Investors flocked to the HSBC European Index and Artemis SmartGARP European Equity funds last year, FE Analytics shows, as the continent’s stock markets outperformed many of their international rivals.

The Euro STOXX made a 32.2% total return in 2025, in sterling terms, outpacing the MSCI AC World’s 13.9% by a significant margin. It was also ahead of the MSCI Emerging Markets (up 24.4%), FTSE All Share (24%), Topix (16.6%) and S&P 500 (9.3%) indices last year.

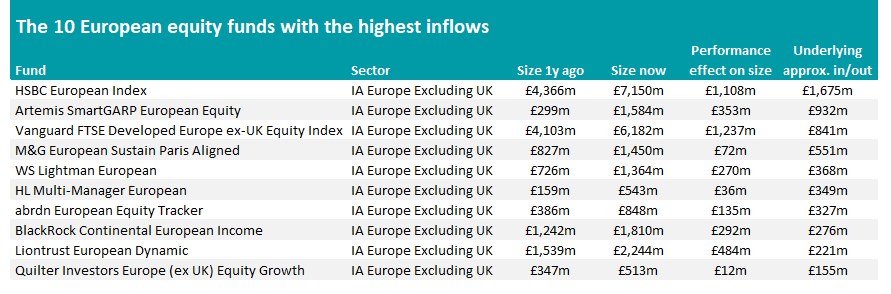

Below, we used the FE Analytics’ Market Movements tool to find out which European equity unit trusts and open-ended investment companies (Oeics) had the highest net inflows during this period. Flows for exchange-traded funds and SICAVs are not included in this data.

Source: FE Analytics. Market movements data for unit trusts and Oeics

As the table above shows, all 10 of the bestselling European equity funds last year resided in the IA Europe Excluding UK sector. This is the largest of the three European equity peer groups and home to many of the region’s best-known funds.

HSBC European Index was the most popular with a net inflow of close to £1.7bn. When combined with £1.1bn of growth from performance, this means the tracker when from £4.4bn at the start of last year to £7.1bn at its close.

The fund tracks the FTSE Developed Europe excluding UK index so its largest holdings are ASML, Roche, Nestle, SAP and Novartis, with France, Switzerland and Germany being the biggest country allocations. It made a 26.7% total return in 2025, putting it in the second quartile of the sector.

HSBC European Index is not the only tracker to prove popular last year, with Vanguard FTSE Developed Europe ex-UK Equity Index and abrdn European Equity Tracker also making it into the top 10.

But a resolutely active fund had the second-largest inflow in 2025 as Artemis SmartGARP European Equity attracted around £932m of investors’ cash. This helped take the fund from just under £300m to £1.6bn over the course of the year.

BlackRock Continental European Income and Liontrust European Dynamic are other funds that benefited from high inflows in 2025 and are liked by analysts.

Titan Square Mile said the team running the BlackRock fund is “one of the most well-resourced European equity teams in Europe, and we hold them in high regard”, while FE Investments said the Liontrust fund is “a compelling core offering” thanks to its “stellar performance track record”.

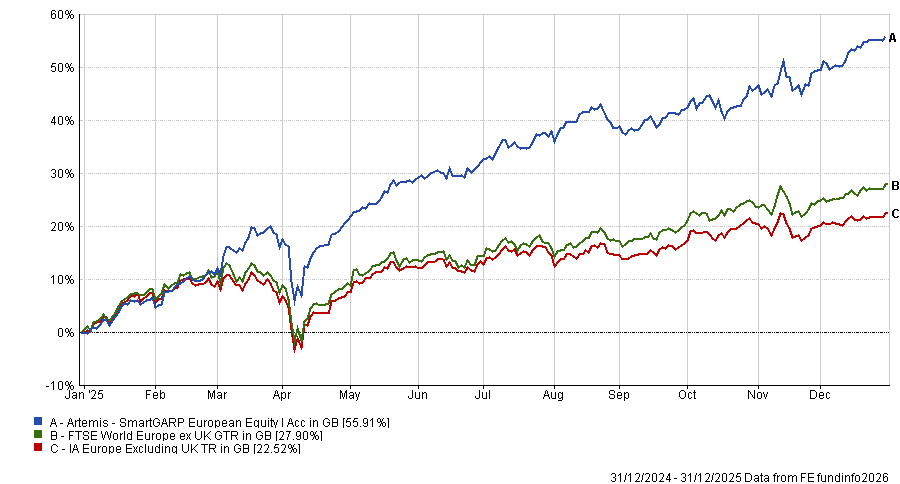

Managed by Philip Wolstencroft, the fund made 55.9% in 2025 – the highest return of the IA Europe Excluding UK sector. It was also the best fund in the peer group in 2024.

Performance of Artemis SmartGARP European Equity vs sector and index in 2025

Source: FE Analytics

The SmartGARP process developed by Wolstencroft scores stocks on eight complementary factors, such as growth, valuation, momentum and investment sentiment, that the manager believes drive share prices.

Titan Square Mile, which gives Artemis SmartGARP European Equity an A rating, said: “The team's approach is one of pragmatism, adapting to the opportunities that emerge from the market backdrop.

“It is not intended to be wedded to a single investment style or factor. However, the earnings revisions and valuation factors are key drivers out of the eight factors used in the SmartGARP process.”

WS Lightman European is another fund with a good year behind it. A top-quartile total return of 31.4% added £270m to the fund’s size with inflows swelling it by another £368m.

Co-managers Rob Burnett and George Boyd-Bowman have a value approach, looking for companies that have been through periods of stress and whose share prices are significantly below what they consider fair value.

Analysts with FE Investments said: “What sets this fund apart is its flexibility – it can take a mild or strong approach to value investing depending on what’s happening in the wider economy.

“In contrast to other value managers, the team is not entirely focused on identifying stocks trading at very cheap valuations, but it places a great emphasis on the identification of operational momentum, where new catalysts could lead to a turnaround in fortunes. This disciplined process should help avoid falling into value traps and limit the downside risk.”

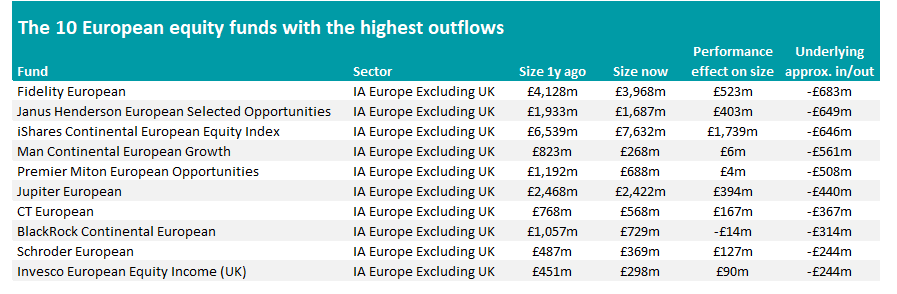

But despite Europe being one of 2025’s investment hotspots, some funds suffered significant outflows last year.

Source: FE Analytics. Market movements data for unit trusts and Oeics

Fidelity European had £683m withdrawn, FE Analytics’ Market Movements tool shows. It made 13.6% last year, putting it in the IA Europe Excluding UK sector’s bottom quartile.

Janus Henderson European Selected Opportunities and iShares Continental European Equity Index were close behind with respective outflows of £649m and £646m. Man Continental European Growth and Premier Miton European Opportunities were the only other European equity funds to have net outflows of more than £500m.