2025 was a year of turbulent economic conditions and geopolitical uncertainty, offering investors both challenges and opportunities.

Sticky inflation, trade tensions and debate over bubbles demanded adaptability – rewarding funds from UK small-cap specialists to global income strategies and renewable energy plays.

Trustnet asked leading fund selectors to share the funds they believe defined success over the past 12 months.

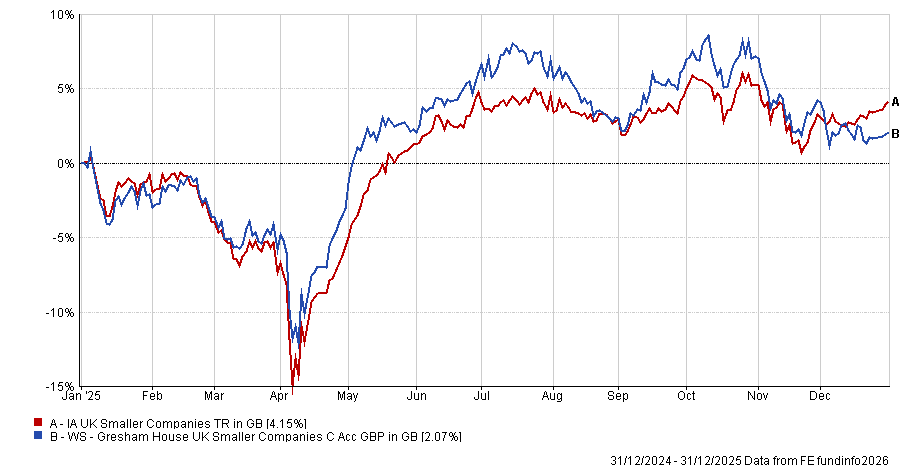

According to Alex Watts, senior investment analyst at interactive investor, one area that began to see quiet improvements was UK small-caps.

While they still lag large-caps and face persistent outflows, valuations have recovered from 2022 lows, which Watts said has left a pool of undervalued, high-quality businesses.

Although he noted that few managers have succeeded in drawing an inflow in this environment, his favourite fund for 2025 is WS Gresham House UK Smaller Companies, which “stands out for its impressive track record of performance in its peer group over the longer term”.

Managed by Ken Wotton, the fund invests in a portfolio of between 40 and 50 UK-listed smaller companies with a market capitalisation of £250m to £2bn. It is heavily weighted to the smallest end of the market cap spectrum, with over a third of the fund in AIM-listed companies and another quarter in FTSE small-cap names.

The management team takes a bottom-up approach to finding well-managed, high-quality companies with strong profit margins and earnings growth which are cash generative, with minimal leverage and decent valuations.

“Since the fund’s launched in early 2019, it has returned just under an annualised 10%, which is well over double the average return of the funds within its IA UK Smaller Companies peer group,” Watts added.

“The fund’s approach has proven itself over its lifetime, and across differing market environments, such as the bull market of late 2020 into 2021, and the drawdowns of 2022, when interest rate hikes and geopolitical chaos put immense pressure on small-cap funds and indices alike.”

Performance of the fund vs sector over 2025

Source: FE Analytics

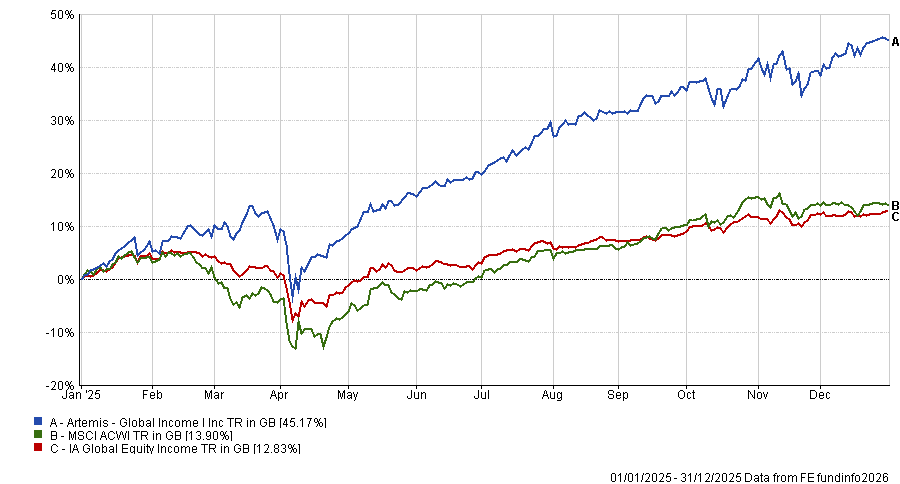

Meanwhile, Rob Morgan, chief analyst at Charles Stanley Direct, took a more global view, selecting the “hugely impressive” Artemis Global Income as his favourite fund of 2025.

He pointed to manager Jacob de Tusch-Lec’s “strong reading” of the macro picture and subsequent targeting of underpriced areas, combined with strong stock selection.

“The fund has benefited from a free-thinking and eclectic approach to finding under-the-radar dividend payers beyond the usual suspects,” said Morgan. For example, areas such as European banks and defence companies were deeply out of favour when the fund first bought in.

The fund has been part of the Charles Stanley Direct Preferred List since 2015. “Truth be told, we waited quite a long while for the fund to come good,” Morgan said. “However, patience has rewarded fund holders spectacularly, and it just goes to show the benefits of backing a good quality manager when things aren’t quite gelling for them.”

Performance of the fund vs sector and benchmark over 2025

Source: FE Analytics

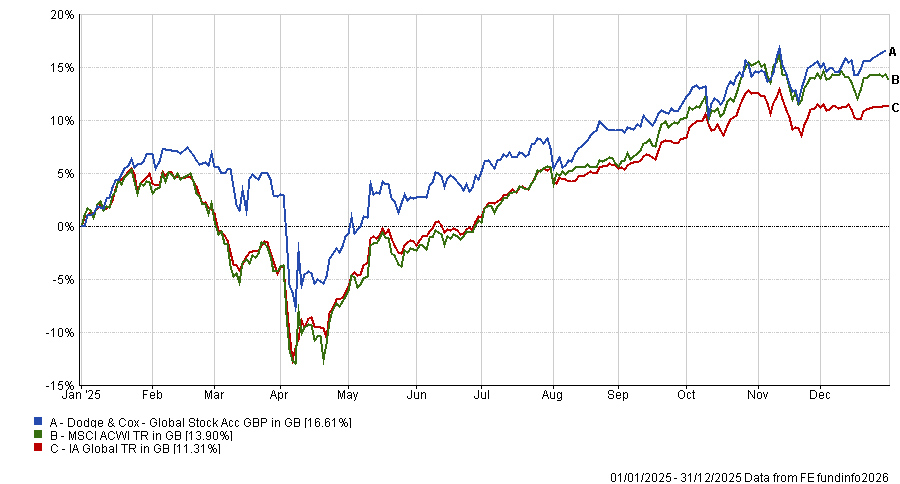

One of the most important lessons of 2025 for Tom Stevenson, investment director at Fidelity International, is that sometimes simple is best.

“Some of my best picks over the year have been the plain vanilla global funds, run by experienced and unflashy managers,” he said.

An example where simple paid off for Stevenson is Dodge & Cox Global Stock Fund, which he noted has been a good diversifier away from a “relatively stretched US stock market”. It also has a value bias which served investors well as they rotated away from growth.

As a value fund, it prefers to invest in a fairly priced company – however, Stevenson noted it is pragmatic, “so it will own a growth stock if it can buy it at a cheap price alongside more traditional contrarian value stocks”.

Performance of the fund vs sector and benchmark over 2025

Source: FE Analytics

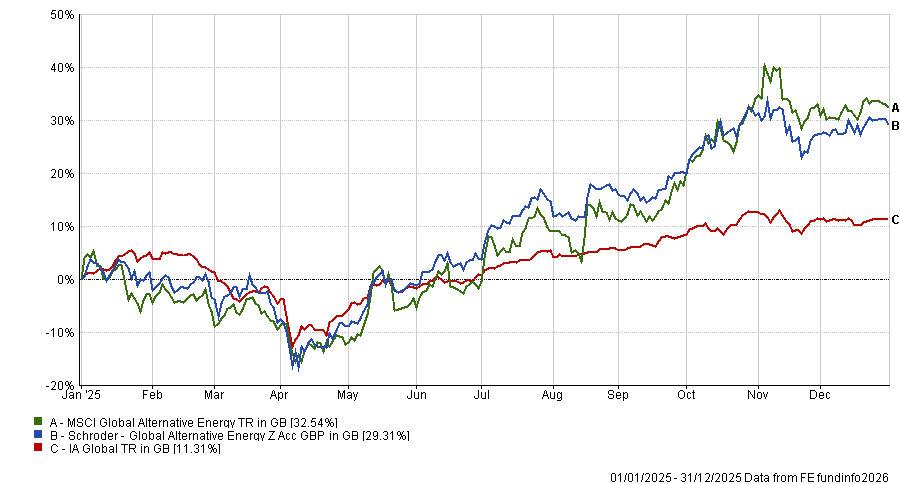

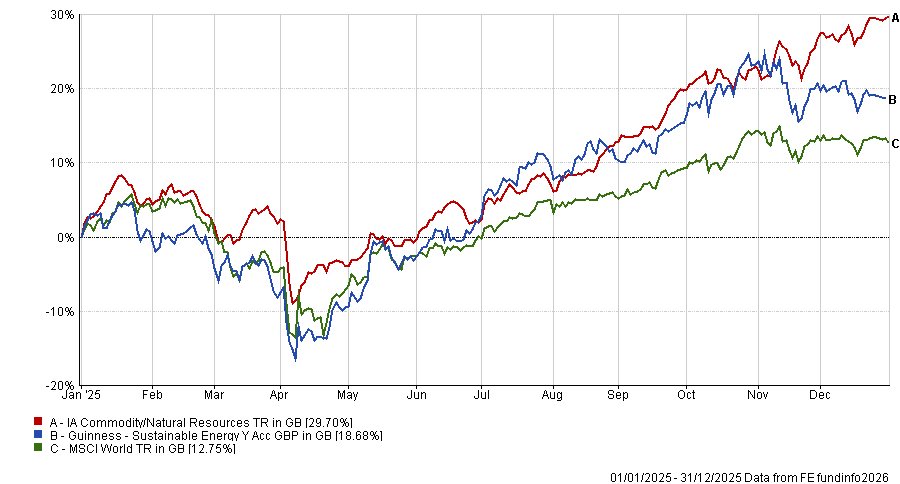

While Morgan and Stevenson stuck to broader equity strategies, Jake Moeller, associate director of responsible investment at Titan Square Mile, turned to a more specialist corner of the market: the energy transition.

He said his top picks – Schroder Global Alternative Energy and Guinness Sustainable Energy – were standout beneficiaries of recovered interest in clean power and infrastructure throughout 2025.

Schroder Global Alternative Energy is managed by Felix Odey, Alex Monk and Mark Lacey and returned 27.4% in the 11 months to November 2025.

“Its recovery stemmed from a more constructive policy backdrop, renewed interest in undervalued transition assets and a rotation into long-duration growth themes as stagflation fears have faded,” Moeller said.

Although US tariff uncertainty weighed on parts of the energy value chain throughout the year, Moeller said the fund’s positioning “offered some buoyancy”, particularly through its selective exposure to US-sensitive names and stronger holdings in European infrastructure.

“Underweights in challenged solar and battery manufacturers supported relative gains, while holdings tied to clean hydrogen, grid investment and energy efficiency services benefited from strengthening demand,” he said.

Performance of the fund vs sector and benchmark over 2025

Source: FE Analytics

Guinness Sustainable Energy is managed by Will Riley and Jonathan Waghorn and returned 20% over the same 11-month period.

It entered 2025 with a deep valuation discount paired with “materially stronger long-term fundamentals”, setting the stage for a sharp recovery, according to Moeller, as clarity around US policy, interest rate cuts and rising electricity demand from artificial intelligence and data centres all improved earnings visibility.

“As we progressed through 2025, the fund consolidated good performance across electrification, grid expansion and power equipment names,” he said, adding that the sector cycle also began to turn, with solar and battery markets showing early signs of stabilisation and renewable power installations “hitting record levels”.

Performance of the fund vs sector and benchmark over 2025

Source: FE Analytics

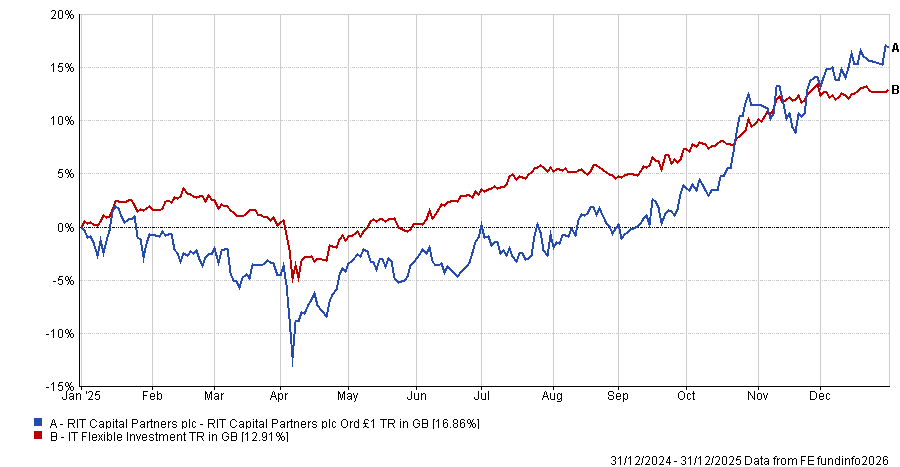

Finally, Victoria Stevenson, head of private clients at Whitman, picked RIT Capital Partners, which was founded as the Rothschild Investment Trust in 1971. It is listed on the London Stock Exchange and has assets totalling around £4bn.

“We believe it is another investment trust with the wrong discount [at 21.7% to NAV], although it has narrowed a little lately,” said Stevenson.

“The trust has returned 10% annualised since its inception and it has a good mix of public and private companies, as well as exposure to some uncorrelated strategies.”

Another positive is that RIT is committed to regular buybacks, she said, making it a “perfect holding for the long term”.

Performance of the trust vs sector over 2025

Source: FE Analytics