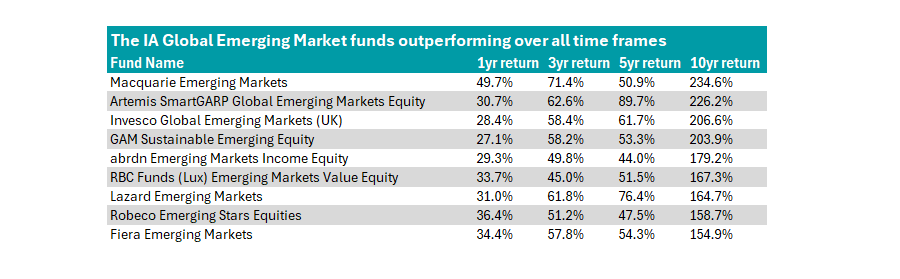

Nine emerging market funds have delivered top-quartile returns over the past one, three, five and 10 years, according to recent Trustnet research, with value investing being a consistent theme among these outperformers.

Emerging market equities are often seen as unpredictable because they have greater political instability, weaker institutions, less diversified economies and more volatile currencies than developed markets.

What’s more, lower liquidity, weaker corporate governance standards and less developed market infrastructure increase the difficulty of running stocks in emerging markets.

However, several funds have proven their ability to navigate these choppy markets over recent years and outperform their peers. As part of an ongoing Trustnet series, we examined the IA Global Emerging Market strategies, which delivered top-quartile returns over one, three, five and 10 years (the standard time frames used by most investors).

Source: FE Analytics. Performance to the end of November. Chart sorted by 10-year return.

The table above shows all the funds that made the shortlist in this research. As its ranked by 10-year performance, Macquarie Emerging Markets sits at the top. Led by Liu-Er Chen, the fund targets companies that have sustainable franchises that are trading below their intrinsic value.

The fund is overweight South Korea, where it has a 31.1% allocation – an 18.2 percentage point overweight the MSCI Emerging Markets index. MSCI says Korean equities are more tilted to the value factor than the wider emerging markets index.

Meanwhile, it is underweight the two largest emerging market economies – China and India.

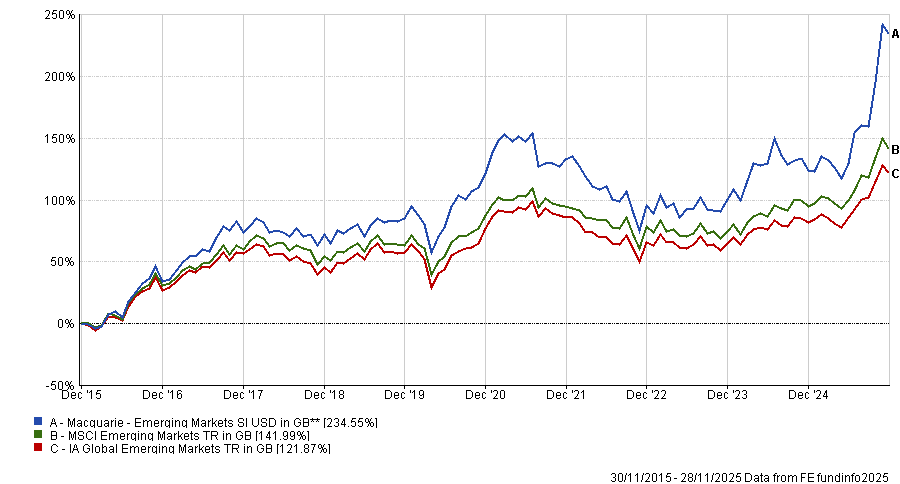

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics. Performance to the end of November.

Over one and three-year periods, it is also the best-performing fund in the IA Global Emerging Markets sector due to top-quartile results year-to-date and in 2023. However, investors should be aware that the strategy did not always deliver, as seen by the bottom-quartile 19.9% loss in 2022.

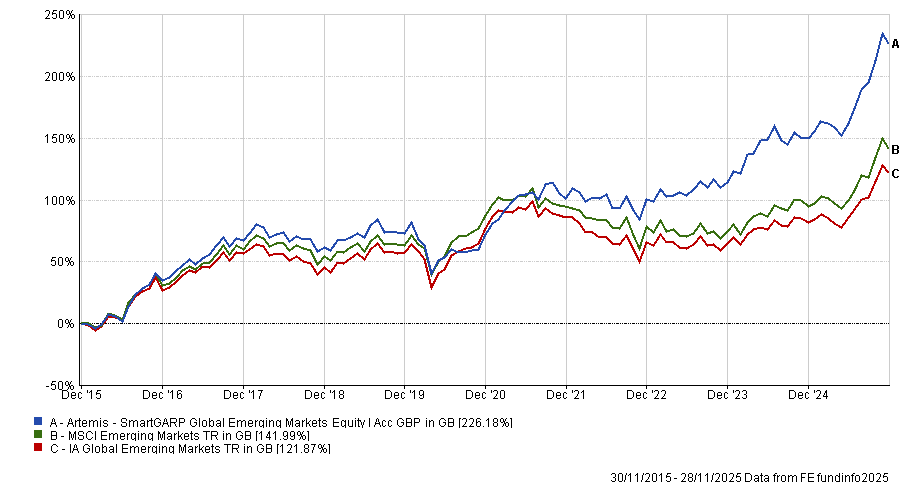

Over the past five years, Artemis SmartGARP Global Emerging Markets Equity has been the top fund in the peer group. It has beaten its benchmark in every calendar year since launch, only faltering against the MSCI Emerging Markets in 2020 when it lagged by around 15 percentage points.

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics. Performance to the end of November.

Led by FE fundinfo Alpha Manager Raheel Altaf, the portfolio uses the SmartGARP (growth at a reasonable price) process to target companies that are undervalued for their growth potential.

The strategy is well regarded by analysts at FE fundinfo, who said: “The fund blends rigorous quantitative analysis with the manager's qualitative judgement to navigate ever-changing market conditions.”

While the strategy is tilted towards value, the managers go “beyond pure value” by considering macro factors to create a more balanced portfolio. “This blend of systematic analysis and fundamental oversight makes the strategy more resilient across different market conditions and a strong candidate for a core emerging market equity allocation,” FE fundinfo analysts said.

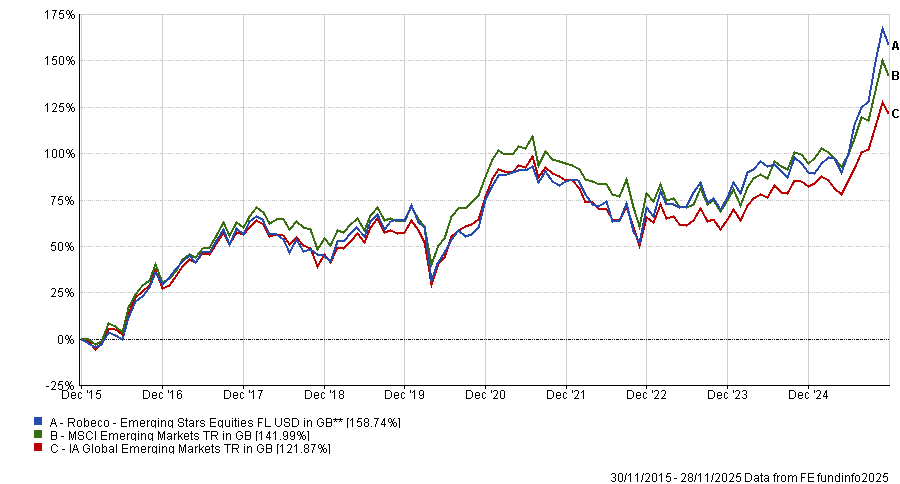

The largest strategy to make the shortlist in this research is the £2.5bn Robeco Emerging Stars Equities fund, up 158.9% over 10 years.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics. Performance to the end of November.

Managed by Jaap Van Der Hart and Karnail Sangha, it combines both top-down and bottom-up analysis to identify companies with a healthy business model at compelling valuations.

The portfolio is highly concentrated with around 35-50 stocks, with the largest position – Taiwan Semiconductor – representing 10% of the total assets.

Analysts at Rayner Spencer Mills Research (RSMR) said the team has considerable experience running emerging market strategies and has built up “considerable resources”, such as a dedicated Chinese analyst team to help find opportunities.

Because emerging markets “have a greater proportion of growth strategies”, Robeco’s value style can provide “something different” for investors hoping to diversify their exposure, RSMR analysts said.

However, while the high-conviction approach has led to strong overall returns, the strategy could prove volatile on a calendar-year basis. For example, while it delivered a top-quartile performance in 2023, it slid into the bottom quartile in the following year.

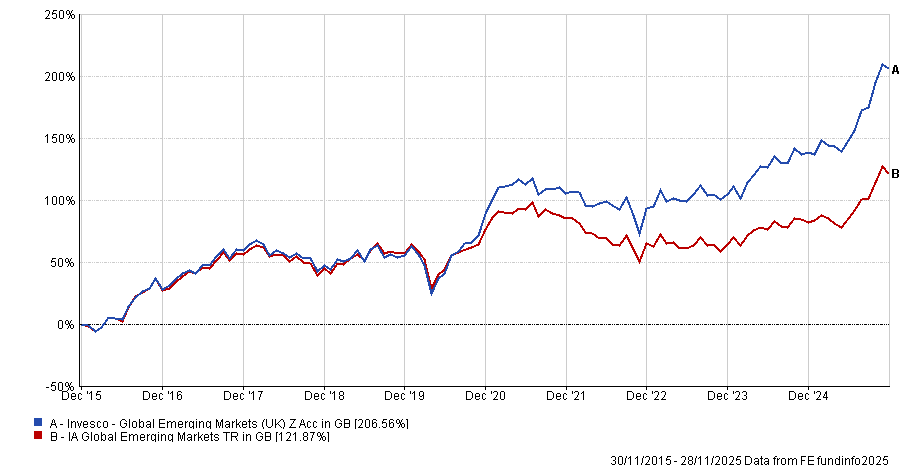

Another consistent option is the £1bn Invesco Global Emerging Markets (UK) Fund, which has also delivered top-quartile results over one, three, five and 10 years.

Performance of fund vs sector over 10yrs

Source: FE Analytics. Performance to the end of November.

Led by FE fundinfo Alpha Manager William Lam and Ian Hargreaves since 2018, this is another value strategy targeting companies whose share prices are substantially below the team’s estimate of fair value.

Analysts at Titan Square Mile have awarded the fund with an ‘A’ rating, due to the team of “skilled portfolio managers” and a well-established process.

However, due to inflows this year, the team have been pushed to more liquid names, which has “reduced their ability to take meaningful positions in smaller, high conviction ideas”, analysts warned.

The Lazard Emerging Markets, Fiera Emerging Markets, GAM Sustainable Emerging Equity, RBC Funds Emerging Markets Value Equity and abrdn Emerging Markets Income Equity funds also made the list.

Previously in this series, we examined the funds that delivered top quartile results over one, three, five, and 10 years in Europe, global markets, the US and the UK.