Over the past two years, we have been in a very narrow market environment in Asia led by momentum-driven flows into specific sectors. This period has seen considerable enthusiasm in areas I describe as ‘themes and dreams’ – investors have chased growth at any price in innovation, biotechnology, electric vehicles and artificial intelligence-led stocks, where fundamentals and valuations have gone in the opposite direction.

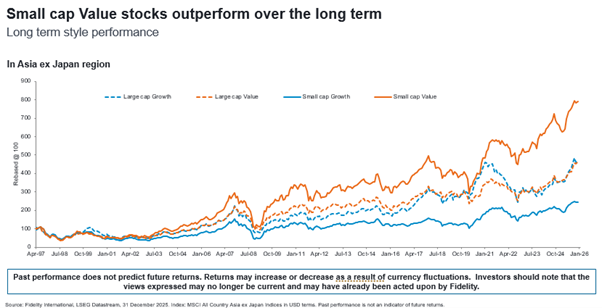

But when I return to my long-term mindset and review data over a 30-year period, it is encouraging to see that the small-cap value segment has meaningfully outperformed other segments in Asia. Therefore, as we look forward to 2026, I would like to dispel two myths about this investment universe.

Myth one – Rewarding opportunities in Asian small-caps must be growth stories

When investors think about Asia’s smaller companies, they often picture fast-growing technology or consumer names. In practice, the strongest long-term results have tended to come not from the loudest growth stories, but from solid businesses bought at sensible prices. Time and again, we have seen markets pay too much for excitement and too little for resilience.

I find it useful to think about stocks in the same way you might think about buying a business for your family. If you had £50m to acquire a local business in London, you would not start by asking how quickly it could grow. You would start by asking whether it sells a product customers genuinely want, at a price that allows a good return on capital.

You would insist that the people running it are both competent and honest. And you would work hard on the purchase price, looking for every flaw you can find to ensure you are not overpaying.

That is exactly how I invest in Asia. Many of the companies in the portfolio are not well-known stocks. For example, a noodle or biscuit manufacturer in Indonesia, a security services provider in India, or a specialist distributor in the technology supply chain.

In Taiwan, for example, we own Pacific Hospital Supply, a producer of medical consumables. It is not a large company in global terms but, under new management, it is gaining share in a sizeable industry and trading on valuation multiples that still offer an attractive dividend yield.

These kinds of businesses rarely grab headlines, yet over long periods they have often produced good outcomes compared to widely chased momentum stories.

The lesson from 30 years of data is simple. In Asian small-caps, paying a reasonable price for a good business with good people has mattered more than chasing the highest predicted growth rate.

Myth two – Asian small-caps are too risky

The second myth is that Asian small-caps are inherently too risky. Reality is that risk is not day-to-day volatility; it is the permanent loss of capital. In my experience, such loss usually comes from four sources: buying a fundamentally weak business; backing untrustworthy people; accepting a fragile balance sheet; or dramatically overpaying for even a reasonable company that leaves no margin of safety.

Our investment approach is designed to avoid these pitfalls by focusing on companies with durable cashflows, capable and honest management teams and balance sheets that can withstand shocks.

And by insisting on valuations that provide a margin of safety, we aim to reduce the likelihood of permanent loss. Viewed through this lens, a diversified portfolio of Asian small-caps bought at sensible prices is not necessarily riskier than the broader market.

Why process matters more than predictions

Discipline of process is what anchors every investment decision. Today, a significant portion of our capital is deployed in Indonesia and China. Indonesia is the region’s third-largest economy after China and India, with favourable demographics, prudent public finances and healthy household balance sheets. Yet its equity market remains out of favour.

Our exposure there spans banks, industrials, building materials and consumer businesses, all selected one by one for our belief in their ability to generate sustainable returns with a margin of safety.

Elsewhere in the region, we own companies like Mega Lifesciences in Thailand, a manufacturer of wellness and pharmaceutical products with a strong distribution network and competitive margins, again trading on undemanding valuations.

What still holds true today

Looking ahead, we cannot say whether Asian markets will be higher or lower in 12 months’ time. What we can say is that the lessons of the past 30 years still apply.

In Asian small-caps, value has beaten growth more often than not and careful attention to business quality, people and price has been a reliable guide through many business and economic cycles.

We do not control outcomes. We control inputs. Our focus remains exactly where it has always been – good businesses, run by good people, at a good price.

Nitin Bajaj is portfolio manager of Fidelity Asian Values trust. The views expressed above should not be taken as investment advice.