Dodge & Cox Global Stock has been added to the AJ Bell Favourite Funds list while Barings Europe Select and Schroder Global Recovery have been ousted, the firm revealed this week.

It was a relatively quiet year for best buy lists, with just 17 new names added across the five major platforms, as Trustnet revealed last week.

The latest moves match the number of changes made to the buy list in the entire fourth quarter of 2025, when the firm removed BlackRock UK Special Situations and BlackRock UK Income, while adding FSSA Asia Focus.

Paul Angell, head of investment research at AJ Bell, said: “Our Favourite Funds list is under constant review to ensure we have the highest conviction in our selections. We analyse each fund’s investment strategy, fund managers, and their teams-"

Starting with the additions, Dodge & Cox Global Stock is a £5bn global fund that buys high-quality businesses that appear undervalued due to short-term disruptions but have long-term potential.

It is managed by a committee, which AJ Bell research analyst Alex Wickham said he liked as it placed an “emphasis on group management over individual leadership”.

“We feel this ensures consistency, embeds robust succession planning and brings together a blend of experience and perspectives,” he said.

The committee looks for businesses that have sustainable earnings, strong cashflow prospects and valuations lower than the wider market, investing in between 80 and 100 underlying holdings.

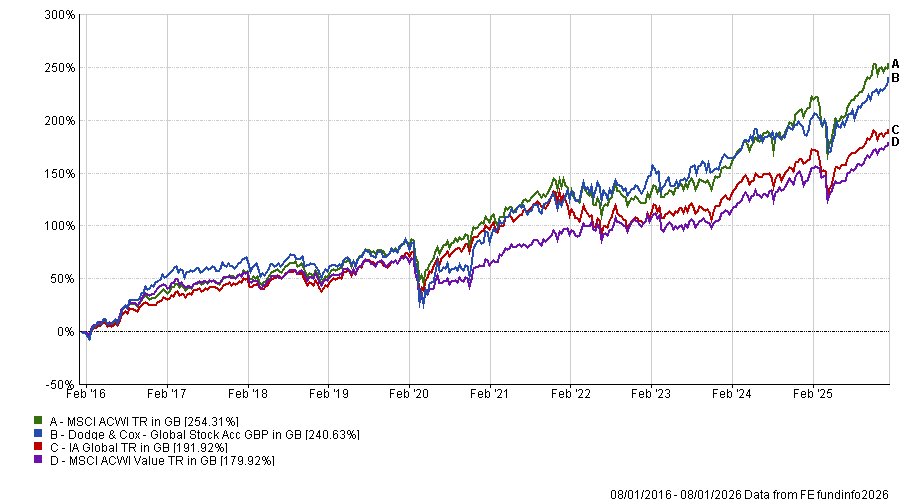

Despite the value style lagging during the 2010s and the artificial intelligence (AI) boom in the early part of the 2020s, the fund has performed well over the long term, up 238% over 10 years – a second-quartile effort in the IA Global sector, although slightly behind the MSCI ACWI benchmark. It is in the top 25% of its peers over one and five years, beating the benchmark over these periods.

Performance of fund vs sector and indices over 10yrs

Source: FE Analytics

“Pleasingly, the fund is ahead of its style-adjusted benchmark, the MSCI ACWI Value index, since its launch in 2009 and has outperformed the broader MSCI ACWI index over five years to the end of November 2025,” said Wickham.

“The stability of the team provides us comfort that they are well placed to continue to deliver positive returns going forward. Additionally, we believe the fund’s 0.63% OCF (ongoing charge figure) is very reasonable for active management in the sector.”

Making way for the Dodge & Cox Global Stock fund was Schroder Global Recovery. It boasts impressive performance, sitting in the first or second quartile of the IA Global sector over one, three, five and 10 years, but this was not enough for the fund to keep its place on AJ Bell’s best-buy list.

“This switch improves diversification within our global equity selections, given the overlap of investment process and underlying holdings between Schroder Global Recovery and Schroder Global Equity Income, which remains on the list,” Wickham said, noting that the firm retains “conviction” in the Schroder value team and the investment approach.

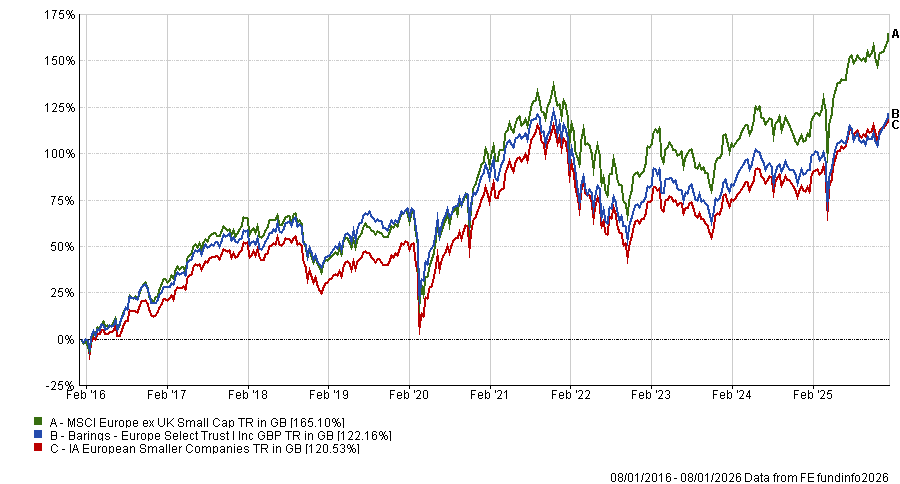

In Europe, Barings Europe Select Trust was also on the chopping block at the start of 2026 as AJ Bell analysts lost confidence in the £426m fund’s ability to beat its benchmark over the long term.

In the IA European Smaller Companies sector, it has failed to register above-average performance over one, three, five and 10 years, while also unable to beat the MSCI Europe ex UK Small Cap benchmark during these periods.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Managers Nicholas Williams, Colin Riddles, Rosemary Simmonds and William Cuss use a growth at a reasonable price (GARP) approach, looking for businesses with durable franchises by assessing competitive advantages and their sustainability over time.

“Whilst we acknowledge that this style has been out of favour in recent years, particularly during 2025 to date, the scale of underperformance has been disappointing, especially when compared with peers who have fared better,” said Wickham.

“Additionally, following a recent review we have conducted into customer demand across different asset classes , the lack of customers investing in a dedicated European smaller companies fund was evident. We therefore no longer believe the asset class warrants a pick on the list.”