Japan’s stock market has staged a remarkable comeback, reaching record highs and beating global rivals after the surprise election of a new prime minister, with some strategists expecting this to continue in 2026.

Sanae Takaichi won the Liberal Democratic Party (LDP) leadership election on 4 October 2025, defeating Shinjiro Koizumi in a run-off vote, and was subsequently elected Japan’s first female prime minister by parliament on 21 October. She replaced Shigeru Ishiba, who lasted just over a year in office, following the LDP’s disastrous election losses in July 2025 that forced the party to form a new coalition with the right-wing Japan Innovation Party.

Markets responded enthusiastically to her election, with the Nikkei 225 surging to a record close following her LDP victory. Investors welcomed Takaichi as a ‘fiscal dove’ committed to expansionary spending and accommodative monetary policy, driving what became known as the ‘Takaichi trade’ – buying Japanese stocks while selling bonds and the yen.

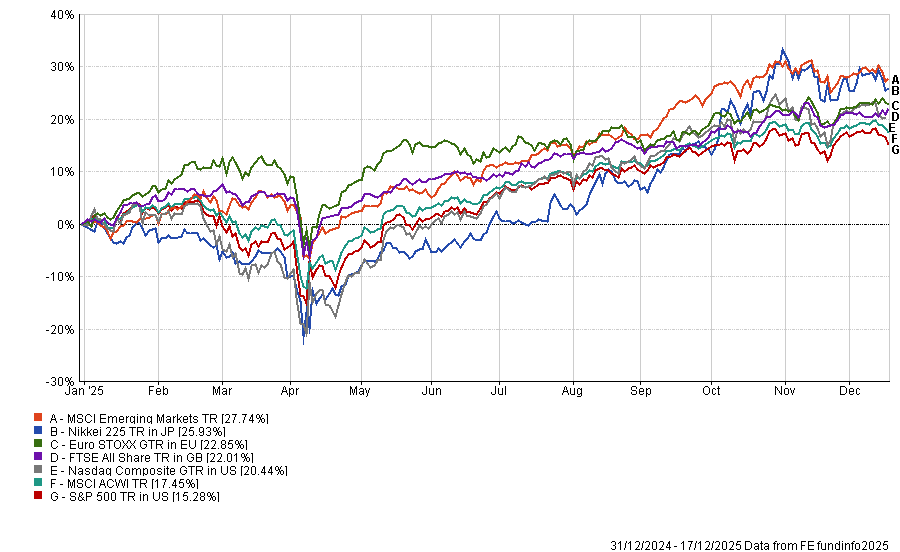

Japanese stocks have outperformed global equities in 2025 thanks in part to this. FE Analytics shows the Nikkei 225 made a 25.9% total return (in local currency terms) between the start of the year and 17 December, beating the MSCI All Country World index by 8 percentage points. It also ahead of the S&P 500, the heavy-tech Nasdaq, the FTSE All Share and the EuroSTOXX this year, but at the start of 2025 few would have predicted that Japan would perform so strongly.

Performance of global equity markets in 2025

Source: FE Analytics. Total return in sterling between 1 Jan and 17 Dec 2025

“The Japanese economy faced headwinds in 2025, weighed down by tariffs and higher inflation,” said Kristina Hooper, chief market strategist at Man Group. “These contributed to the surprise election outcome in the summer of 2025 and growing public calls for more stimulus.”

Hooper noted that Takaichi had introduced ‘Sanaeconomics’, her own version of Abenomics (former prime minister Shinzo Abe’s stimulus-focused economic policy). The approach favours fiscal stimulus and deficit spending to spur economic growth.

Her cabinet has already approved a $135bn stimulus package, the largest since the pandemic. Takaichi also prioritised military expansion, breaking from Japan’s recent pacifist stance in a move that will inject substantial stimulus into the economy.

The new administration is also expected to strengthen ties with the US, which Hooper said should support trade. Consumer spending, which represented approximately 55% of GDP, remains critical to economic health, particularly as US tariffs pressure exports.

Hooper also identified potential headwinds that could constrain Japan’s economic performance. The Bank of Japan (BoJ) appears intent on normalising monetary policy, with rate hikes and quantitative tightening likely in 2026, whilst inflation is weighing on consumer and business sentiment. The BoJ faces a difficult balancing act, as aggressive US trade policy threatening Japanese exports might necessitate a less hawkish approach.

Additional risks could emerge from bond markets and geopolitical tensions. Bondholders might react negatively to increased deficit spending, potentially driving up borrowing costs, particularly for longer-dated bonds. Heightened Japan-China tensions, if they persist, could dampen both consumer spending and business investment.

Strategists at JP Morgan Asset Management are positive on Japan overall, saying: “Sanaenomics and corporate reforms will likely propel Japanese equities in 2026.

“Businesses will likely focus on unlocking excess cash, which could in turn fuel capital investment, wage growth and shareholder returns. In addition, Sanaenomics is expected to revive middle-class spending and strategic investments, providing tailwinds for the market.”

Goldman Sachs Asset Management identified multiple supportive factors for Japanese equities entering 2026, including moderating inflation, stable monetary policy and potential fiscal support from the Takaichi government. Experts at the firm expect strong corporate capital expenditure and consumer spending, driven by wage growth, to support earnings in 2026.

Takaichi’s fiscal stance appears likely to benefit the defence, nuclear energy and technology sectors, given pledged investments in AI, semiconductors, quantum computing, space, advanced medicine and cybersecurity.

“Japanese investors, who have traditionally preferred holding cash, are now gradually shifting towards riskier assets. A significant driver of this behavioural shift is the expanded Nippon Individual Savings Account (NISA) program, which offers enhanced tax-free investment limits and particularly appeals to younger, financially informed investors,” the Goldman Sachs strategists said.

“In our view, this behavioural change, coupled with corporate reforms, further strengthens the asset class. The Japanese stock market also has unique characteristics, including fewer research analysts covering each company compared to other developed markets, language differences and valuable data that is hard to access.”

Japan’s corporate governance reforms have been evolving for over a decade, beginning with the Stewardship Code in 2014 and the Corporate Governance Code in 2015. Since 2023, the Tokyo Stock Exchange has intensified its restructuring efforts to promote capital efficiency and improve stock prices amongst listed companies, initially targeting the Prime and Standard markets.

From 2025, the exchange entered a second phase, shifting focus to the Growth Market for start-ups and high-growth companies. It also ended the transition measures introduced in 2022 for companies failing to meet listing requirements.

In 2026, the exchange will take its final restructuring step by initiating delisting procedures for companies that have not made sufficient improvements. The Japanese Financial Services Agency (FSA) finalised the third revision of Japan’s Stewardship Code in 2025 to strengthen engagement effectiveness and accountability. The FSA planned to revise the Corporate Governance Code in 2026, with key agenda items including effective capital allocation and better utilisation of cash for investment.

Many investors who are overweight Japanese stocks cite corporate governance reforms as positive. The BlackRock Investment Institute, for example, is overweight Japan as “strong nominal GDP, healthy corporate capex and governance reforms – such as the decline of cross-shareholdings – all support equities”.

Katsunori Ogawa, senior portfolio manager on the Sakigake High Alpha strategy, predicted that “there’s a lot more to this picture” than just corporate governance and argued rising inflation could actually be a tailwind for Japanese equities over the next few years.

Ogawa noted that the Japanese stock market recovery has been a “value rally” rather than one driven by speculative technology companies. The market recovered because investors repriced large, traditional names in the financial, utilities and manufacturing sectors.

“Our point here is that Japan as a stock market has certain structural features that made a ‘value rally’ possible and also that we may be going to see phase two of the value rally in the not-too-distant future,” Ogawa said.

“Indeed, value usually outperforms growth in Japan. However, for the time being, we expect to continue to see a period in Japan where neither the ‘value’ or ‘growth’ style predominates.”

Market leadership is undergoing a profound shift, Ogawa said. Between 2021 and 2024, industrial and engineering companies focused on exports and international markets had been the key drivers.

The market is now transitioning towards domestic stocks such as services, transport and construction that focus on selling to the Japanese consumer. This shift reflected a fundamental change in the economic landscape.

“In our view, this is due to a major change in the Japanese economy which is here to stay: inflation has returned. Although the immediate catalyst for price rises in Japan was external pressures (including elevated global rice prices), Japan was actually primed for a number of years to return to inflation,” Ogawa said.

“Overall, we feel this is one of the most exciting periods to be an investor in Japan. The Japanese stock market is back on its feet, and the return of inflation will bring with it profound shifts in market leadership.”