Investment trusts come in all shapes and sizes but while the likes of Scottish Mortgage and F&C can garner headlines and attention, there are several minnows worth exploring too.

Philippa Maffioli, senior adviser at Blyth-Richmond Investment Managers, said: “We should look at smaller investment trusts because they provide greater diversification within a portfolio and give investors access to innovative, informed managers with years of experience.”

Below, experts reveal their favourite trusts with less than £200m of assets under management (AUM).

Two tiny trusts from the world’s largest asset manager

Having the name of US titan BlackRock has not dragged in the investors it might have, as two trusts from the world’s largest asset manager could be slipping under most investors’ radars.

Thomas Milford, investment analyst at Crossing Point, highlighted BlackRock Income and Growth (AUM of £55m) and BlackRock American Income (£136m) as his selections.

The former avoids growth-heavy tech names, making it a “vital diversifier” against stretched valuations in other markets, he said.

In particular, it could benefit from the current UK renaissance, with the FTSE 100 breaching 10,000 for the first time in early 2026.

“This surge is driven by a global rotation toward the value and income sectors such as banking and energy, where the UK holds a structural advantage,” he said.

The trust invests in high-quality, cash-generative companies and offers a 3.4% yield, while shares sit on a discount to the net asset value (NAV) of 12%.

BlackRock American Income, meanwhile, offers a “compelling opportunity” for investors seeking US exposure that does not rely on the tech titans.

It has a “market-leading” 6% annual dividend target and “performance has been equally noteworthy,” said Milford, with the trust the best performer in the IT North America sector over the past year.

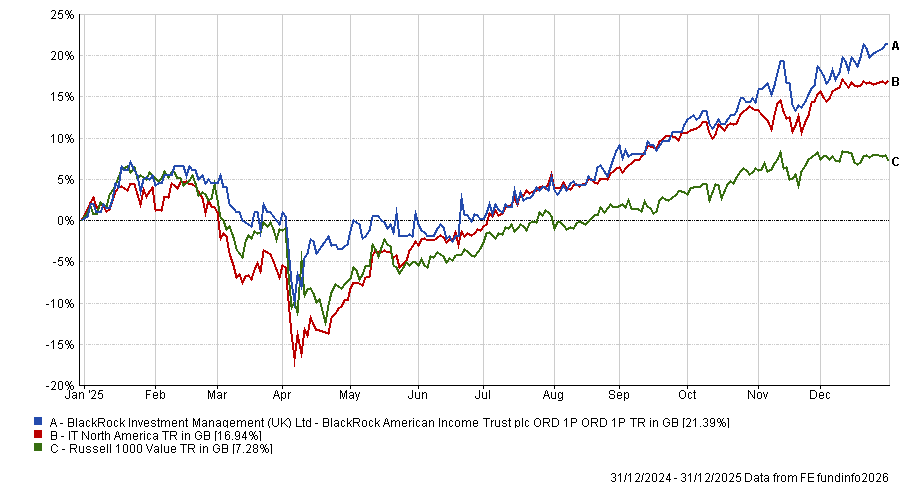

Performance of trust vs sector and benchmark in 2025

Source: FE Analytics

“It has used a new systematic ‘active equity’ approach that leverages AI [artificial intelligence] and big data to uncover undervalued companies. This strategic shift has clearly resonated with the market, as evidenced by the sharp narrowing of the discount to about 1% over the past month, signalling a significant increase in investor demand and confidence in their modernised, technology-led mandate,” he noted.

Two UK smaller companies portfolios

Maffioli highlighted the £130m Montanaro UK Smaller Companies trust as her selection for small trusts worth a second look.

UK small-caps remain under-researched, which can create bargain opportunities for managers who “do the work”, she said.

Montanaro’s team is led by Charles and Adam Montanaro, who back high-quality growth businesses. They conduct detailed analysis and hold regular company meetings, she said.

“I like it as a long-term capital growth allocation because most portfolios benefit from some small-cap exposure. The risks are higher volatility, slower liquidity and periods of reluctance to invest in the small-cap sector.”

In the same sector, Callum Stokeld, vice president and research analyst of investment funds at Panmure Liberum, highlighted Strategic Equity Capital (£153m), managed by Gresham House.

“The closed-end nature of the fund gives it the ability to hold positions without reference to flows. This means it can maintain exposure whilst engaging with management to help realise shareholder value. It also means it has the capacity to hold smaller, less liquid companies that often become a very significant shareholder in them,” he said.

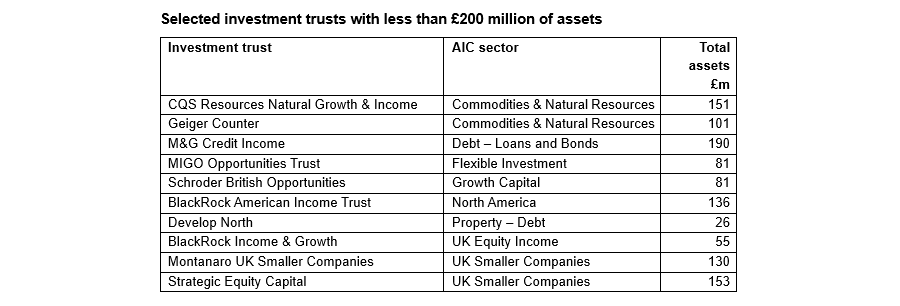

Source: The AIC

For the trust lovers

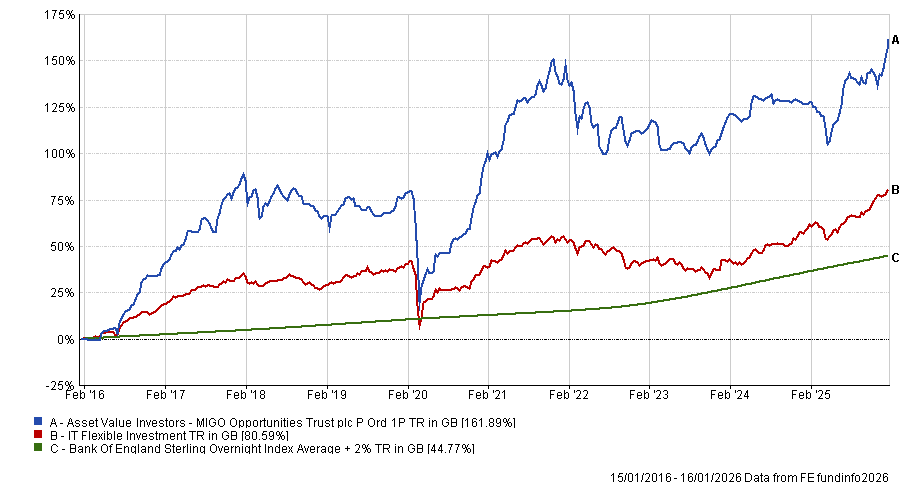

For those who want access to several trusts, Maffioli suggested MIGO Opportunities Trust, where manager Charlotte Cuthbertson runs a “disciplined, discount-aware process”.

“It also gives investors access to specialist and smaller trusts I would not normally buy directly, while keeping sensible position sizes.”

With assets under management of £81m, it has been an above-average performer in the IT Flexible sector over one, three and five years, while its 10-year return places it in the top-quartile of the peer group.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Finally getting the credit

Shavar Halberstadt, research analyst at Winterflood Securities, said M&G Credit Income fits the bill, although it may not for much longer as its AUM is the highest on the list at £190m.

It has grown through new share issuance over the past few years, including around £47m of new shares last year, as investors have “rightly taken notice of its unique offering”.

The fund aims to deliver high-yield returns while taking investment-grade risk, with a yield of 7% as at the end of November.

“While other debt trusts may deliver higher returns in an average year, this is a good option for investors who want to see a widely diversified portfolio with an emphasis on risk mitigation,” he said.

The northern powerhouse

Another compelling income option is the Develop North, which invests in property assets in the north-east of England and Scotland.

Saftar Sarwar, chief investment officer at Binary Capital, highlighted the trust as it “combines a strong yield and an opportunity for capital growth”.

“Crucially, the management has good local knowledge,” he added, noting that the investment trust structure allows it to “deploy capital selectively, recycle assets and avoid forced selling”.

It currently has a yield of 6% that is “fully covered” and shares trade on an approximate 10% discount to NAV.

Three alternative options

For options a little further afield, Stokeld suggested Geiger Counter as a “fascinating proposition”, as there has been strong support for nuclear energy due to the increase in energy demand for AI data centres.

“The trust invests in a range of assets in the uranium sector and, although physical uranium is not openly traded, we have seen estimates of uranium prices moving higher, coinciding with a significant pick up in contracting activity late last year, with mine supply forecast to be insufficient to meet existing demand, let alone when the pipeline of future demand is included,” he said.

Sticking with natural resources, Sarwar said CQS Natural Resources Growth and Income’s stellar performance in 2025 (up more than 100%) “may not be a transient phenomenon”.

“The world’s insatiable demand for critical minerals and energy, driven by energy transitions, major technological advancements and geopolitical realignments, provides a robust, long-term tailwind,” he said.

Away from commodities, he highlighted Schroder British Opportunities, which recently changed its mandate to exclusively invest in private equity.

“This is an important realignment towards an asset class where genuine outperformance can be achieved, away from the volatile public market,” he said.

“The UK private market, often overlooked by generalist investors, offers an interesting ground for growth capital and buyout opportunities. This trust, with its unique access to Schroders Capital’s deal flow, is positioned to exploit this.”