When James Lowen, co-manager of the £1.9bn JOHCM UK Equity Income fund, began his career over 20 years ago, investing in the UK market was “like a badge of honour”.

The market has since been through some difficult times, shaken by volatile events such as Brexit and the Covid pandemic.

In 2025, the picture is changing again and more positive sentiment is returning, he said.

“The UK has been a good market – we made 20% last year and we’re doing 20% again this year. The market is far from going backwards,” he said.

The fund, which is managed by Lowen and Clive Beagles, has an FE fundinfo Crown Rating of four out of five.

Top holdings in the fund include familiar FTSE 100 stocks such as oil major BP, banking group Barclays and mining titan Glencore. It has the biggest weighting toward financials (36.9%), followed by industrials (19.7%) and basic materials (17.3%).

Below, Lowen outlines the fund’s core investment principles, shares his outlook for the UK market and reflects on the stock picks that have shaped performance over the past year.

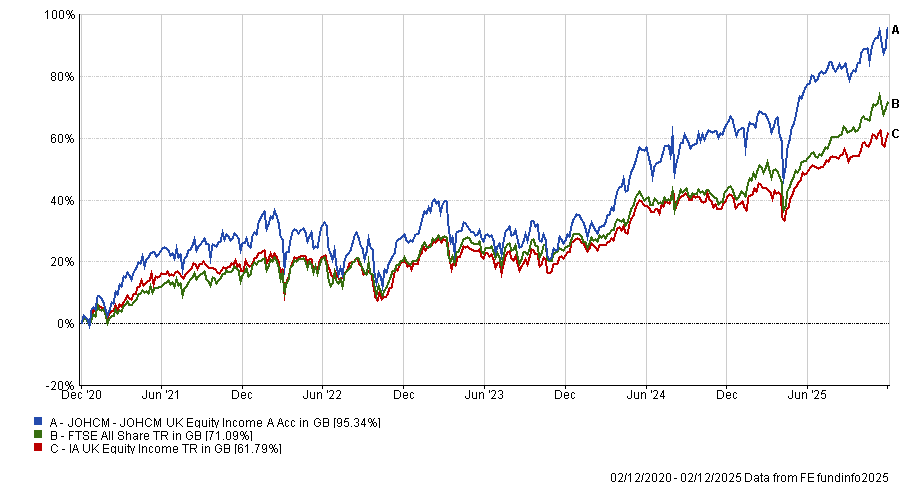

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

What is your process?

The fund is not esoteric. It’s very simple. We stick to our knitting and we just looking for very cheap stocks meeting our metrics.

One of our core areas of focus is normalised earnings. For every stock we own, we consider how much that stock could earn on a three-to-five-year view and then we will base our valuations off that.

We’ve found that the market is more short term now than it was 20 years ago. For example, for a stock like Forterra – the second largest brick company in the country – its earnings for next year are quite low because it has been a difficult time for house building. As we came out of last year it recovered a bit and now it’s flatlining. Its current earnings per share for this year are 12p and next year are 14p. That’s consensus. But our normalised earnings are 32p.

If they did 32p of earnings on a P/E [price-to-earnings] of 10x or 12x, it would be £3.54. The share price [at the time of talking is] £1.81 – so we think the share price can double.

All I need to get to my 32p is interest rates to carry on being cut, which I think is going to happen, and for the government to continue pushing for its target of around 300,000 new homes a year. To reach 32p a year, the government can miss this materially and achieve 150,000 to 200,000 new homes a year.

What are your thoughts on the UK market right now?

UK stocks are performing well. It’s still not great, but it’s a bit better than how it is portrayed in the media.

We have much better management than we had around the time of the financial crisis. We have interest rates that are normal now, rather than 0%, which helps insurers and the banking sector, so they are on the front foot – particularly the banks.

All my retailers are taking market share from the private sector, so the publicly-listed sector is doing better than the private sector.

There’s also a huge amount of infrastructure spend, meaning all my construction stocks are doing well.

How do you approach active engagement with UK companies?

Although the market is performing well, companies are understandably very frustrated. Their share prices are on their backsides even though many of them are outperforming, upgrading and delivering buybacks and dividends.

As a result of this they are often encouraging shareholders to enter the room for more discussion. There is more of a sense of working together.

We all know the UK stock market is cheap. We all hope it’s going to get better – and I do think it is getting better. But we can’t all sit around and do nothing and wait. We have to be constructively active underneath the surface and engage with our companies to try and unlock value.

For example, we wrote a letter to TPI ICAP suggesting it sell its data business as it is worth more than its market capitalisation. Subsequently, the company has announced it is going to do that and we are now waiting for it to spin it off into an IPO in the US.

What has been one of your worst calls over the past 12 months?

We obviously all make mistakes and one of the worst ones this year for us has been a stock called WPP, which we bought in March 2019 and sold in August of this year as it was our biggest detractor.

It had an average portfolio weighting of 2.6% and contributed 0.9% to the portfolio performance. Its share price fell by 54% over the ownership period. It still created a positive contribution despite the price fall, as we made a significant amount in the post-Covid bounce-back after increasing the weighting. More recently, as the price fell, there was a loss of contribution.

It was a mistake because of structural risks and, ultimately, it was too leveraged. The learning point is that we need to remain resolutely focused on both of those points.

What has been one of your best calls over the past 12 months?

On the other side is construction company Galliford, which was five-folded – we bought it for less than £1 a share in March 2018 and, although we haven’t sold it all yet, we have sold some of it. The stock is now worth £5.

It has had an average portfolio weighting of 1% and contributed 3.6%, with its share price increasing by 489% over the ownership period.

We have also enjoyed lots of dividends along the way and it’s still cheap. Our target prize is nearer £7.

As well as being cheap, the company’s management also laid out a very clear strategy for 2026 to 2030 in terms of how it is going to grow the business and drive margins up. It has been well managed.

In addition, it is involved in a lot of the infrastructure investment we are seeing in the UK, especially around the water sector. Galliford is one of the companies doing all the work.

What do you do outside of fund management?

I collect wine and I’m doing wine exams for a WSCT diploma. I also like to go skiing and travelling, as well as playing golf.