As companies and governments tighten their approach to climate targets, the carbon credit market is shifting from one driven by volume to one shaped by credibility and compliance.

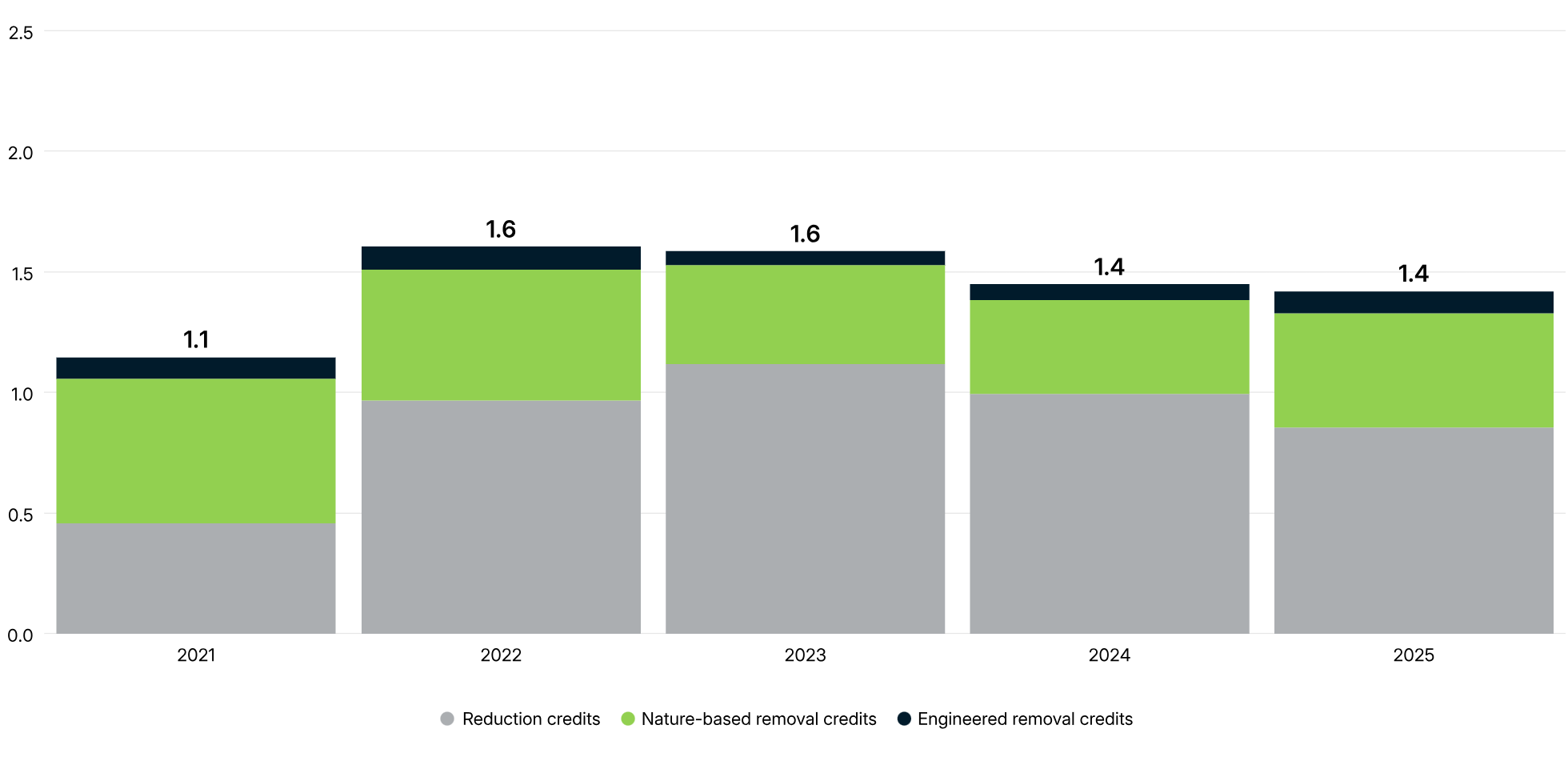

Research published by MSCI Carbon Markets estimates that the primary carbon credit market – calculated as the volume of credits retired multiplied by their estimated purchase price – remained broadly flat in 2025 at $1.4bn, below a 2022 peak of $1.6bn.

Carbon credit market value in dollars

Source: MSCI Carbon Markets

A carbon credit is a tradeable unit representing one tonne of carbon dioxide avoided or removed through environmental projects.

They are typically purchased by companies or governments to offset emissions that cannot be eliminated directly, creating a market in which prices can fluctuate sharply as rules and standards evolve.

While individual credits are not easily accessible to retail investors, exposure can be gained through carbon-linked exchange-traded funds, thematic strategies or listed companies that benefit from higher carbon prices and increased trading activity.

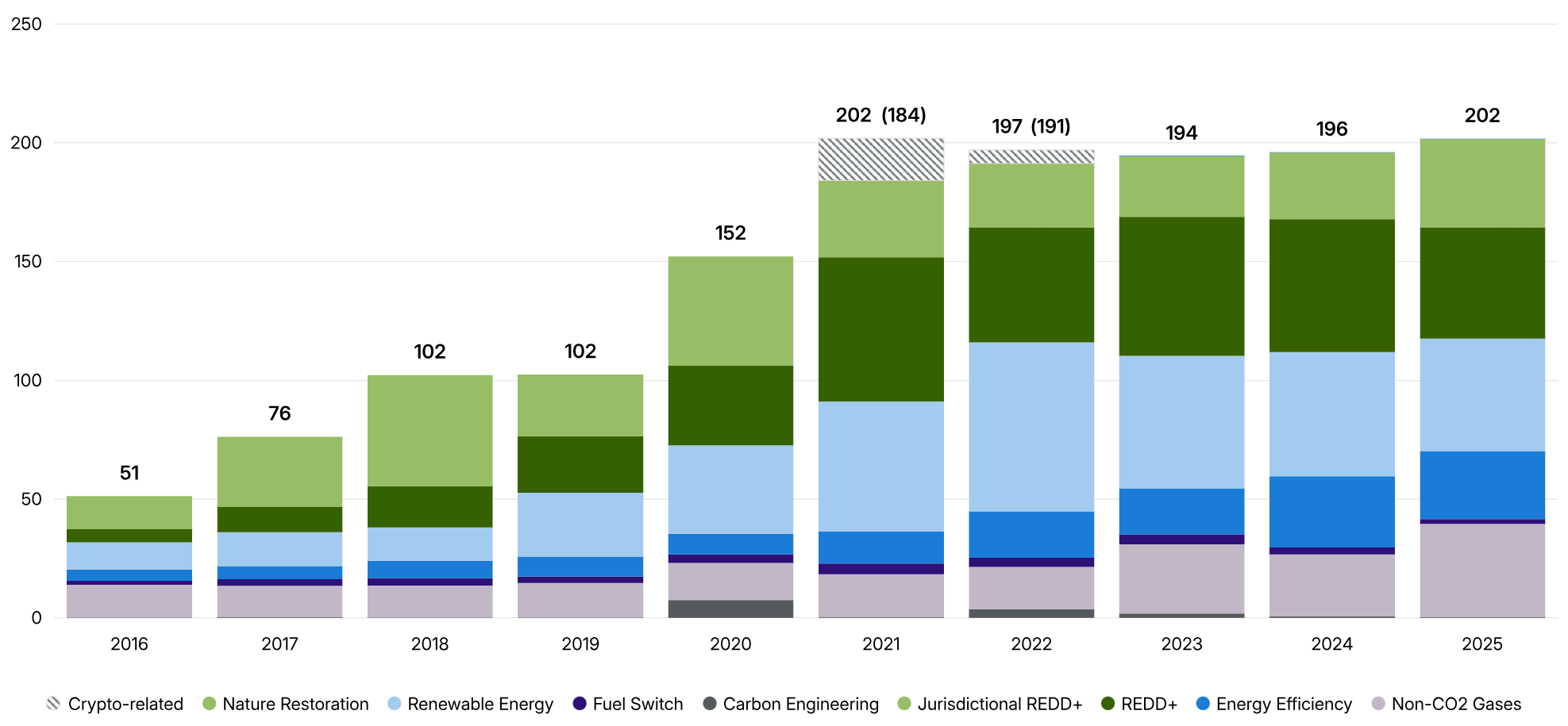

As of 31 December 2025, over 10,200 environmental projects were registered across 18 carbon credit registries tracked by MSCI, collectively issuing more than 294 million tonnes of carbon dioxide equivalent (MtCO2e) in credits over the course of the year.

On the demand side, 202 MtCO2e of credits were retired. When a carbon credit is retired, it is permanently taken off the market to ensure the emissions reduction or avoidance it represents is only accounted for once.

Global carbon credit retirements in 2025 (MtCO2e)

Source: MSCI Carbon Markets

The flight to quality

The MSCI Carbon Markets research noted that there are several underlying trends beginning to reshape market dynamics which are supportive of future growth.

In particular, there is a notable flight to quality, with demand and prices rising for higher-integrity credits, such as nature-based solutions like reforestation and engineered removal credits, while lower-quality credits are lagging or contracting.

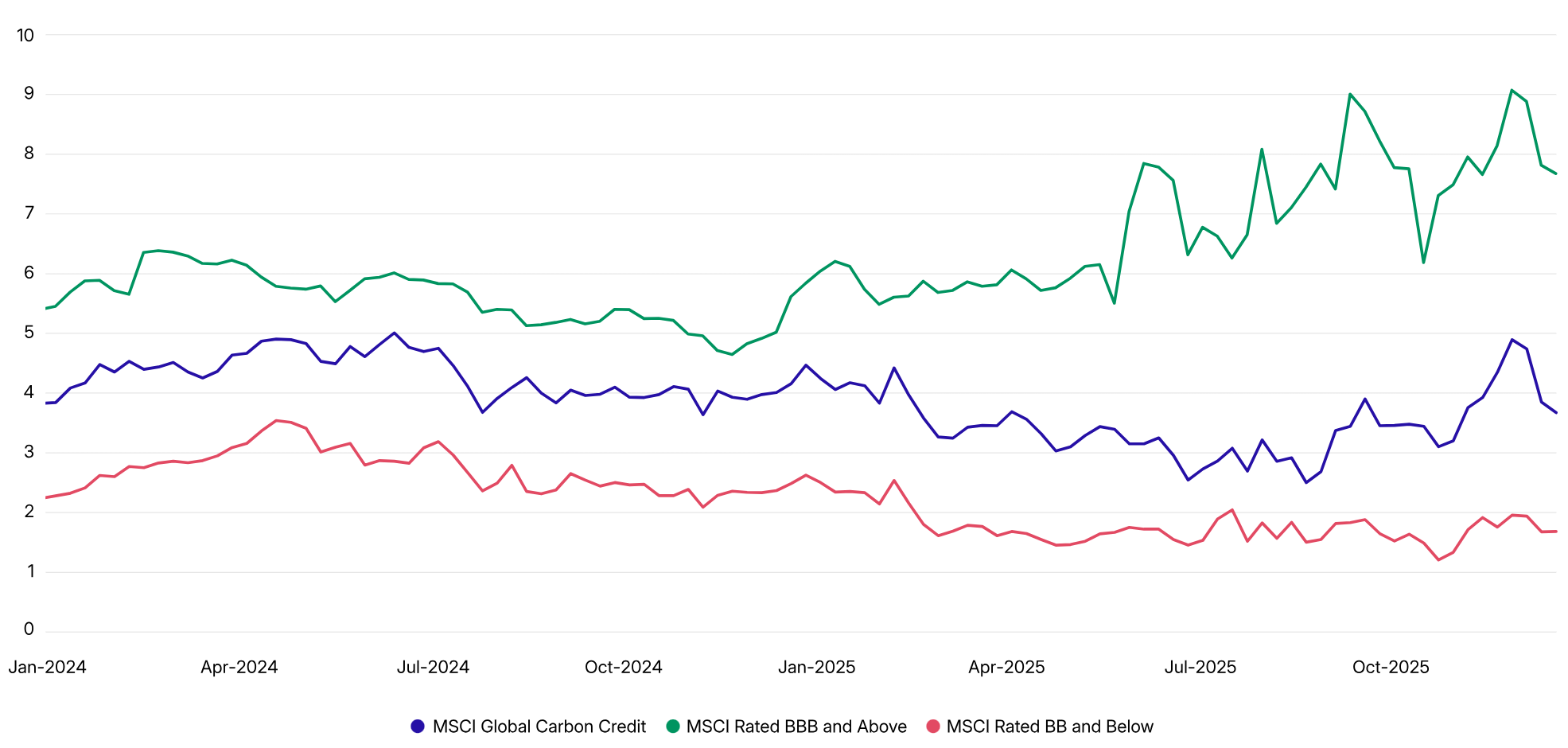

Similarly to corporate bonds, carbon credits with higher integrity – meaning demonstrable ties to environmental projects resulting in credible carbon removal or avoidance – are increasingly commanding price premiums, widening the gap with lower-rated credits.

While the annual average price of carbon credits, as measured by the MSCI Global Carbon Credit Price index, fell to $3.5 per tonne of CO2 equivalent (tCO2e) in 2025, down from $4.3 in 2024, a stronger focus on credit integrity supported higher prices for higher-rated credits, with the MSCI Rated ‘BBB’ and Above index increasing by 20% year-on-year from $5.6 in 2024 to $6.8.

Low-integrity credits moved in the opposite direction, with the average spread between MSCI Rated ‘BBB’ and Above and the MSCI Rated ‘BB’ and Below index widening to $7 by year-end in 2025 – up from $2.9 in 2024 – which implies a premium of 360% for higher-quality credits.

MSCI carbon credit price indexes (tCO2e)

Source: MSCI Carbon Markets

The increasing divergence in pricing can in part be attributed to groups such as the Integrity Council for the Voluntary Carbon Market, which has developed Core Carbon Principles (CCPs) – effectively a de facto quality benchmark for credits. Credits carrying the CCP label trade at higher multiples than uncertified alternatives.

In addition, an evolving regulatory backdrop is introducing higher standards for credits – most notably, Article 6.4 of the Paris Agreement, which establishes a centralised crediting mechanism for projects meeting its quality criteria.

Growth expected in 2026

If the appetite for quality continues, MSCI predicted that the market could grow substantially, reaching between $5bn to $20bn by 2030 and $60bn to $270bn by the mid-century.

Growth will also come from the increasing number of companies looking to utilise carbon credits to fulfil their climate-related commitments.

MSCI’s corporate database shows that 1,300 companies globally have committed to achieving carbon neutrality by 2030 or earlier, while more than 12,000 companies have an emissions reduction target approved by the Science Based Targets initiative (SBTi) – an increase of nearly 70% over the past 12 months.

Such targets will encourage companies to compensate for any residual emissions that will prevent them from reaching their goals, with MSCI predicting greater use of the carbon market as a result.

A spokesperson for MSCI Carbon Markets said: “The long-term outlook points to a market that becomes larger, more differentiated by credit quality, increasingly shaped by the need for higher quality and supported by a broader set of buyers including companies, regulated sectors and sovereigns.

“For investors, the widening dispersion in market outcomes highlights the increasing role of credit quality, project type and exposure to removal-based solutions, as long-term value is likely to accrue disproportionately to higher-integrity segments of the market.”