continues to offer growth potential, particularly in AI through Gemini 3, which has the potential to reach billions of consumers and offers a new commercial growth avenue that was not previously available, he said.

Smit expects the potential re-rating to extend beyond individual names to the broader global quality universe. This year’s AI rally drew capital away from more stable, compounding businesses, causing their ratings to fall.

“The relative P/E ratio of quality stocks against the MSCI World Index has derated from almost two standard deviations above average to a standard deviation below, despite strong earnings delivery. On a relative basis, the comfort and certainty around quality with lower valuations may become more valuable going forward,” he said.

Not all sectors are the same: technology remains close to historic valuation levels but financials and staples are trading well below their averages.

Some companies, such as S&P Global, have been penalised for negative AI perception and classification as financials, even though the potentially vulnerable portion of their business is minimal.

Similarly, healthcare and selected staples offer opportunities, although Smit remains cautious on those affected by changing consumer patterns and slower organic growth.

Looking ahead, the manager expects quality stocks to outperform over time by more than 1.5 percentage points per annum relative to the MSCI World Index.

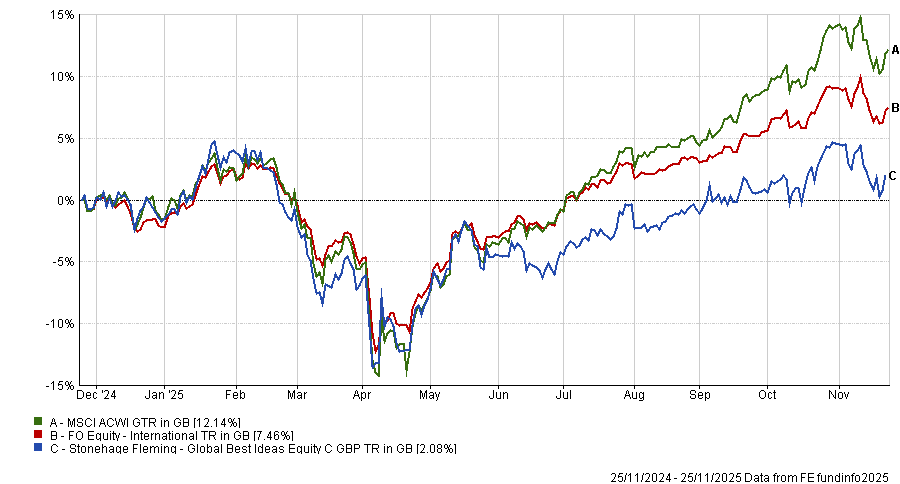

While the style has underperformed this year (as did Smit’s fund, whose performance is illustrated below), apart from the internet bubble of 2000, quality rarely underperforms for consecutive years.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“As a buy-to-hold strategy, that’s historically what has happened. While quality is underperforming this year, historically it has not underperformed in successive years except during the tech bubble of 2000, which caused a deep bear market.

“Quality usually underperforms for a single year, so based on that metric, it suggests quality’s turn may come in 2026,” he concluded.