Europe has little chance of producing a global champion in artificial intelligence infrastructure, leaving the foundations of the industry concentrated in the hands of a small number of US technology groups.

According to Scottish Mortgage manager Tom Slater, the sheer scale of capital required to build and run the foundations of artificial intelligence (AI) has already locked in a narrow group of winners, leaving other regions and most would-be challengers structurally excluded.

“There is no way we’re getting a European player in AI infrastructure any time soon,” Slater said.

“AI is developing into a market with winner-takes-most or winner-takes-all economics”, he added, noting that the landscape is dominated by a handful of US hyperscale cloud companies.

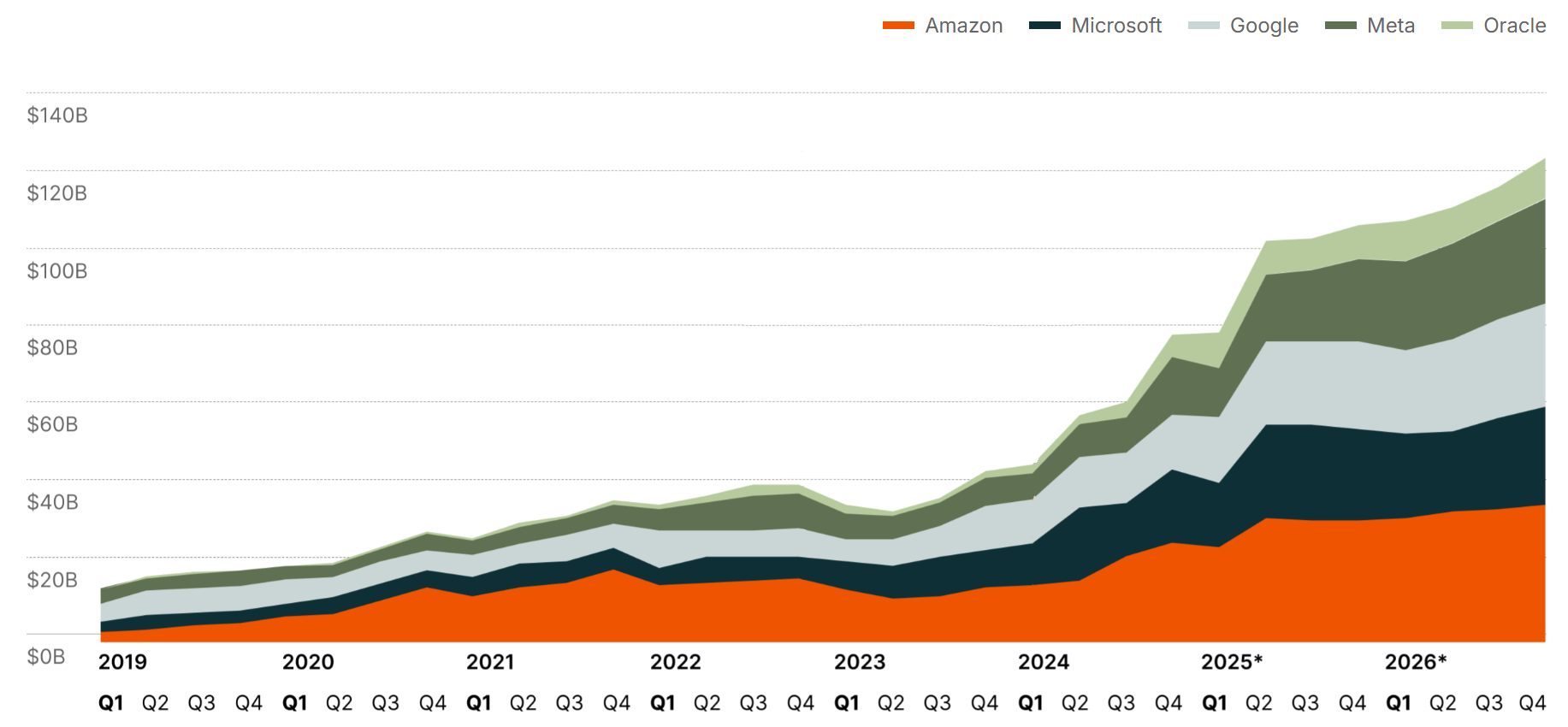

The reason is not a lack of technical expertise elsewhere but the unprecedented level of spending now required. Slater pointed to the concentration of the infrastructure layer in the hands of companies such as Meta, Amazon and Google. Combined, their investment is on a scale usually associated with national economies rather than private enterprise. The capital expenditure (capex) of these groups is equivalent to the gross fixed capital formation of Spain and roughly two-thirds of that of the UK.

That level of spending acts as an insurmountable barrier to entry. Few companies globally can fund it from their own balance sheets, and even fewer can do so while absorbing the inevitable inefficiencies and missteps that come with building capacity ahead of demand. In Slater’s view, this is why Europe, which lacks technology firms with comparable cash generation, is unlikely to produce a serious contender in this part of the AI stack.

Top 5 hyperscaler capex spend Source: Bloomberg

Source: Bloomberg

This concentration is also what is fuelling a growing debate among investors about whether the industry is in the midst of an AI capital expenditure bubble. Concerns have mounted over the scale of announced spending plans and whether returns will ultimately justify them. Slater rejected the relevance of that question for Scottish Mortgage.

“Whether we’re in a capex bubble or not doesn’t actually matter a great deal,” he said, arguing that investors need to differentiate between companies that can afford to play and those that cannot. The risk lies not with the hyperscalers but with companies trying to compete without the financial resources to sustain prolonged investment.

Slater highlighted his concerns around businesses such as Oracle, which he said has never spent capital on this scale and does not have the existing cash flows to fund it comfortably.

By contrast, he is relatively relaxed about the hyperscalers themselves, even if they overspend. He acknowledged the sums involved are vast in absolute terms, but far less so when set against the cash generated by their existing businesses. Any inefficiency, Slater argued, is unlikely to derail the long-term investment case.

These dynamics are also reflected in a broader shift in where open-ended growth opportunities can be found, with progress in the physical economy “becoming harder to achieve”. Trade tensions, a focus on resilience over efficiency, declining immigration and lower labour force participation all point to rising costs and weaker productivity growth.

By contrast, “the market for intelligence is global”. AI systems can be deployed at scale and serve vast numbers of users at relatively low marginal cost. If companies were able to reach multi-trillion-dollar valuations by distributing entertainment and social media, the potential prize from deploying intelligence into finance, professional services, creative industries and healthcare is significantly larger, Slater suggested.

This backdrop informs how Scottish Mortgage approaches the sector. Slater stressed that the trust “does not need the average AI company to succeed”.

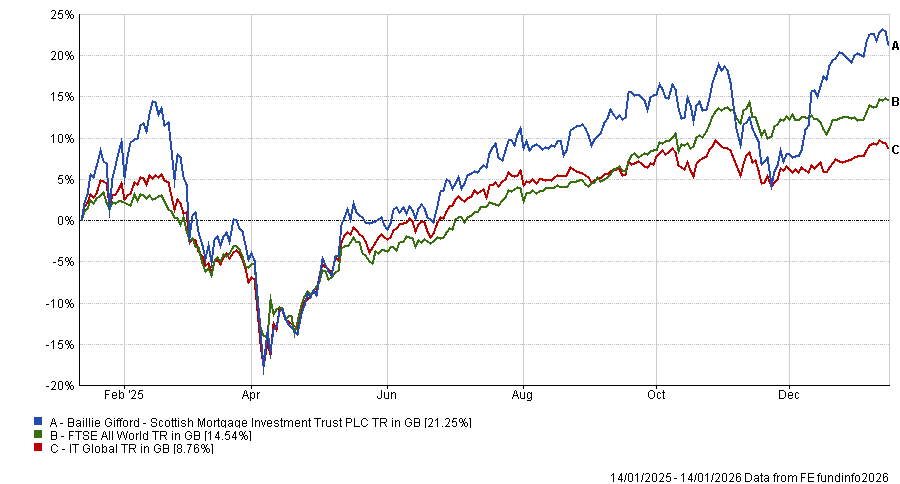

Performance of fund against index and sector over 1yr

Source: FE Analytics

“Instead, it is looking for one or two exceptional businesses that can exploit the structural advantages created by concentration and scale”.

The trust does not own companies building power infrastructure, data centres or cooling systems, focusing instead on areas such as chips, where demand is being driven by the increasing difficulty of extracting more performance from existing silicon, and on software, where value can compound as AI adoption spreads.

Slater also sees the implications of AI extending well beyond software and data centres. In transport, he argued, AI-enabled systems are approaching a point where steady technological progress translates into sudden market disruption. Autonomous vehicles and aircraft, he said, are beginning to demonstrate capabilities that were not possible under previous paradigms.

In that context, Slater warned that incumbents may be poorly positioned, especially in automotive. “The conventional transport companies are not prepared and they are going to be swept away by this AI wave that’s about to hit this industry,” he concluded.